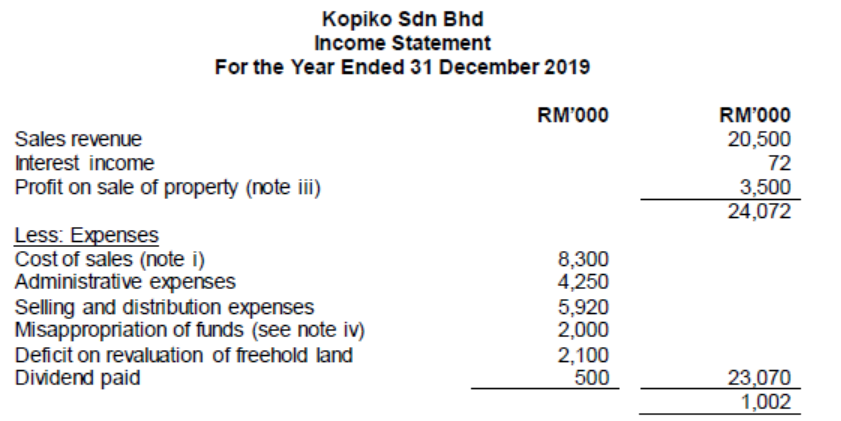

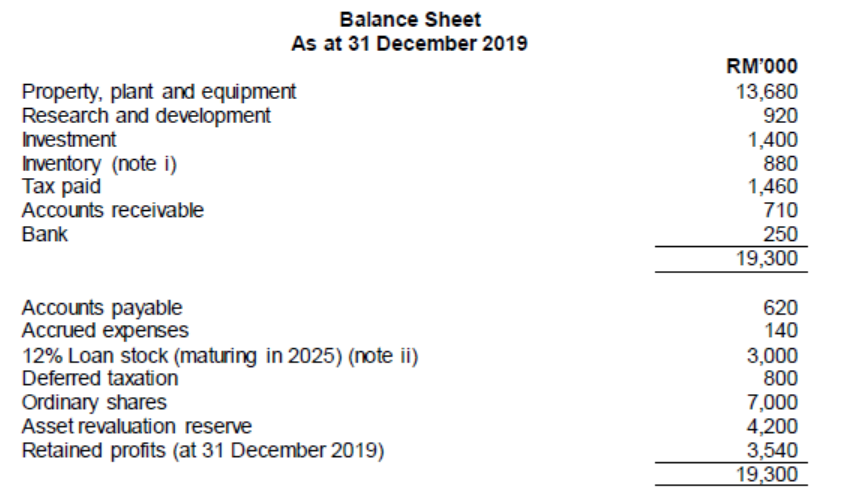

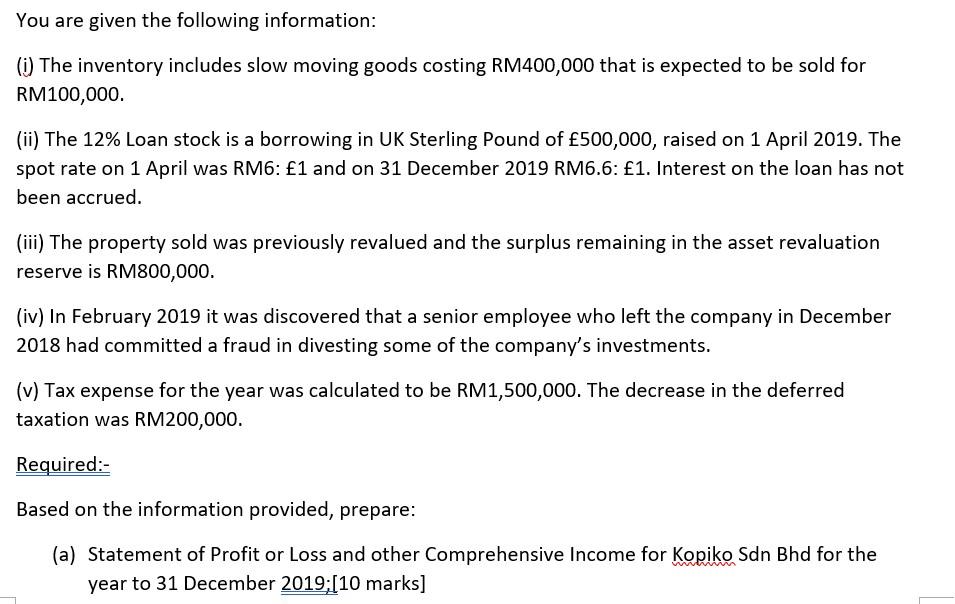

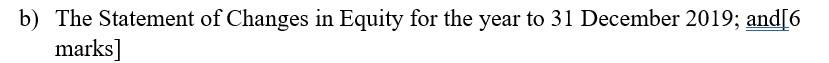

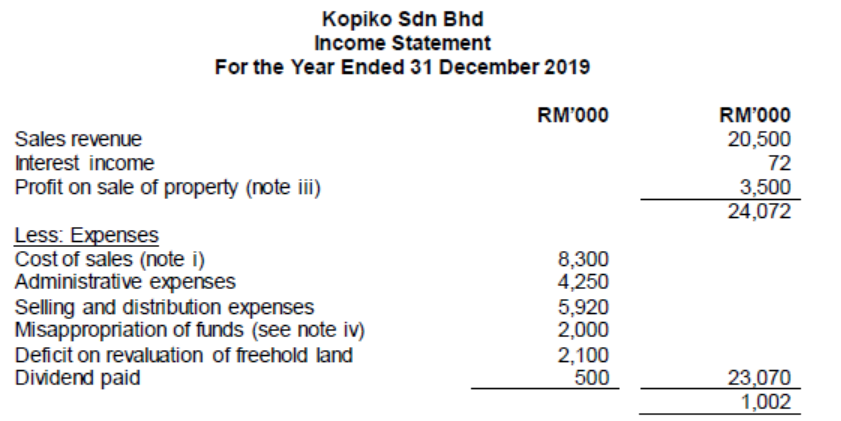

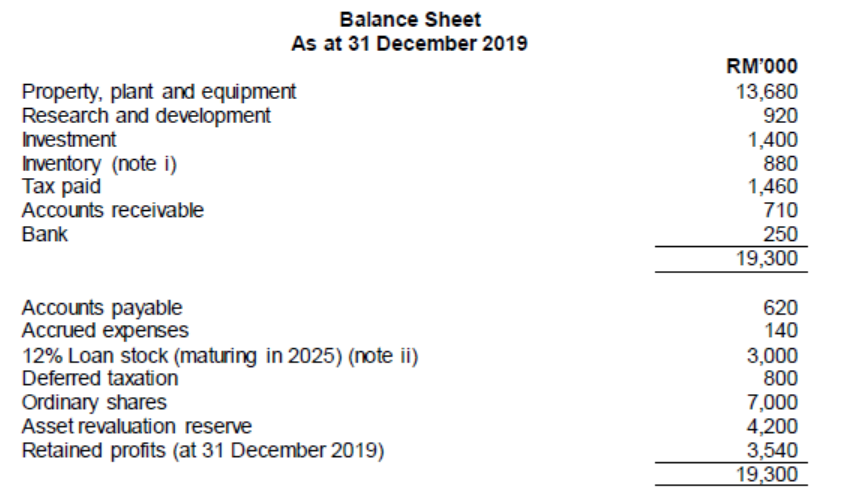

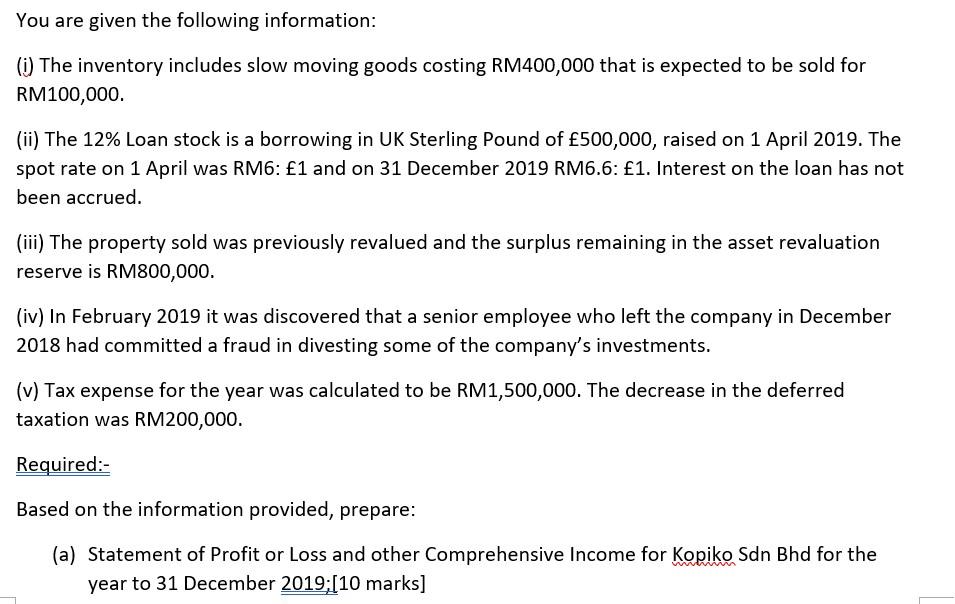

Kopiko Sdn Bhd Income Statement For the Year Ended 31 December 2019 RM'000 Sales revenue Interest income Profit on sale of property (note iii) RM'000 20,500 72 3,500 24,072 Less: Expenses Cost of sales (note i) Administrative expenses Selling and distribution expenses Misappropriation of funds (see note iv) Deficit on revaluation of freehold land Dividend paid 8,300 4,250 5,920 2,000 2.100 500 23,070 1,002 Balance Sheet As at 31 December 2019 Property, plant and equipment Research and development Investment Inventory (note i) Tax paid Accounts receivable Bank RM'000 13,680 920 1,400 880 1,460 710 250 19,300 Accounts payable Accrued expenses 12% Loan stock (maturing in 2025) (note ii) Deferred taxation Ordinary shares Asset revaluation reserve Retained profits (at 31 December 2019) 620 140 3,000 800 7.000 4,200 3,540 19,300 You are given the following information: (i) The inventory includes slow moving goods costing RM400,000 that is expected to be sold for RM100,000 (ii) The 12% Loan stock is a borrowing in UK Sterling Pound of 500,000, raised on 1 April 2019. The spot rate on 1 April was RM6: 1 and on 31 December 2019 RM6.6: 1. Interest on the loan has not been accrued. (iii) The property sold was previously revalued and the surplus remaining in the asset revaluation reserve is RM800,000. (iv) In February 2019 it was discovered that a senior employee who left the company in December 2018 had committed a fraud in divesting some of the company's investments. (v) Tax expense for the year was calculated to be RM1,500,000. The decrease in the deferred taxation was RM200,000. Required:- Based on the information provided, prepare: (a) Statement of Profit or Loss and other Comprehensive Income for Kopiko Sdn Bhd for the year to 31 December 2019;[10 marks] b) The Statement of Changes in Equity for the year to 31 December 2019; and[6 marks] c) Statement of Financial Position as at 31 December 2019.[14 marks] Kopiko Sdn Bhd Income Statement For the Year Ended 31 December 2019 RM'000 Sales revenue Interest income Profit on sale of property (note iii) RM'000 20,500 72 3,500 24,072 Less: Expenses Cost of sales (note i) Administrative expenses Selling and distribution expenses Misappropriation of funds (see note iv) Deficit on revaluation of freehold land Dividend paid 8,300 4,250 5,920 2,000 2.100 500 23,070 1,002 Balance Sheet As at 31 December 2019 Property, plant and equipment Research and development Investment Inventory (note i) Tax paid Accounts receivable Bank RM'000 13,680 920 1,400 880 1,460 710 250 19,300 Accounts payable Accrued expenses 12% Loan stock (maturing in 2025) (note ii) Deferred taxation Ordinary shares Asset revaluation reserve Retained profits (at 31 December 2019) 620 140 3,000 800 7.000 4,200 3,540 19,300 You are given the following information: (i) The inventory includes slow moving goods costing RM400,000 that is expected to be sold for RM100,000 (ii) The 12% Loan stock is a borrowing in UK Sterling Pound of 500,000, raised on 1 April 2019. The spot rate on 1 April was RM6: 1 and on 31 December 2019 RM6.6: 1. Interest on the loan has not been accrued. (iii) The property sold was previously revalued and the surplus remaining in the asset revaluation reserve is RM800,000. (iv) In February 2019 it was discovered that a senior employee who left the company in December 2018 had committed a fraud in divesting some of the company's investments. (v) Tax expense for the year was calculated to be RM1,500,000. The decrease in the deferred taxation was RM200,000. Required:- Based on the information provided, prepare: (a) Statement of Profit or Loss and other Comprehensive Income for Kopiko Sdn Bhd for the year to 31 December 2019;[10 marks] b) The Statement of Changes in Equity for the year to 31 December 2019; and[6 marks] c) Statement of Financial Position as at 31 December 2019.[14 marks]