Question

Klinn Fliemann considers opening a premium vegan fair-trade burger restaurant. The initial investment equals 5 000 000 EUR. This investment will be all-equity financed. The

Klinn Fliemann considers opening a premium vegan fair-trade burger restaurant. The initial investment equals 5 000 000 EUR. This investment will be all-equity financed. The appropriate yield equals 6%. The risk-free interest rate equals 2%. Klinn claims to use only "Made in Germany" organic vegetables for his burgers from farmers that are paid fairly. He can either decide to do justice to this claim or to actually purchase pesticide-treated vegetables from non-german farmers paid at below minimum wage. If he plays fair, the year 1 FCF Will be 1 000 000 EUR. If he plays unfair, he can increase this FCF by 250 000 EUR in year 1 due to cost savings connected to the lower quality products. Those free cash flows (independent of whether he played fair or not) will stay constant thereafter until infinity. However, there is a probability p=0.2 that an investigative journalist uncovers Klinn's cheating during year 2. If this happens, Klinn will have to close his restaurant (no future cash inflows) and pay an expected one-time fee of 100 000 EUR for the legal settlement at the end of year 2.

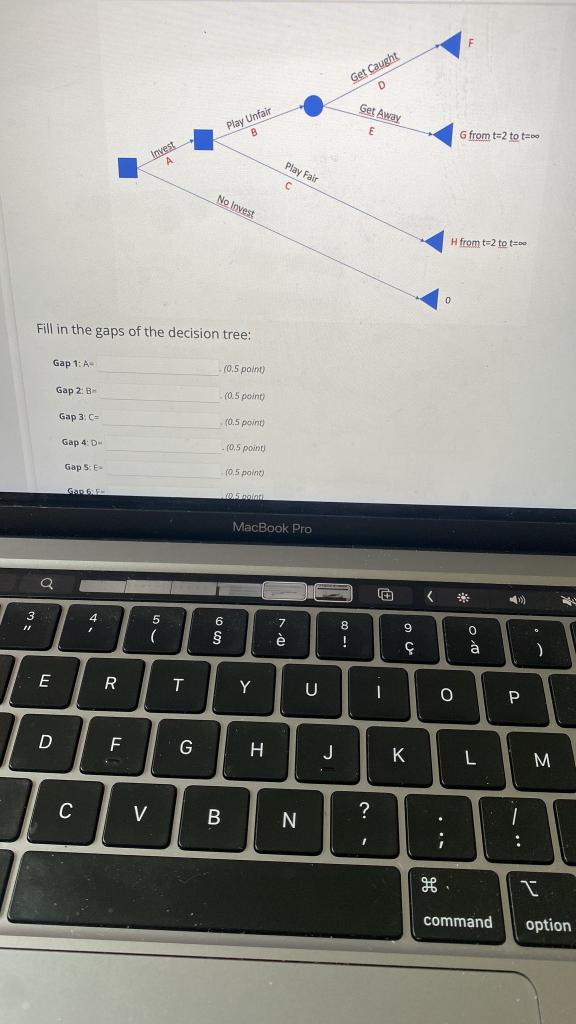

Gap 1: A= Gap 2: B= Gap 3: C= Gap 4: D= Gap 5: E= Gap 6: F= Gap 7: G= Gap 8: H= Gap 9: Klinn learns that he might have wrongly estimated the legal settlement fee. What value would this fee at lea be (all else equal) such that Klinn would play fair. Legal Fee

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started