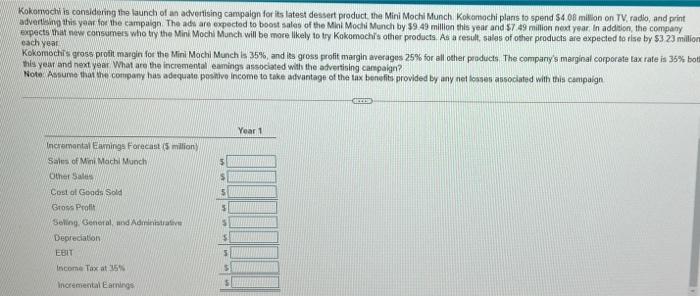

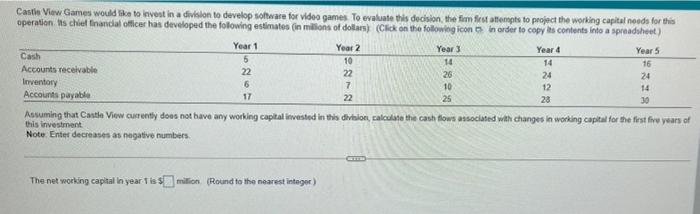

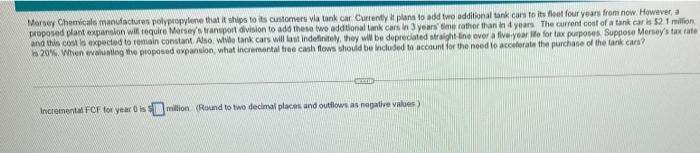

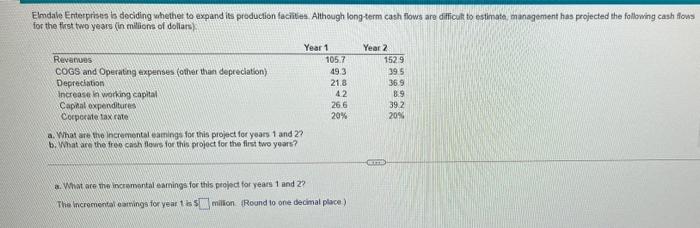

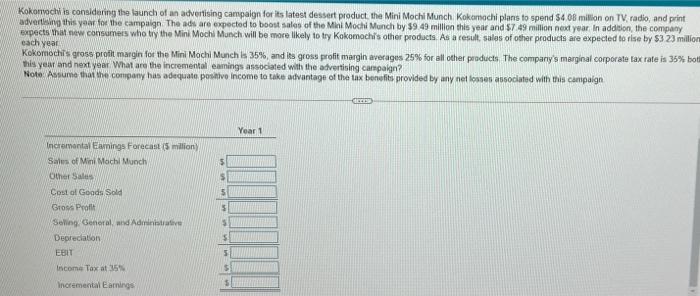

Kokonvoc in considering the launch of an advertising campaign for its latest dessert product the Mini Mochi Munch Kokamochi plans to spend 54.08 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by 39.49 million this year and S7 49 million next year. In addition, the company expect the consumers who try the Mink Mochi Munch will be more likely to try Kokomachis other products. As a result sales of other products are expected to rise by $323 milion each year Kokomochis gross profit margin for the Mini Mochi Munch is 35%, and its gross profit margin averages 25% for all other products. The company's marginal corporate tax rate is 35% bot this year and next year. What are the incremental earnings associated with the advertising campaign? Note Assume that the company has adequate positive Income to take advantage of the tax benefits provided by any netes associated with this campaign Year 1 $ 5 Incremental amings Forecast (5 million Sales of Mini Machi Munch Other Sale Cost of Goods Sold Gross Pro Seling. General and Aditive Depreciation EBIT Income Tax at 5 5 5 $ Incremental Earnings 16 Carth View Games would like to invest in a division to develop software for video games To evaluate this decision, the firm first attempts to project the working capital needs for this operation is chied financial officer has developed the following estimates (in millions of dollars) (Click on the following icon in order to copy is contents into a spreadsheet) Year 1 Year 2 Year 3 Year & Year 5 Cash 10 14 14 Accounts receivable 22 22 26 24 24 Inventory 6 10 12 14 Accounts payable 17 25 28 30 Assuming that Castle View currently does not have any working capital invested in this divinion, calculate the cash flows associated with changes in working capital for the first five years of this investment Note Enter decreases as negative numbers 7 22 | The networking capital in year is million (Round to the nearest integer) Morsey Chemicals manufactures polypropylene that it ships to its customers via tank cat Current plans to add two additional tank cars to its float four years from now. However, a proposed plant expansion will require Merseys transport division to add these two additional tank cars 3 years me rather than in years. The current cont of a tank cars 52 million and this contexpected to main constant. Also will tank cars will la indefinitely, they will be deprecated straight line over five Ho for tax purposes suppose Mersey's tax rate 20% When wanting the proposed expansion what incremental tree cash flows should be included to account for the need to accelerate the purchase of the tank cars? Incrementa FCF for year is million (Round to two decimal places and outflows an nepative values Elmdale Enterprises is deciding whether to expand its production facilities Although long term cash flows are difficult to estimate, management has projected the following cash flows for the test two years in millions of dollars) Year 2 1529 Year 1 Revenues 105.7 COGS and Operating expenses (other than depreciation) 493 Depreciation 21.8 Increase in working capital 42 Capital expenditures 266 Corporate tax rate 20% a. What are the incremental amings for this project for years 1 and 2? b. What are the tree cash flows for this project for the first two years? 1395 36.9 8.9 392 20% Gm 3. What are the incremental earnings for this project for years 1 and 2? The Incremental rings for year 15 million (Round to one decimal place) Kokonoch is considering the launch of an advertising campaign for its latest dessert product the Mini Mochi Munch Kokemochi plans to spend 54.08 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by 39 49 million this year and $749 million next year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomachi's other products. As a result sales of other products are expected to rise by $3 23 milion each year Kokomochis gross profit margin for the Mini Mochi Munchs 35%, and is gross profit margin averages 25% for all other products. The company's marginal corporate tax rate is 35% bot this year and next year. What are the incremental earnings associated with the advertising campaign? Note Amume that the company has adequate positive Income to take advantage of the tax benefits provided by any net losses associated with this campaign Year 1 $ S 5 Incremental amings Forecast (5 million Salus of Mini Machi Munch Other Sales Cost of Goods Sold Gross Profit Selling General, and Administrative Deprecation EBIT $ 3 5 Income Tax at $ Incremental Earnings