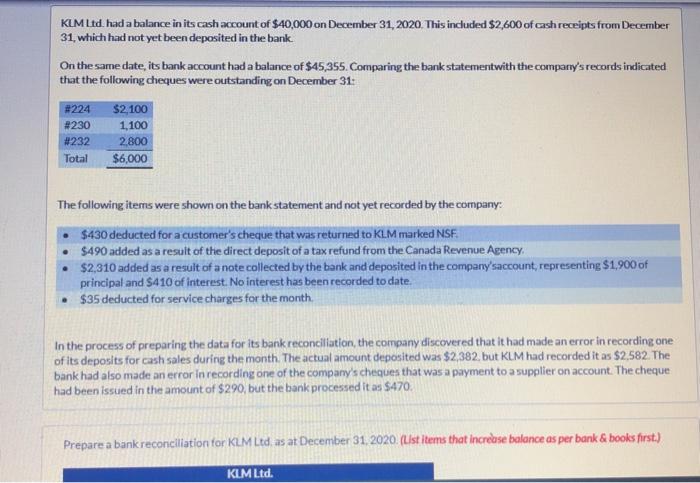

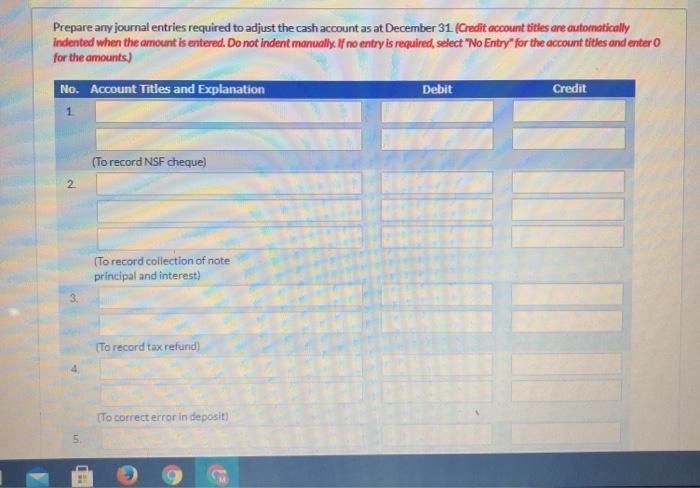

KLM Ltd had a balance in its cash account of $40,000 on December 31, 2020 This included $2,600 of cash receipts from December 31, which had not yet been deposited in the bank. On the same date, its bank account had a balance of $45,355. Comparing the bank statementwith the company's records indicated that the following cheques were outstanding on December 31 #224 #230 #232 Total $2100 1.100 2.800 $6,000 The following items were shown on the bank statement and not yet recorded by the company $430 deducted for a customer's cheque that was returned to KLM marked NSF. $490 added as a result of the direct deposit of a tax refund from the Canada Revenue Agency, $2,310 added as a result of a note collected by the bank and deposited in the company'saccount, representing $1,900 of principal and S410 of interest. No interest has been recorded to date. $35 deducted for service charges for the month In the process of preparing the data for its bank reconciliation, the company discovered that it had made an error in recording one of its deposits for cash sales during the month. The actual amount deposited was $2,382, but KLM had recorded it as $2,582. The bank had also made an error in recording one of the company's cheques that was a payment to a supplier on account. The cheque had been issued in the amount of $290, but the bank processed it as $470 Prepare a bank reconciliation for KLM Ltd as at December 31, 2020. (List items that increase balance as per bank & books first.) KLM Ltd. Prepare any journal entries required to adjust the cash account as at December 31 (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry"for the account titles and entero for the amounts.) No. Account Titles and Explanation Debit Credit 1 (To record NSF cheque) 2 (To record collection of note principal and interest) (To record tax refund) (To correct error in deposit) KLM Ltd had a balance in its cash account of $40,000 on December 31, 2020 This included $2,600 of cash receipts from December 31, which had not yet been deposited in the bank. On the same date, its bank account had a balance of $45,355. Comparing the bank statementwith the company's records indicated that the following cheques were outstanding on December 31 #224 #230 #232 Total $2100 1.100 2.800 $6,000 The following items were shown on the bank statement and not yet recorded by the company $430 deducted for a customer's cheque that was returned to KLM marked NSF. $490 added as a result of the direct deposit of a tax refund from the Canada Revenue Agency, $2,310 added as a result of a note collected by the bank and deposited in the company'saccount, representing $1,900 of principal and S410 of interest. No interest has been recorded to date. $35 deducted for service charges for the month In the process of preparing the data for its bank reconciliation, the company discovered that it had made an error in recording one of its deposits for cash sales during the month. The actual amount deposited was $2,382, but KLM had recorded it as $2,582. The bank had also made an error in recording one of the company's cheques that was a payment to a supplier on account. The cheque had been issued in the amount of $290, but the bank processed it as $470 Prepare a bank reconciliation for KLM Ltd as at December 31, 2020. (List items that increase balance as per bank & books first.) KLM Ltd. Prepare any journal entries required to adjust the cash account as at December 31 (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry"for the account titles and entero for the amounts.) No. Account Titles and Explanation Debit Credit 1 (To record NSF cheque) 2 (To record collection of note principal and interest) (To record tax refund) (To correct error in deposit)