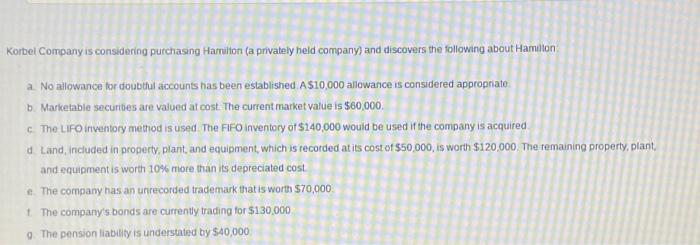

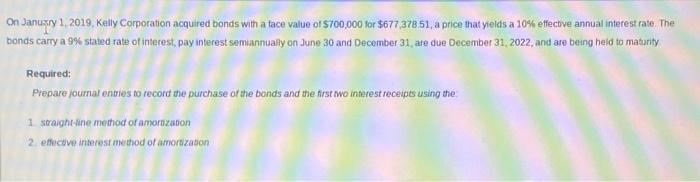

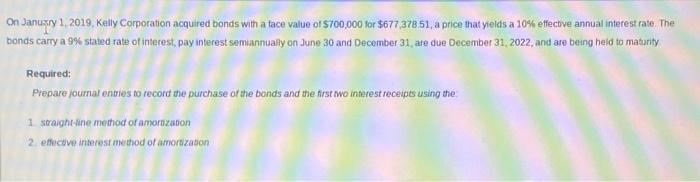

Korbel Company is considering purchasing Hamilton (a privately heid company) and discovers the following about Hamllon a. No allowance for doubtul accounts has been established A $10,000 allowance is considered appropriate b. Marketable securites are valued at cost. The current market value is $60,000. c. The LiFO inventory method is used. The FFF inventory of $140,000 would be used if the company is acquired d Land, included in property, plant, and equipment, which is recorded at its cost of $50,000, is worth $120,000. The remaining property, plant. and equipment is worth 10% more than its depreciated cost e. The company has an unrecorded trademark that is worth $70,000 t. The company's bonds are currently trading for $130,000 9. The pension liability is understated by $40,000 On Janusry 1,2019, Kelly Corporation acquired bonds with a tace value of 5700,000 lor $677,378.51, a price that yelds a 10% effective annual interest rate. The bonds carry a 9% stated rate of interest, pay interest semiannualy on dune 30 and December 31 , are due December 31,2022 , and ate being held to maturity Required: Prepare joumal enties to record the purchase of the bonds and the first wo interest receipts using the 1 straight-ine medhod of amorizabon 2. effecave interest method of amortization Korbel Company is considering purchasing Hamilton (a privately heid company) and discovers the following about Hamllon a. No allowance for doubtul accounts has been established A $10,000 allowance is considered appropriate b. Marketable securites are valued at cost. The current market value is $60,000. c. The LiFO inventory method is used. The FFF inventory of $140,000 would be used if the company is acquired d Land, included in property, plant, and equipment, which is recorded at its cost of $50,000, is worth $120,000. The remaining property, plant. and equipment is worth 10% more than its depreciated cost e. The company has an unrecorded trademark that is worth $70,000 t. The company's bonds are currently trading for $130,000 9. The pension liability is understated by $40,000 On Janusry 1,2019, Kelly Corporation acquired bonds with a tace value of 5700,000 lor $677,378.51, a price that yelds a 10% effective annual interest rate. The bonds carry a 9% stated rate of interest, pay interest semiannualy on dune 30 and December 31 , are due December 31,2022 , and ate being held to maturity Required: Prepare joumal enties to record the purchase of the bonds and the first wo interest receipts using the 1 straight-ine medhod of amorizabon 2. effecave interest method of amortization