Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KLY Corporation's projected sales for January to August 2023 are as follows: Of the sales, 10% is collected immediately for cash, 60% is collected the

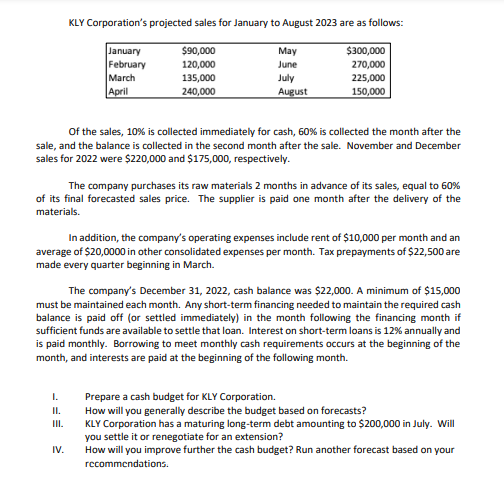

KLY Corporation's projected sales for January to August 2023 are as follows: Of the sales, 10% is collected immediately for cash, 60% is collected the month after the sale, and the balance is collected in the second month after the sale. November and December sales for 2022 were $220,000 and $175,000, respectively. The company purchases its raw materials 2 months in advance of its sales, equal to 60% of its final forecasted sales price. The supplier is paid one month after the delivery of the materials. In addition, the company's operating expenses include rent of $10,000 per month and an average of $20,0000 in other consolidated expenses per month. Tax prepayments of $22,500 are made every quarter beginning in March. The company's December 31,2022 , cash balance was $22,000. A minimum of $15,000 must be maintained each month. Any short-term financing needed to maintain the required cash balance is paid off (or settled immediately) in the month following the financing month if sufficient funds are available to settle that loan. Interest on short-term loans is 12% annually and is paid monthly. Borrowing to meet monthly cash requirements occurs at the beginning of the month, and interests are paid at the beginning of the following month. I. Prepare a cash budget for KLY Corporation. II. How will you generally describe the budget based on forecasts? III. KLY Corporation has a maturing long-term debt amounting to $200,000 in July. Will you settle it or renegotiate for an extension? IV. How will you improve further the cash budget? Run another forecast based on your recommendations

KLY Corporation's projected sales for January to August 2023 are as follows: Of the sales, 10% is collected immediately for cash, 60% is collected the month after the sale, and the balance is collected in the second month after the sale. November and December sales for 2022 were $220,000 and $175,000, respectively. The company purchases its raw materials 2 months in advance of its sales, equal to 60% of its final forecasted sales price. The supplier is paid one month after the delivery of the materials. In addition, the company's operating expenses include rent of $10,000 per month and an average of $20,0000 in other consolidated expenses per month. Tax prepayments of $22,500 are made every quarter beginning in March. The company's December 31,2022 , cash balance was $22,000. A minimum of $15,000 must be maintained each month. Any short-term financing needed to maintain the required cash balance is paid off (or settled immediately) in the month following the financing month if sufficient funds are available to settle that loan. Interest on short-term loans is 12% annually and is paid monthly. Borrowing to meet monthly cash requirements occurs at the beginning of the month, and interests are paid at the beginning of the following month. I. Prepare a cash budget for KLY Corporation. II. How will you generally describe the budget based on forecasts? III. KLY Corporation has a maturing long-term debt amounting to $200,000 in July. Will you settle it or renegotiate for an extension? IV. How will you improve further the cash budget? Run another forecast based on your recommendations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started