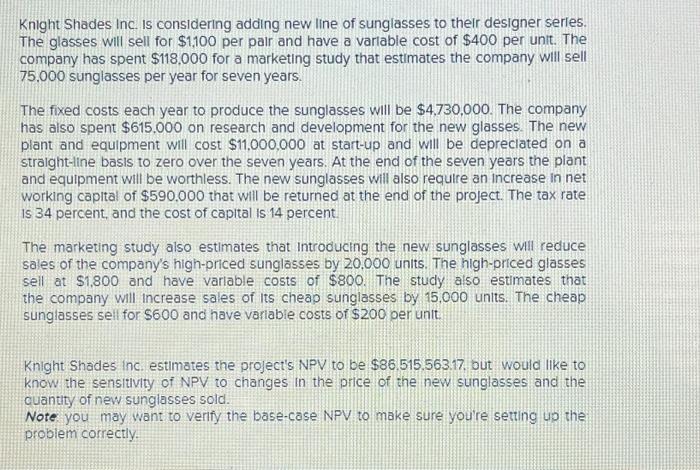

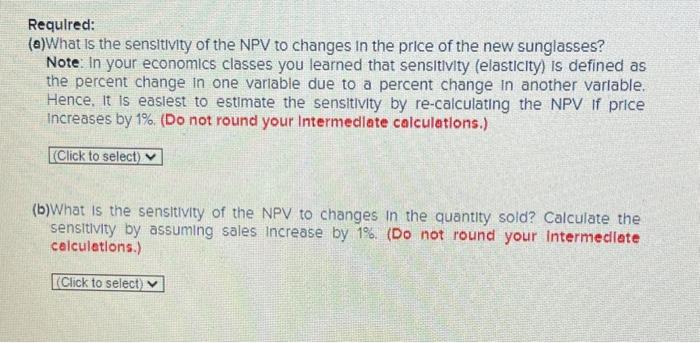

Knight Shades Inc. Is considering adding new line of sunglasses to their designer series. The glasses will sell for $1,100 per pair and have a varlable cost of $400 per unit. The company has spent $118,000 for a marketing study that estimates the company will sell 75.000 sunglasses per year for seven years. The fixed costs each year to produce the sunglasses will be $4,730,000. The company has also spent $615.000 on research and development for the new glasses. The new plant and equipment will cost $11,000,000 at start-up and will be depreciated on a straight-line basis to zero over the seven years. At the end of the seven years the plant and equipment will be worthless. The new sunglasses will also require an increase in net working capltal of $590,000 that will be returned at the end of the project. The tax rate is 34 percent, and the cost of capital is 14 percent. The marketing study also estimates that introducing the new sunglasses will reduce sales of the company's high-priced sunglasses by 20.000 units. The high-priced glasses sell at $1,800 and have varlable costs of $800. The study also estimates that the company will increase sales of Its cheap sunglasses by 15,000 units. The cheap sunglasses sell for $600 and have variable costs of $200 per unit. Knight Shades inc. estimates the project's NPV to be $86.515.563.17. but would like to know the sensitulty of NPV to changes in the price of the new sunglasses and the cuantity of new sunglasses sold. Note you may want to verify the base-case NPV to make sure you're setting up the problem correctly. Required: (a)What is the sensitivity of the NPV to changes in the price of the new sunglasses? Note: In your economics classes you learned that sensitivity (elasticity) is defined as the percent change in one variable due to a percent change in another varlable. Hence, It is easiest to estimate the sensitivity by re-calculating the NPV if price increases by 1%. (Do not round your Intermedlate calculations.) (b)What is the sensitivity of the NPV to changes in the quantity sold? Calculate the sensitlvity by assuming sales increase by 1%. (Do not round your intermecllate calculetions.)