Answered step by step

Verified Expert Solution

Question

1 Approved Answer

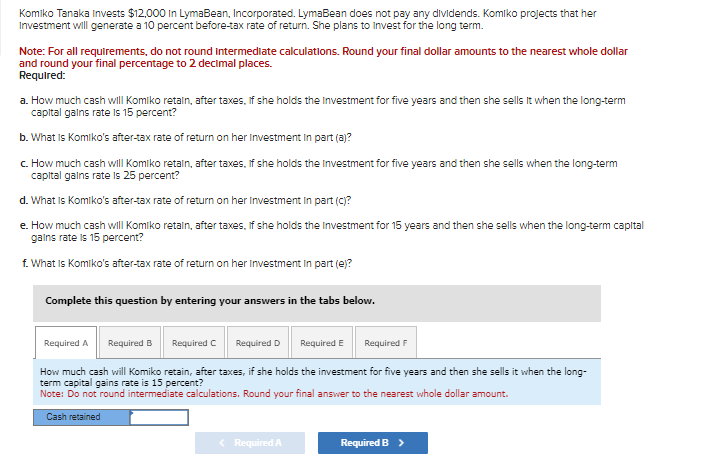

Komiko Tanaka Invests $ 1 2 , 0 0 0 In LymaBean, Incorporated. LymaBean does not pay any dividends. Komiko projects that her Investment will

Komiko Tanaka Invests $ In LymaBean, Incorporated. LymaBean does not pay any dividends. Komiko projects that her

Investment will generate a percent beforetax rate of return. She plans to invest for the long term.

Note: For all requirements, do not round intermediate calculations. Round your final dollar amounts to the nearest whole dollar

and round your final percentage to decimal places.

Required:

a How much cash will Komiko retain, after taxes, if she holds the Investment for five years and then she sells it when the longterm

capital gains rate is percent?

b What is Komiko's aftertax rate of return on her Investment in part a

c How much cash will Komiko retain, after taxes, if she holds the Investment for five years and then she sells when the longterm

capital gains rate is percent?

d What is Komiko's aftertax rate of return on her Investment in part c

e How much cash will Komiko retain, after taxes, if she holds the Investment for years and then she sells when the longterm capltal

gains rate is percent?

f What is Komiko's aftertax rate of return on her Investment in part e

Complete this question by entering your answers in the tabs below.

How much cash will Komiko retain, after taxes, if she holds the investment for five years and then she sells it when the long

term capital gains rate is percent?

Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started