Answered step by step

Verified Expert Solution

Question

1 Approved Answer

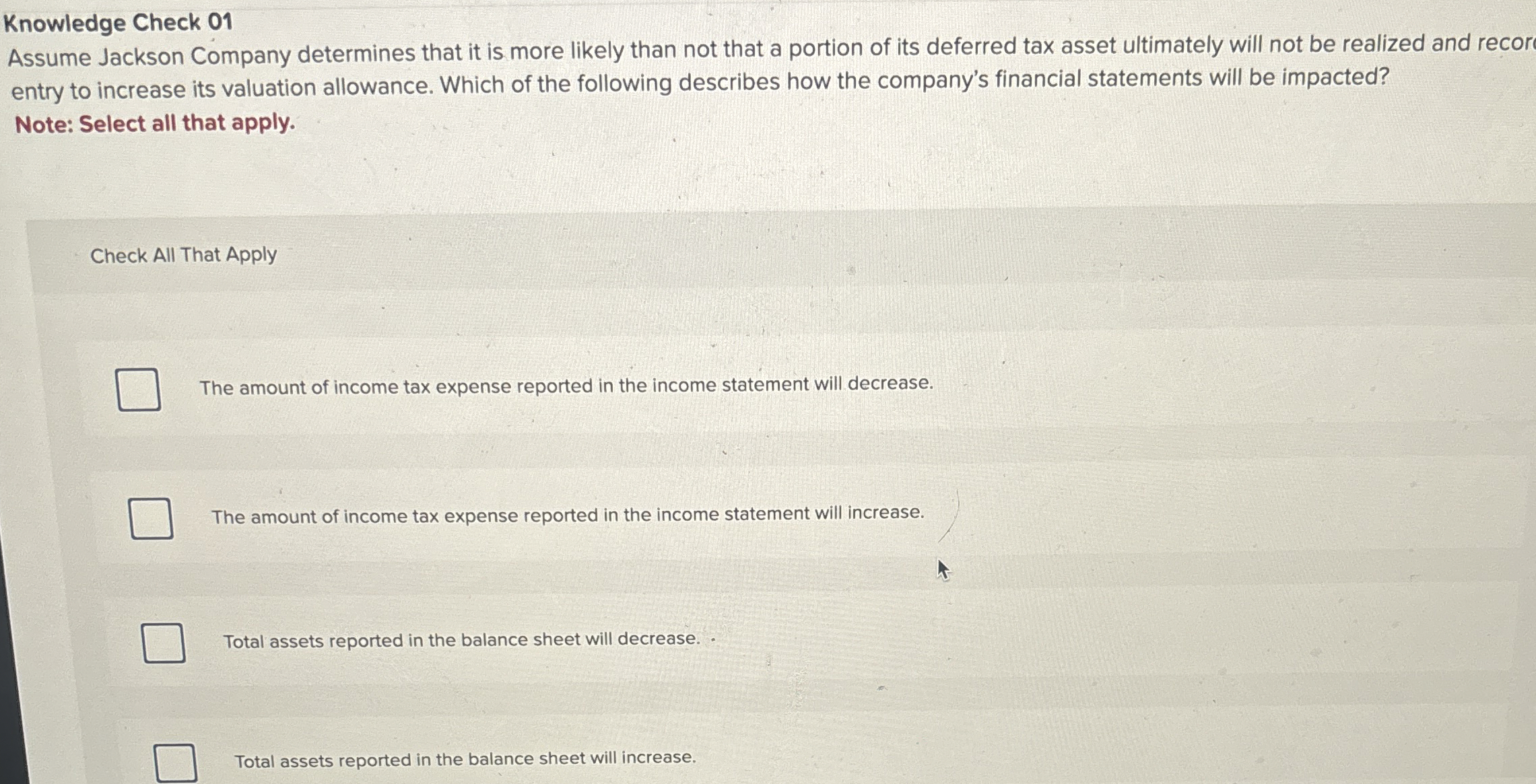

Knowledge Check 0 1 Assume Jackson Company determines that it is more likely than not that a portion of its deferred tax asset ultimately will

Knowledge Check

Assume Jackson Company determines that it is more likely than not that a portion of its deferred tax asset ultimately will not be realized and recor

entry to increase its valuation allowance. Which of the following describes how the company's financial statements will be impacted?

Note: Select all that apply.

Check All That Apply

The amount of income tax expense reported in the income statement will decrease.

The amount of income tax expense reported in the income statement will increase.

Total assets reported in the balance sheet will decrease.

Total assets reported in the balance sheet will increase.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started