Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Knowing you have just completed a financial management course in Healthcare Finance, a potential employer is seeking your advice on selecting a revenue generating

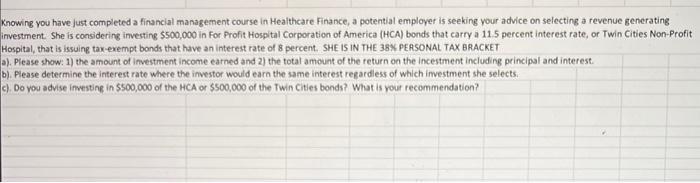

Knowing you have just completed a financial management course in Healthcare Finance, a potential employer is seeking your advice on selecting a revenue generating investment. She is considering investing $500,000 in For Profit Hospital Corporation of America (HCA) bonds that carry a 11.5 percent interest rate, or Twin Cities Non-Profit Hospital, that is issuing tax-exempt bonds that have an interest rate of 8 percent. SHE IS IN THE 38% PERSONAL TAX BRACKET a). Please show: 1) the amount of investment income earned and 2) the total amount of the return on the incestment including principal and interest. b). Please determine the interest rate where the investor would earn the same interest regardless of which investment she selects. c). Do you advise investing in $500,000 of the HCA or $500,000 of the Twin Cities bonds? What is your recommendation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compare the two investment options well calculate the investment income earned and the total retu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started