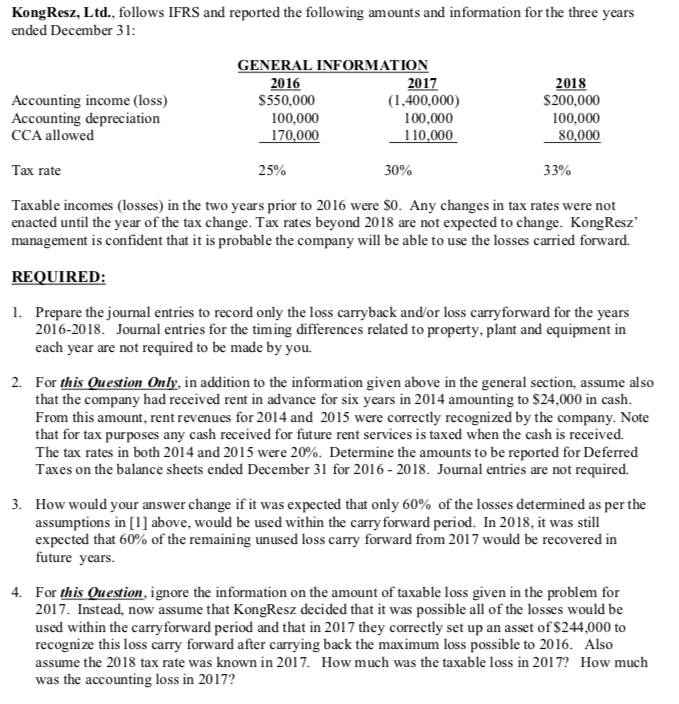

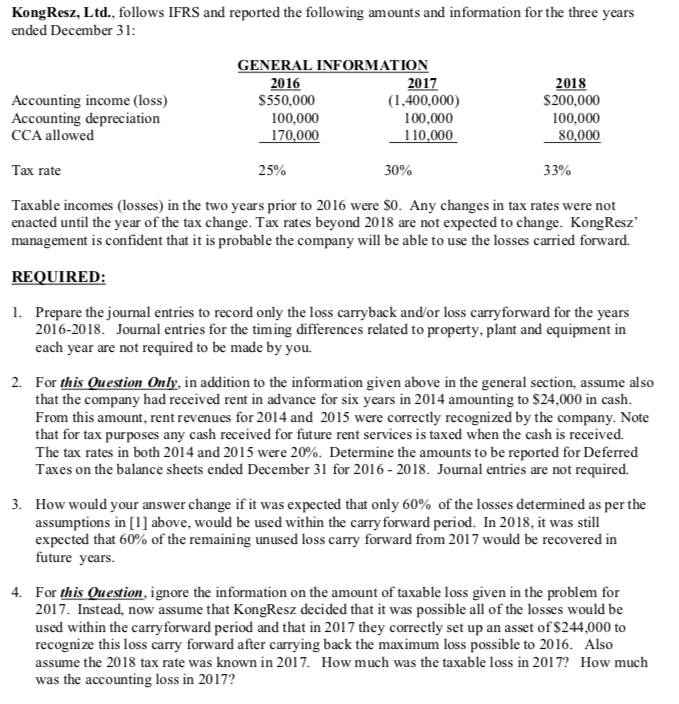

KongResz, Ltd., follows IFRS and reported the following amounts and information for the three years ended December 31: GENERAL INFORMATION 2016 2017 2018 Accounting income (loss) $550,000 (1,400,000) $200,000 Accounting depreciation 100,000 100,000 100,000 CCA allowed 170,000 110,000 80,000 Tax rate 25% 30% 33% Taxable incomes (losses) in the two years prior to 2016 were $0. Any changes in tax rates were not enacted until the year of the tax change. Tax rates beyond 2018 are not expected to change. KongResz? management is confident that it is probable the company will be able to use the losses carried forward. REQUIRED: 1. Prepare the journal entries to record only the loss carryback and/or loss carry forward for the years 2016-2018. Journal entries for the timing differences related to property, plant and equipment in each year are not required to be made by you. 2. For this Question Only, in addition to the information given above in the general section, assume also that the company had received rent in advance for six years in 2014 amounting to $24,000 in cash. From this amount, rent revenues for 2014 and 2015 were correctly recognized by the company. Note that for tax purposes any cash received for future rent services is taxed when the cash is received. The tax rates in both 2014 and 2015 were 20%. Determine the amounts to be reported for Deferred Taxes on the balance sheets ended December 31 for 2016 - 2018. Journal entries are not required. 3. How would your answer change if it was expected that only 60% of the losses determined as per the assumptions in [1] above, would be used within the carry forward period. In 2018, it was still expected that 60% of the remaining unused loss carry forward from 2017 would be recovered in future years. 4. For this Question, ignore the information on the amount of taxable loss given in the problem for 2017. Instead, now assume that KongResz decided that it was possible all of the losses would be used within the carryforward period and that in 2017 they correctly set up an asset of $244,000 to recognize this loss carry forward after carrying back the maximum loss possible to 2016. Also assume the 2018 tax rate was known in 2017. How much was the taxable loss in 2017? How much was the accounting loss in 2017? KongResz, Ltd., follows IFRS and reported the following amounts and information for the three years ended December 31: GENERAL INFORMATION 2016 2017 2018 Accounting income (loss) $550,000 (1,400,000) $200,000 Accounting depreciation 100,000 100,000 100,000 CCA allowed 170,000 110,000 80,000 Tax rate 25% 30% 33% Taxable incomes (losses) in the two years prior to 2016 were $0. Any changes in tax rates were not enacted until the year of the tax change. Tax rates beyond 2018 are not expected to change. KongResz? management is confident that it is probable the company will be able to use the losses carried forward. REQUIRED: 1. Prepare the journal entries to record only the loss carryback and/or loss carry forward for the years 2016-2018. Journal entries for the timing differences related to property, plant and equipment in each year are not required to be made by you. 2. For this Question Only, in addition to the information given above in the general section, assume also that the company had received rent in advance for six years in 2014 amounting to $24,000 in cash. From this amount, rent revenues for 2014 and 2015 were correctly recognized by the company. Note that for tax purposes any cash received for future rent services is taxed when the cash is received. The tax rates in both 2014 and 2015 were 20%. Determine the amounts to be reported for Deferred Taxes on the balance sheets ended December 31 for 2016 - 2018. Journal entries are not required. 3. How would your answer change if it was expected that only 60% of the losses determined as per the assumptions in [1] above, would be used within the carry forward period. In 2018, it was still expected that 60% of the remaining unused loss carry forward from 2017 would be recovered in future years. 4. For this Question, ignore the information on the amount of taxable loss given in the problem for 2017. Instead, now assume that KongResz decided that it was possible all of the losses would be used within the carryforward period and that in 2017 they correctly set up an asset of $244,000 to recognize this loss carry forward after carrying back the maximum loss possible to 2016. Also assume the 2018 tax rate was known in 2017. How much was the taxable loss in 2017? How much was the accounting loss in 2017