Question

KPCB, a top venture capital firm, is considering a $6 Million Series A investment for 6 Million shares of convertible preferred stock (CP) at $1

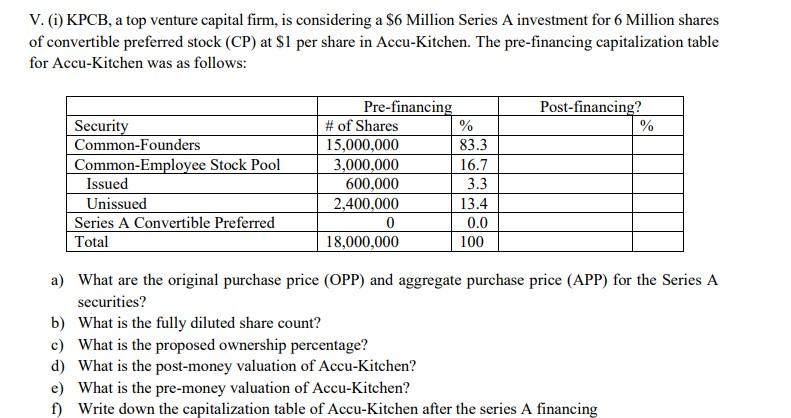

KPCB, a top venture capital firm, is considering a $6 Million Series A investment for 6 Million shares of convertible preferred stock (CP) at $1 per share in Accu-Kitchen. The pre-financing capitalization table for Accu-Kitchen was as follows: Pre-financing Post-financing? Security # of Shares % % Common-Founders 15,000,000 83.3 Common-Employee Stock Pool 3,000,000 16.7 Issued 600,000 3.3 Unissued 2,400,000 13.4 Series A Convertible Preferred 0 0.0 Total 18,000,000 100 a) What are the original purchase price (OPP) and aggregate purchase price (APP) for the Series A securities? b) What is the fully diluted share count? c) What is the proposed ownership percentage? d) What is the post-money valuation of Accu-Kitchen? e) What is the pre-money valuation of Accu-Kitchen? f) Write down the capitalization table of Accu-Kitchen after the series A financing?

V. (i) KPCB, a top venture capital firm, is considering a $6 Million Series A investment for 6 Million shares of convertible preferred stock (CP) at $1 per share in Accu-Kitchen. The pre-financing capitalization table for Accu-Kitchen was as follows: a) What are the original purchase price (OPP) and aggregate purchase price (APP) for the Series A securities? b) What is the fully diluted share count? c) What is the proposed ownership percentage? d) What is the post-money valuation of Accu-Kitchen? e) What is the pre-money valuation of Accu-Kitchen? f) Write down the capitalization table of Accu-Kitchen after the series A financingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started