Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Koyna Jal manufactures and sells a special energy drink for sports players. The organization follows a policy of charging 20 profit on its selling price,

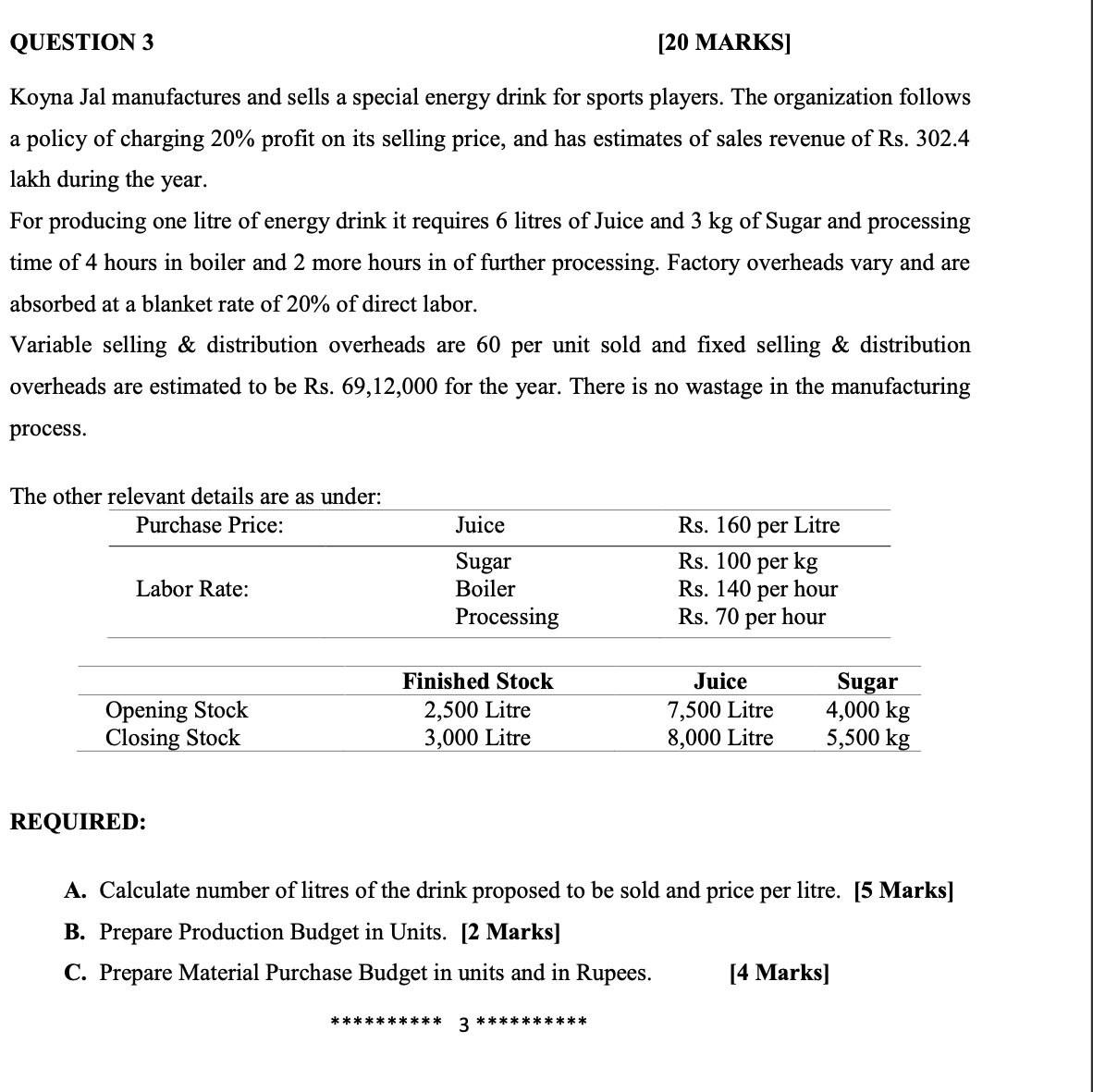

Koyna Jal manufactures and sells a special energy drink for sports players. The organization follows a policy of charging \20 profit on its selling price, and has estimates of sales revenue of Rs. 302.4 lakh during the year. For producing one litre of energy drink it requires 6 litres of Juice and \\( 3 \\mathrm{~kg} \\) of Sugar and processing time of 4 hours in boiler and 2 more hours in of further processing. Factory overheads vary and are absorbed at a blanket rate of \20 of direct labor. Variable selling \\& distribution overheads are 60 per unit sold and fixed selling \\& distribution overheads are estimated to be Rs. \\( 69,12,000 \\) for the year. There is no wastage in the manufacturing process. The other relevant details are as under- REQUIRED: A. Calculate number of litres of the drink proposed to be sold and price per litre. [5 Marks] B. Prepare Production Budget in Units. [2 Marks] C. Prepare Material Purchase Budget in units and in Rupees. [4 Marks] D. Monthly Labour requirement and overall Labour Cost Budget. [4 Marks] E. How can variance analysis be used as a tool of performance management? Explain based on your readings and learning in this course. [5 marks]

Koyna Jal manufactures and sells a special energy drink for sports players. The organization follows a policy of charging \20 profit on its selling price, and has estimates of sales revenue of Rs. 302.4 lakh during the year. For producing one litre of energy drink it requires 6 litres of Juice and \\( 3 \\mathrm{~kg} \\) of Sugar and processing time of 4 hours in boiler and 2 more hours in of further processing. Factory overheads vary and are absorbed at a blanket rate of \20 of direct labor. Variable selling \\& distribution overheads are 60 per unit sold and fixed selling \\& distribution overheads are estimated to be Rs. \\( 69,12,000 \\) for the year. There is no wastage in the manufacturing process. The other relevant details are as under- REQUIRED: A. Calculate number of litres of the drink proposed to be sold and price per litre. [5 Marks] B. Prepare Production Budget in Units. [2 Marks] C. Prepare Material Purchase Budget in units and in Rupees. [4 Marks] D. Monthly Labour requirement and overall Labour Cost Budget. [4 Marks] E. How can variance analysis be used as a tool of performance management? Explain based on your readings and learning in this course. [5 marks] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started