Question

Knowledge Management Question 3: Read the following case study and then answer the questions that follow: Horizon Bank, based in Michigan City, Ind., is using

Knowledge Management

Question 3:

Read the following case study and then answer the questions that follow:

Horizon Bank, based in Michigan City, Ind., is using Aunalytics Daybreak for Financial Services to drive datadriven insights and positive outcomes for the banks customers. With plans to expand the platform with AI and machine learning to generate new business, as well as additional data sources to support customers, the system is taking Horizon Bank to the next level of services that make it a preferred financial partner with compelling advantages over larger, competitive establishments.

Aunalytics is a data platform company delivering insightsasaservice for enterprise businesses. Founded in 1873, Horizon Bank seeks to provide customers with technology that is designed to facilitate interaction. It provides online conveniences that support innovative solutions for personal, commercial and mortgage banking needs, as well as wealth and investment services. A community banking organization with 74 locations, Horizon wanted to resolve an ongoing customer relationship management (CRM) concern that had plagued it for years. The banks CRM systems fell short of meeting the organizations objectives due do a data infrastructure that wasnt conducive to robust customer relationship management.

The CRM systems lacked data integration capabilities needed for the company to utilize the full breadth and depth of its information resources held across a wide range of databases, data warehouses and other repositories. This restrained sales, marketing and services which would improve the quality of experience for customers and support the organizations revenue objectives. As a result, Horizon made the strategic decision to develop a custom inhouse CRM solution and selected Aunalytics Daybreak for Financial Services for seamless data integration and analytics that would facilitate its business intelligence goals.

What we needed to succeed was an analytics platform capable of unifying and helping us to fully leverage our informational assets. Expectations for the platform would be to deliver clean information from all available sources, not just for our CRM solution, but for marketing and financial operations as well, said Madelaine Spoljoric, Vice President of Business Intelligence for Horizon Bank. With this in mind, we selected the Daybreak for Financial Services platform, which made the integration of informational sources fast and simple while delivering powerful analytics and actionable insights.

Data experts at Aunalytics took a threepronged approach to solve Horizon Banks business challenges using the Daybreak for Financial Services analytics database platform. The first step was to get the data right by converging disparate repositories, and organizing the information for ingestion in the proper application area. Horizon Bank would leverage Daybreaks robust, cloud native platform to convert data into answers in support of a wide range of business intelligence applications.

Daybreak allows Horizons executives to view systemwide data from all business units, cleansing and verifying records to provide enriched data for accurate decision making. The aggregated data delivers a 360degree view of customer information including behavioral data, from which the platforms proprietary AI technology and deep learning models developed by Aunalytics data scientists glean customer intelligence insights. Aunalytics data centers host customer data in a secure enterprise cloud and compute environment, which is based on a highly redundant and scalable platform. This allows customers to scale as their business requires with hosted servers, applications, and data.

To initiate the companys digital transformation strategy, Horizon Bank migrated 100,000 customers from an acquisition into the Daybreak for Financial Services analytics database platform overnight. This resulted in a successful postmerger transition. The introduction of automation and the simplification of IT infrastructure by bringing systems together has streamlined the companys computing environment significantly. Automated dashboards now generate reports daily using multiple sources, replacing spreadsheets that required the review of data across hundreds of tabs.

This advancement allows for deeper insights as the bank can now get very granular and take actions based on clear, accurate datasomething that was not possible previously.

In support of this Daybreak deployment, the excellent strategic direction of the business intelligence team at Horizon Bank has made the platform that much more effective, providing for more accurate datadriven decision making, said Ryan Wilson, vice president, client relationships for Aunalytics. We are enjoying this journey and look forward to continue working together with Horizon on these initiatives.

In your answers integrate the theory and application to the case study rather than separately.

QUESTION 3.1 - Differentiate between data and information, with application to the case study.

This will help answer the question:

- Data consist of facts, observations, perceptions and usually devoid of context, meaning or intent

- Information is a subset of data, includes data possessing context, relevance and purpose. Involves manipulation of raw data to identify trends or patterns

QUESTION 3.2 - With the use of examples from the case study, analyse the benefits of Customer Relationship Management.

This may assist with your answer:

CRM (Customer Relationship Management) manages interactions between a company and its customers. It includes operational CRM (automation of customer interactions) and analytical CRM (uses data mining for customer intelligence).

Data mining in CRM:

- CRM automates data mining to predict customer behavior.

- Prediction models assign scores indicating the likelihood of specific customer behaviors.

- Scores are used to target customers for tailored marketing campaigns.

----------

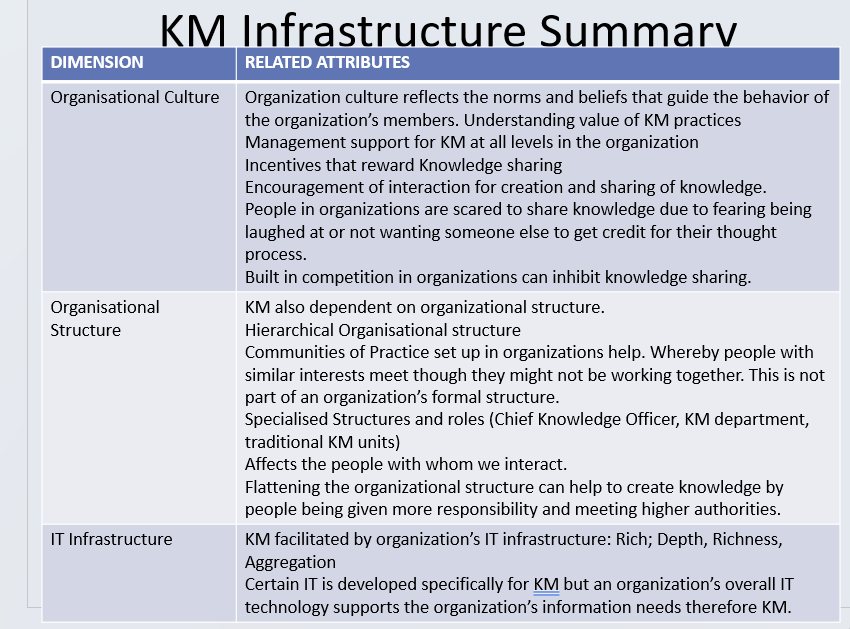

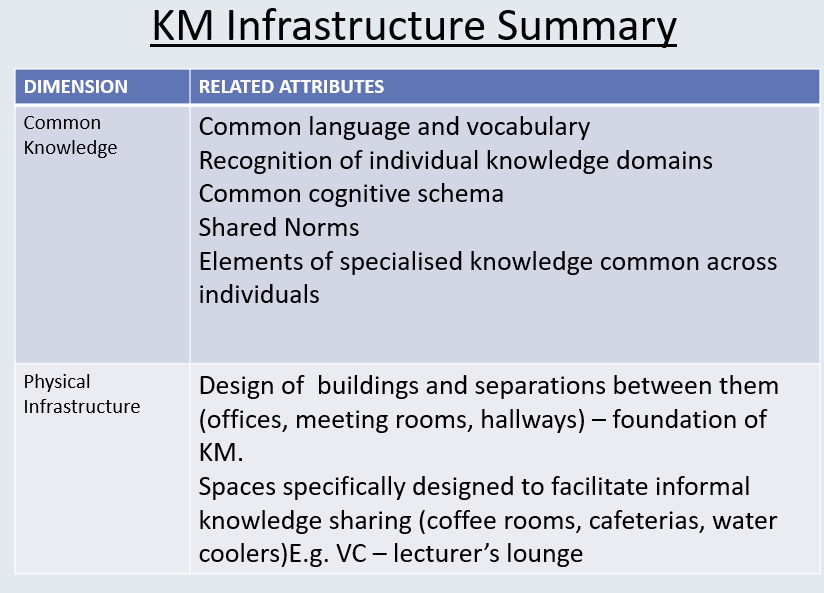

QUESTION Q.3.3 - Assess Horizon Banks Information Technology Infrastructure as part of their KM infrastructure. Please refer to the case study when answering this question and use the screenshots below to asssit.

This may assist with your answer:

----------

KM Infrastructure Summary RELATED ATTRIBUTES Common language and vocabulary Recognition of individual knowledge domains Common cognitive schema Shared Norms Elements of specialised knowledge common across individuals Design of buildings and separations between them (offices, meeting rooms, hallways) - foundation of KM. Spaces specifically designed to facilitate informal knowledge sharing (coffee rooms, cafeterias, water coolers)E.g. VC-lecturer's lounge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started