Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KLM Sdn Bhd foresees that its pre-recapitalization earnings for the fiscal year will amount to RM7.3 million. The company presently possesses a total of

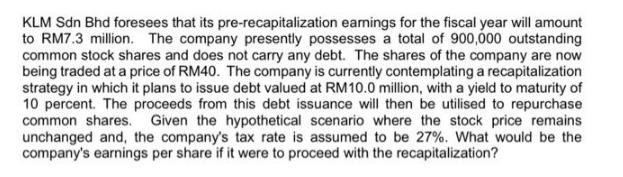

KLM Sdn Bhd foresees that its pre-recapitalization earnings for the fiscal year will amount to RM7.3 million. The company presently possesses a total of 900,000 outstanding common stock shares and does not carry any debt. The shares of the company are now being traded at a price of RM40. The company is currently contemplating a recapitalization strategy in which it plans to issue debt valued at RM10.0 million, with a yield to maturity of 10 percent. The proceeds from this debt issuance will then be utilised to repurchase common shares. Given the hypothetical scenario where the stock price remains unchanged and, the company's tax rate is assumed to be 27%. What would be the company's earnings per share if it were to proceed with the recapitalization?

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 Interest Expense on Debt Debt Issued RM100 million Yield to Maturity 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started