Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Komiko Tanaka invests $23,.000 in LymaBean, Inc. LymaBean does not pay any dividends, Komiko projects that her investment will generate a 10 percent before-tax rate

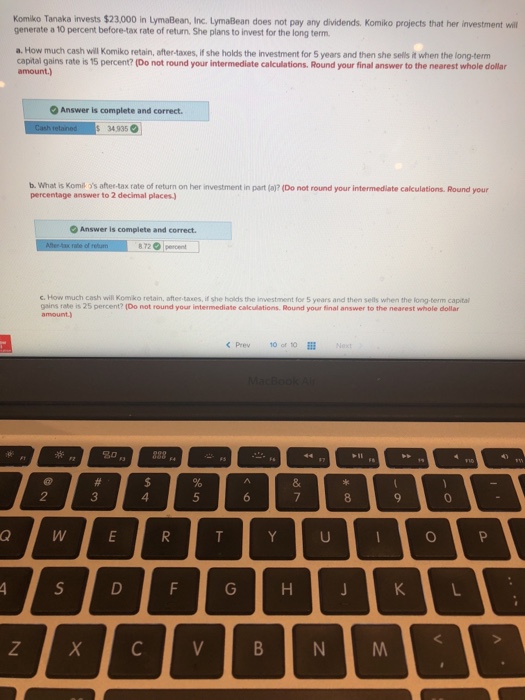

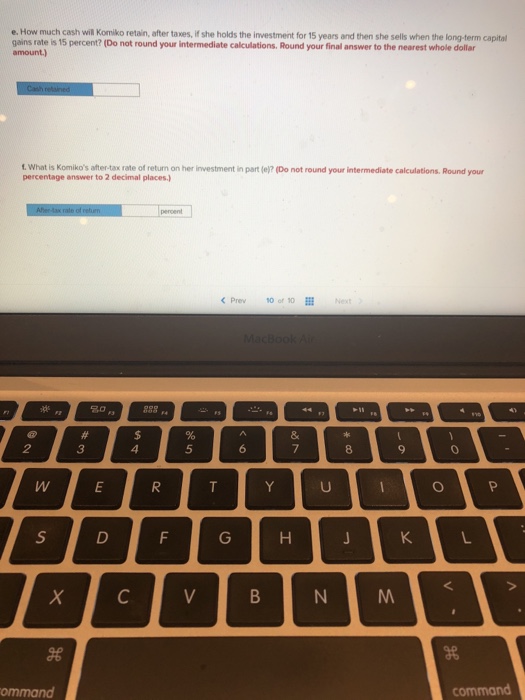

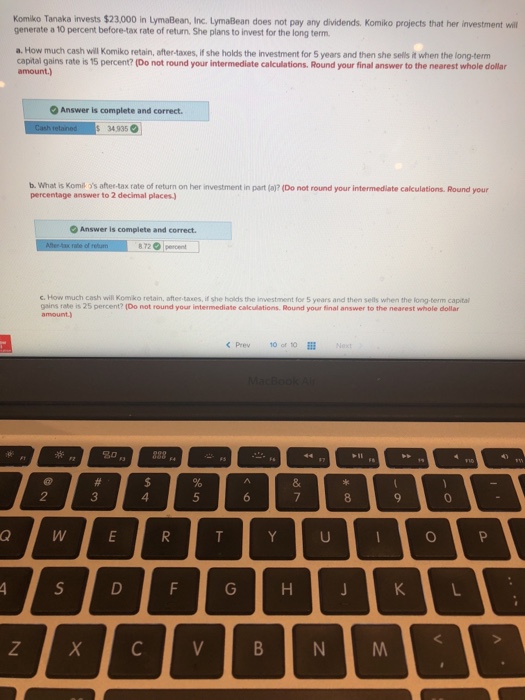

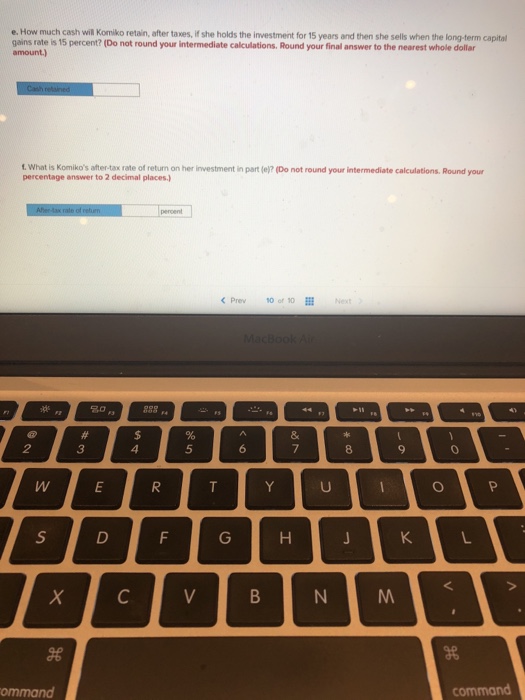

Komiko Tanaka invests $23,.000 in LymaBean, Inc. LymaBean does not pay any dividends, Komiko projects that her investment will generate a 10 percent before-tax rate of return. She plans to invest for the long term a. How much cash will Komiko retain, after-taxes, if she holds the investment for 5 years and then she sells it when the long-tenm capital gains rate is 15 percent? (Do not round your intermediate calculations. Round your final answer to the nearest whole dollar amount.) Answer is complete and correct. s 34935 b. What is Komil o's afher-tax rate of return on her investment in part (a? (Do not round your intermediate calculations. Round your percentage answer to 2 decimal places Answer is complete and correct. c. How much cash will Komko retain, after taxes, if she holds the investment for 5 years and then sells when the long-term capital gains rate is 25 percent? (Do not round your intermediate calculations. Round your final answer to the nearest whole dollar 3 5

Komiko Tanaka invests $23,.000 in LymaBean, Inc. LymaBean does not pay any dividends, Komiko projects that her investment will generate a 10 percent before-tax rate of return. She plans to invest for the long term a. How much cash will Komiko retain, after-taxes, if she holds the investment for 5 years and then she sells it when the long-tenm capital gains rate is 15 percent? (Do not round your intermediate calculations. Round your final answer to the nearest whole dollar amount.) Answer is complete and correct. s 34935 b. What is Komil o's afher-tax rate of return on her investment in part (a? (Do not round your intermediate calculations. Round your percentage answer to 2 decimal places Answer is complete and correct. c. How much cash will Komko retain, after taxes, if she holds the investment for 5 years and then sells when the long-term capital gains rate is 25 percent? (Do not round your intermediate calculations. Round your final answer to the nearest whole dollar 3 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started