Answered step by step

Verified Expert Solution

Question

1 Approved Answer

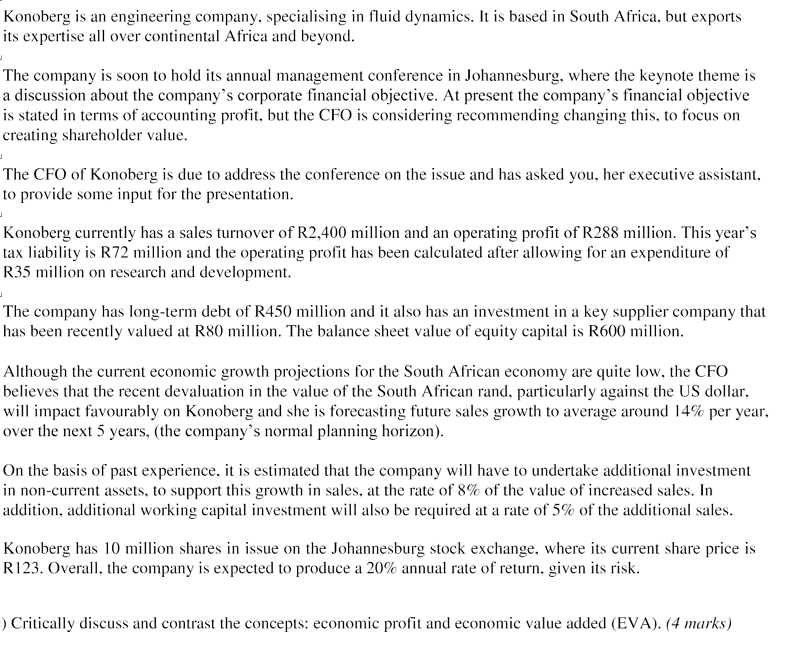

Konoberg is an engineering company, specialising in fluid dynamics. It is based in South Africa, but exports its expertise all over continental Africa and beyond.

Konoberg is an engineering company, specialising in fluid dynamics. It is based in South Africa, but exports

its expertise all over continental Africa and beyond.

The company is soon to hold its annual management conference in Johannesburg, where the keynote theme is

a discussion about the company's corporate financial objective. At present the company's financial objective

is stated in terms of accounting profit, but the CFO is considering recommending changing this, to focus on

creating shareholder value.

The CFO of Konoberg is due to address the conference on the issue and has asked you, her executive assistant,

to provide some input for the presentation.

Konoberg currently has a sales turnover of R million and an operating profit of R million. This year's

tax liability is R million and the operating profit has been calculated after allowing for an expenditure of

R million on research and development.

The company has longterm debt of R million and it also has an investment in a key supplier company that

has been recently valued at R million. The balance sheet value of equity capital is R million.

Although the current economic growth projections for the South African economy are quite low, the CFO

believes that the recent devaluation in the value of the South African rand, particularly against the US dollar,

will impact favourably on Konoberg and she is forecasting future sales growth to average around per year,

over the next years, the company's normal planning horizon

On the basis of past experience, it is estimated that the company will have to undertake additional investment

in noncurrent assets, to support this growth in sales, at the rate of of the value of increased sales. In

addition, additional working capital investment will also be required at a rate of of the additional sales.

Konoberg has million shares in issue on the Johannesburg stock exchange, where its current share price is

R Overall, the company is expected to produce a annual rate of return, given its risk.

Critically discuss and contrast the concepts: economic profit and economic value added EVA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started