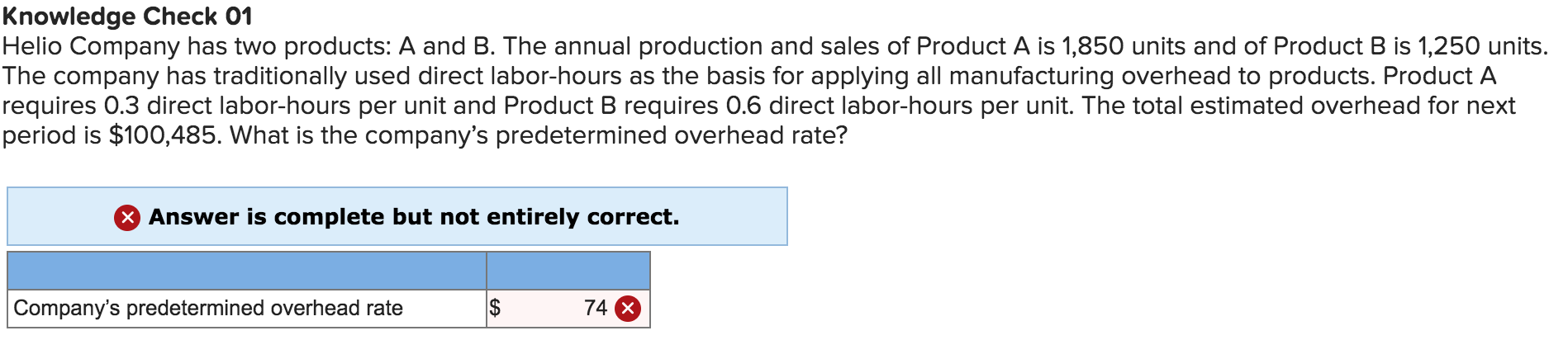

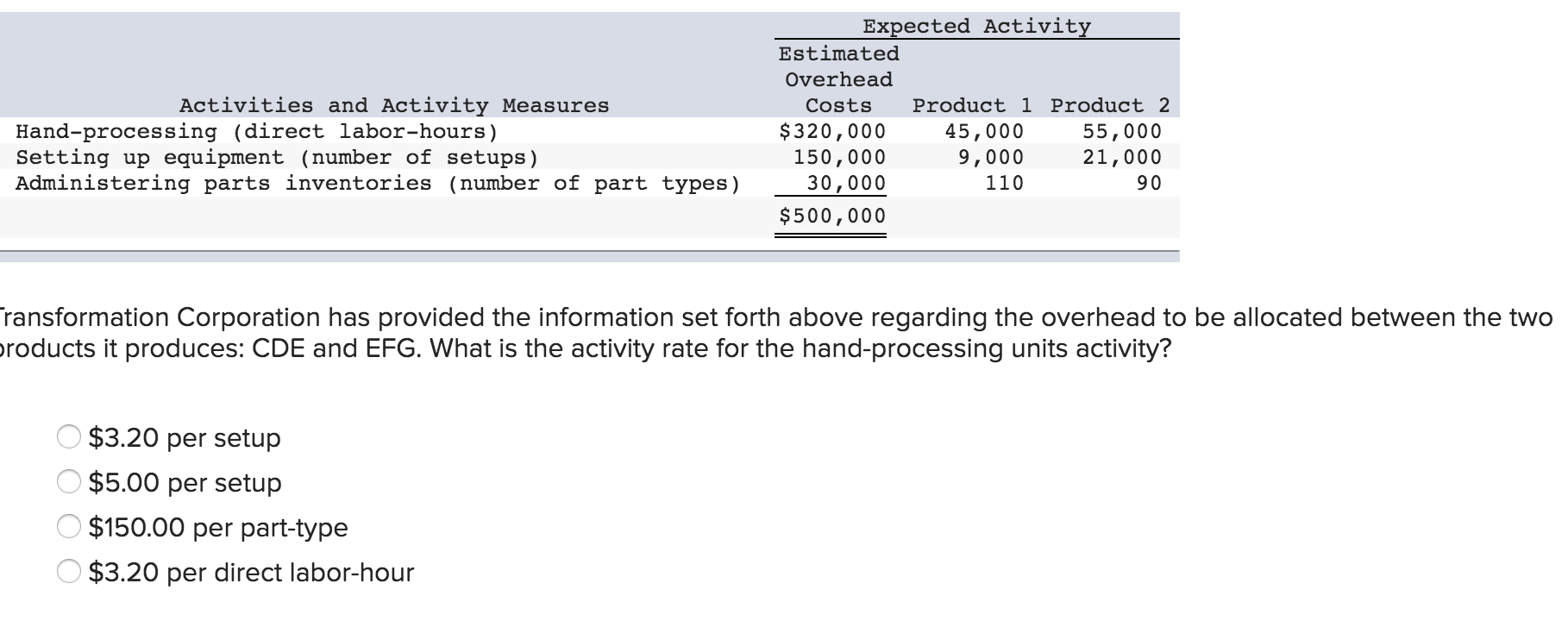

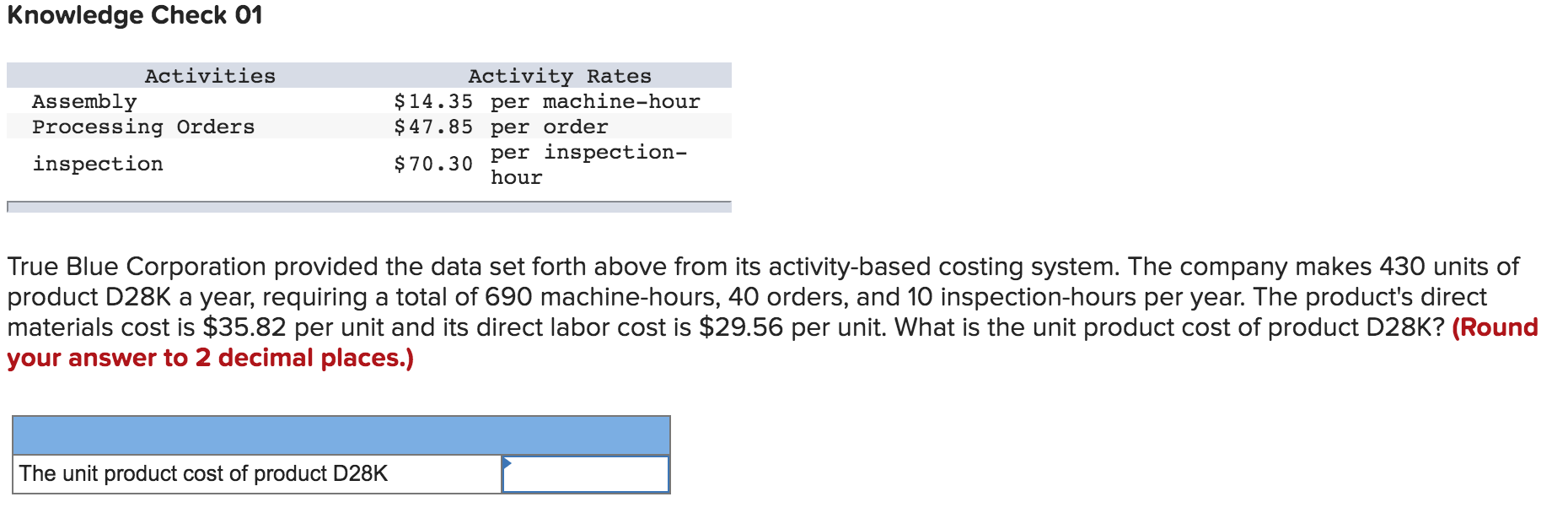

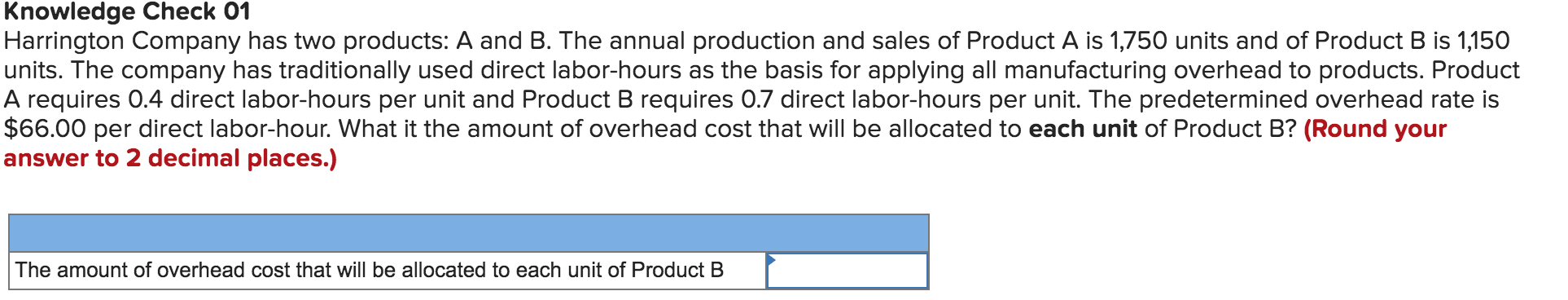

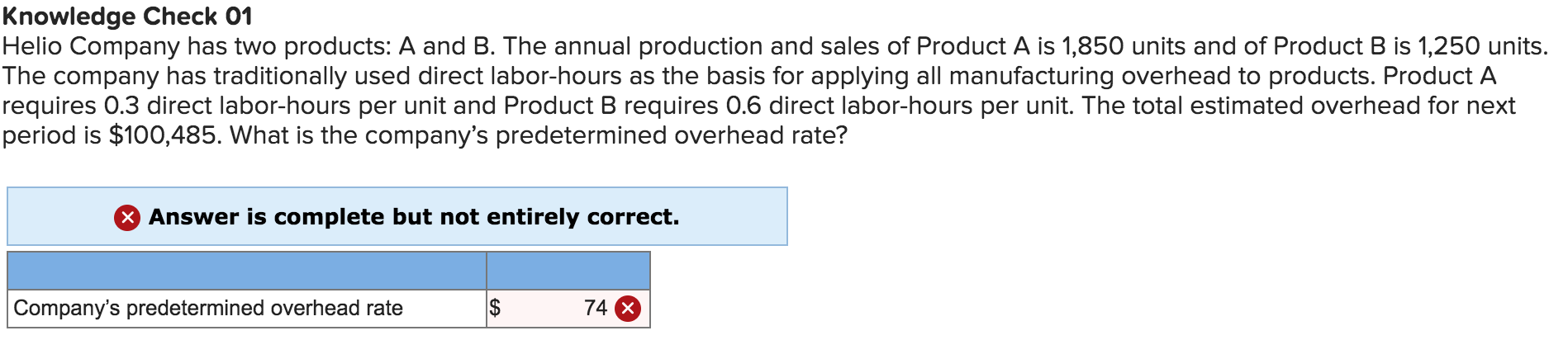

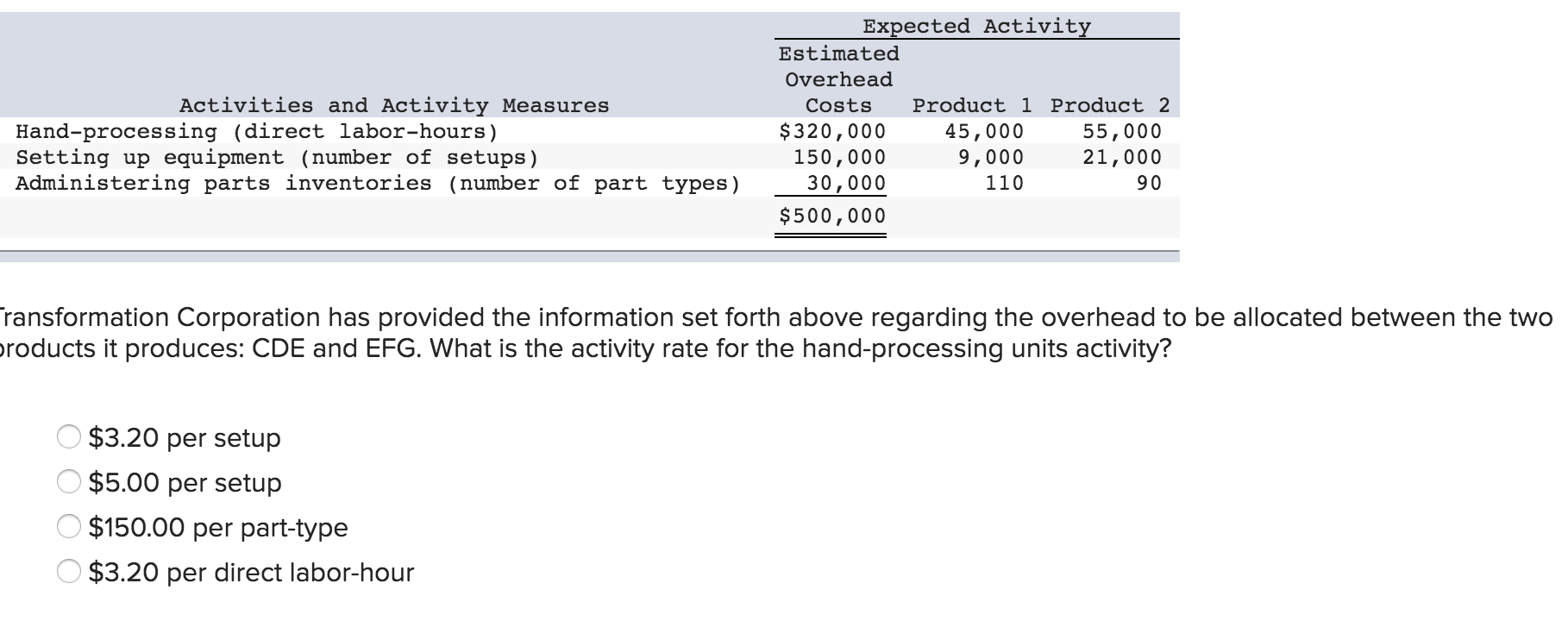

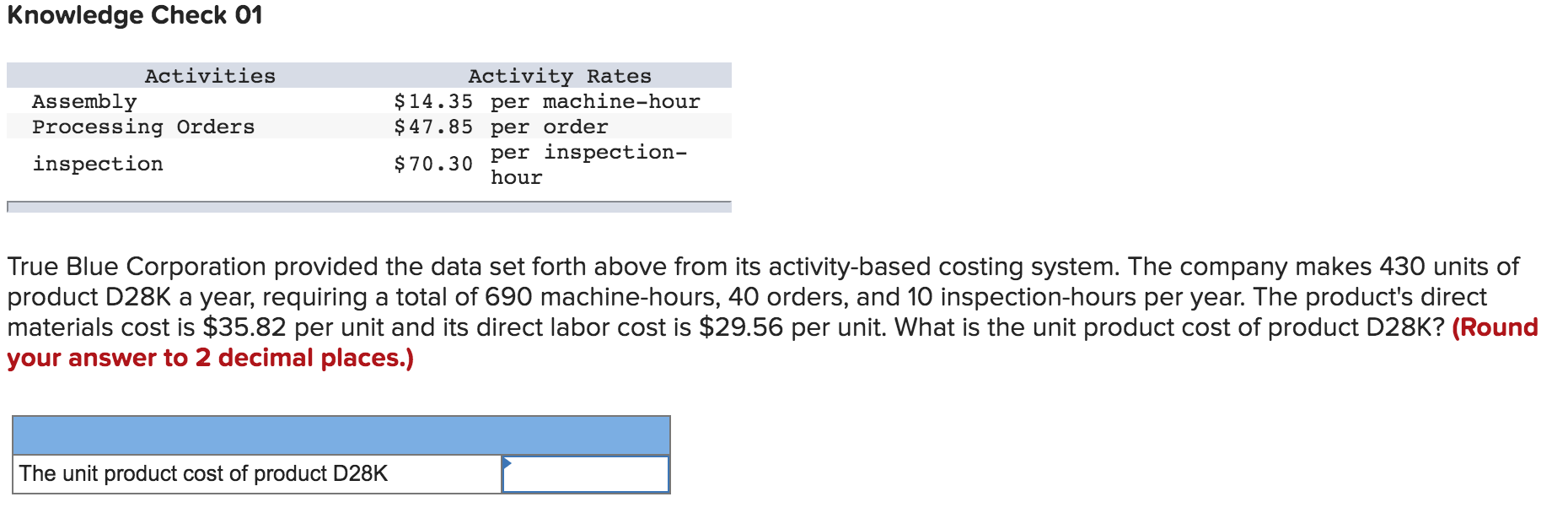

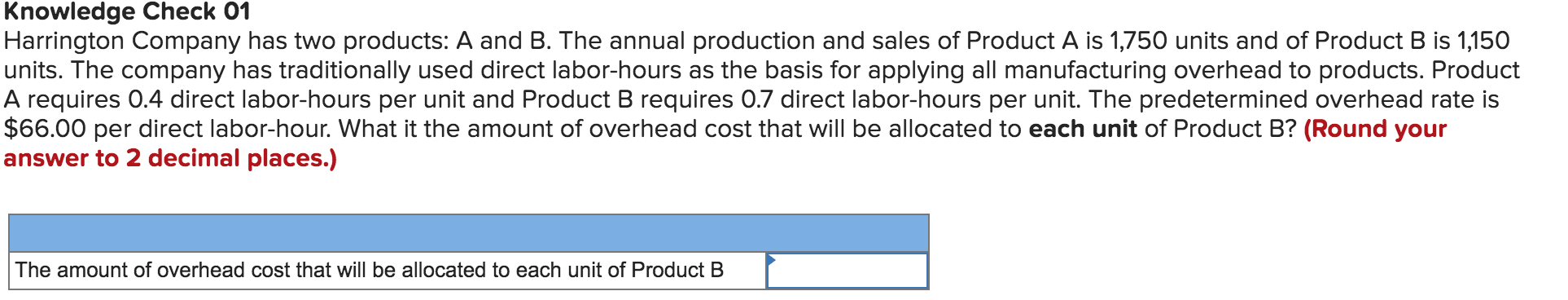

Knowledge Check 01 Helio Company has two products: A and B. The annual production and sales of Product A is 1,850 units and of Product B is 1,250 units. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $100,485. What is the company's predetermined overhead rate? Answer is complete but not entirely correct. Company's predetermined overhead rate $ 74 X Activities and Activity Measures Hand-processing (direct labor-hours) Setting up equipment (number of setups ) Administering parts inventories (number of part types) Expected Activity Estimated Overhead Costs Product 1 Product 2 $320,000 45,000 55,000 150,000 9,000 21,000 30,000 110 90 $500,000 Transformation Corporation has provided the information set forth above regarding the overhead to be allocated between the two products it produces: CDE and EFG. What is the activity rate for the hand-processing units activity? O $3.20 per setup $5.00 per setup $150.00 per part-type O $3.20 per direct labor-hour Knowledge Check 01 Activities Assembly Processing Orders inspection Activity Rates $14.35 per machine-hour $ 47.85 per order $ 70.30 per inspection- hour True Blue Corporation provided the data set forth above from its activity-based costing system. The company makes 430 units of product D28K a year, requiring a total of 690 machine-hours, 40 orders, and 10 inspection-hours per year. The product's direct materials cost is $35.82 per unit and its direct labor cost is $29.56 per unit. What is the unit product cost of product D28K? (Round your answer to 2 decimal places.) The unit product cost of product D28K Knowledge Check 01 Harrington Company has two products: A and B. The annual production and sales of Product A is 1,750 units and of Product B is 1,150 units. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.7 direct labor-hours per unit. The predetermined overhead rate is $66.00 per direct labor-hour. What it the amount of overhead cost that will be allocated to each unit of Product B? (Round your answer to 2 decimal places.) The amount of overhead cost that will be allocated to each unit of Product B