Answered step by step

Verified Expert Solution

Question

1 Approved Answer

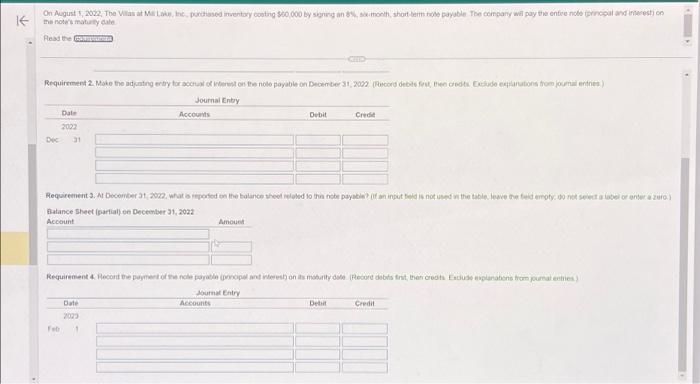

KOn August 1, 2022, The Villas at Mill Lake, Inc., purchased inventory costing $60,000 by signing an 8%, six-month, short-term note payable. The company will

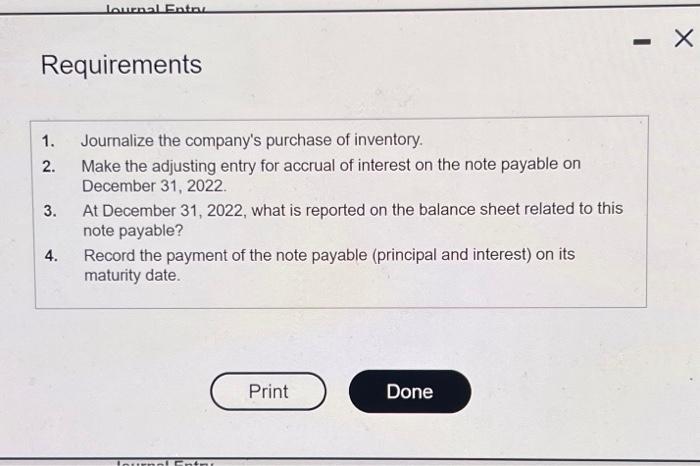

KOn August 1, 2022, The Villas at Mill Lake, Inc., purchased inventory costing $60,000 by signing an 8%, six-month, short-term note payable. The company will pay the entire note (principal and interest) on the note's maturity date. Read the equirements Requirement 2. Make the adjusting entry for accrual of interest on the note payable on December 31, 2022. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Date 2022 Dec 31 Accounts Date 2023 Requirement 3. At December 31, 2022, what is reported on the balance sheet related to this note payable? (If an input field is not used in the table, leave the field empty; do not select a label or enter a zero.) Balance Sheet (partial) on December 31, 2022 Account Debit Amount Accounts Requirement 4. Record the payment of the note payable (principal and interest) on its maturity date. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Credit Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started