Answered step by step

Verified Expert Solution

Question

1 Approved Answer

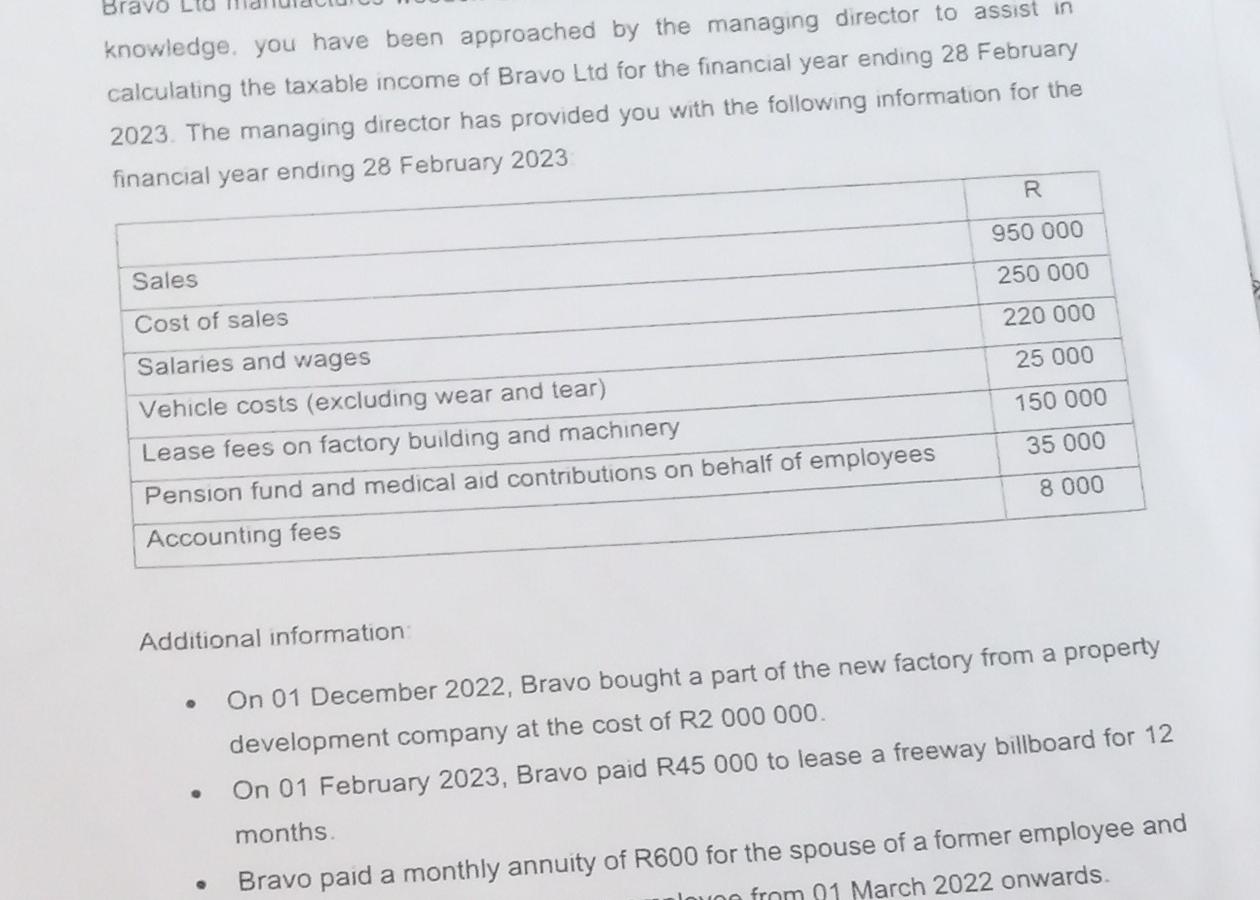

knowledge. you have been approached by the managing director to assist in calculating the taxable income of Bravo Ltd for the financial year ending 28

knowledge. you have been approached by the managing director to assist in calculating the taxable income of Bravo Ltd for the financial year ending 28 February 2023. The managing director has provided you with the following information for the fimancial vear ending 28 February 2023 Additional information: - On 01 December 2022, Bravo bought a part of the new factory from a property development company at the cost of R2 000000 . - On 01 February 2023, Bravo paid R45 000 to lease a freeway billboard for 12 months. - Bravo paid a monthly annuity of R600 for the spouse of a former employee and knowledge. you have been approached by the managing director to assist in calculating the taxable income of Bravo Ltd for the financial year ending 28 February 2023. The managing director has provided you with the following information for the fimancial vear ending 28 February 2023 Additional information: - On 01 December 2022, Bravo bought a part of the new factory from a property development company at the cost of R2 000000 . - On 01 February 2023, Bravo paid R45 000 to lease a freeway billboard for 12 months. - Bravo paid a monthly annuity of R600 for the spouse of a former employee and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started