Question

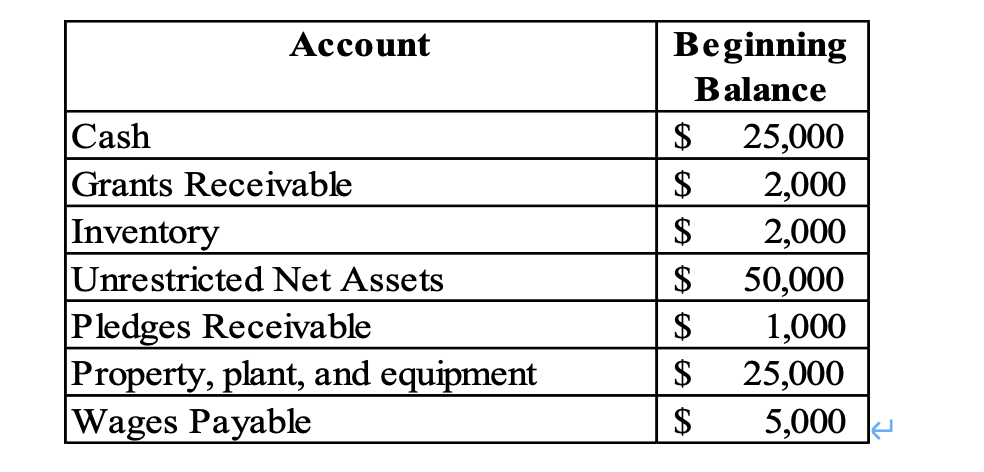

Kok Foundation (KF) began operations on January 1 st 2021, the first day of its fiscal year with the assets, liability and net asset balances

- Kok Foundation (KF) began operations on January 1st 2021, the first day of its fiscal year with the assets, liability and net asset balances shown in the following table.

Record the eight transactions (1-8) below on the worksheet provided with the exam. Be sure to identify the accounts impacted by each transaction and show that the transactions are balanced. You must enter each transaction in the worksheet provided.

1) Took out a $50,000 bank loan. SF also signed a contract with a local car dealer to buy a van for their summer program and gave the dealer a $1,000 deposit.

2) Received $50,000 in contribution pledges and cash contributions from members of the Konkuk community. $25,000 of the contributions were received in cash. KF expects that 20% of the remaining pledges will not be collected.

3) Received a check for $10,000 from the Korea Society. This amount includes the final payment of $2,000 from a grant made by the Korea Society in 2019 as well as new grant for the remainder.

4) Purchased a van for $50,000. The van is expected to have a useful life of 10 years and no residual value. KF uses straight-line depreciation. The van was purchased at the beginning of the year.

5) Purchased $5,000 worth in supplies for the Summer Camp. KF paid 80% of the cost of the supplies in cash.

6) KF paid its employees $30,000 in wages during the fiscal year. Wage expense for the year was $25,000. The payment included the wages payable balance outstanding from fiscal year 2020.

7) By the end of the year, LU used $4,000 worth of supplies to operate their summer camp.

8) Complied with terms of the bank loan, which require KF to pay the bank $1,400. That includes interest for the year at an annual rate of 2% plus a portion of the principal.

Account Cash Grants Receivable Inventory Unrestricted Net Assets Pledges Receivable Property, plant, and equipment Wages Payable Beginning Balance $ $ $ $ $ $ $ 25,000 2,000 2,000 50,000 1,000 25,000 5,000 KEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started