Answered step by step

Verified Expert Solution

Question

1 Approved Answer

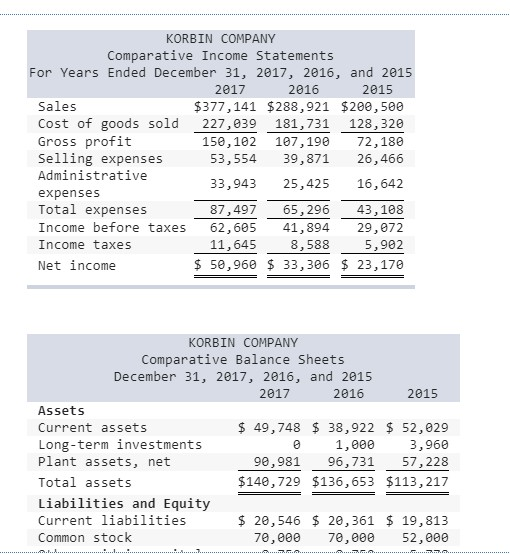

KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 $377,141 $288,921 $280,500 2016 2015 Sales Cost of goods sold

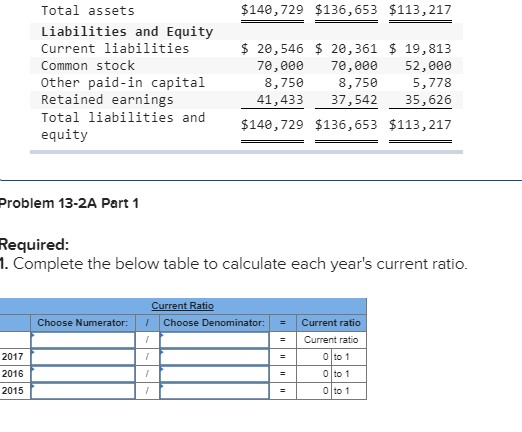

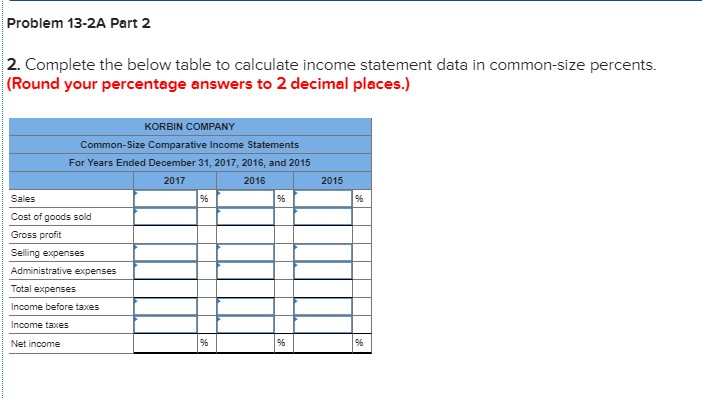

KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 $377,141 $288,921 $280,500 2016 2015 Sales Cost of goods sold 227,039 181,731 128,320 Gross profit 150,102 107,190 72,180 53, 554 39,871 26,466 33,943 25,425 16, 642 43,108 29,072 8,5885905 $50,960 $ 33, 306 $ 23,170 Selling expense:s Administrative expenses Total expenses 87,497 65, 296 Income before taxes 62,605 41,894 Income taxes 11,645 Net income KORBIN COMPANY Comparative Balance Sheets December 31, 2017, 2016, and 2015 2017 2016 2015 Assets Current assets Long-term investments Plant assets, net Total assets $ 49,748 38,922 52,929 3,960 90,981 96,731 57,228 $140,729 $136,653 $113,217 1,900 Liabilities and Equity Current liabilities Common stock $20,546 $ 20,361 $ 19,813 78,000 7e,00 52,800 Total assets $140,729 $136,653 $113,217 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total 1iabilities and equity $ 20,546 $ 20, 361 $ 19,813 78,000 7e,0 52,800 5,778 41,433 37,542 35,626 8,750 8,750 $140,729 $136,653 $113,217 Problem 13-2A Part 1 Required 1. Complete the below table to calculate each year's current ratio Choose Denominator: | # | Current ratio Current ratio 2017 2016 2015 0 to 1 0 to 1 0 to 1 Problem 13-2A Part 2 2. Complete the below table to calculate income statement data in common-size percents (Round your percentage answers to 2 decimal places.) KORBN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 2015 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income taxes Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started