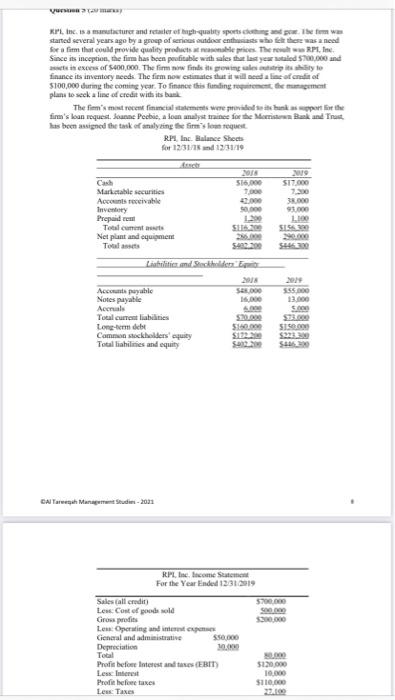

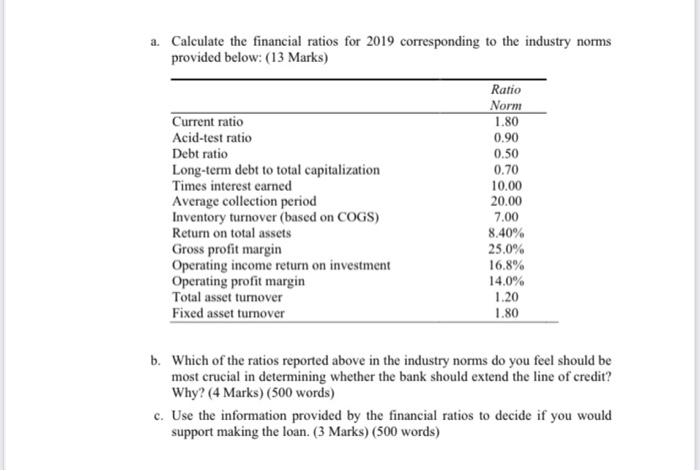

KPL the state and retailer of high quality sports the started several years ago by a groep of series outdoor enthusiasts while there was a need for a firm that could provide quality products.leries. There wa PT. In Since its inception, the firm has been profitable with sales that last year old 700.000 and in exons or 400.000. The fimiwfindes points to finance its inventory needs. The firm now estimates that it will need a line of credit of $100,000 during the coming year. To finance this funding in the management plans to seck a line of credit with its bank The firm's most recent financial statements were preseshukport for the fimm's loan request, Joanne Peebie, a loan analyst trainee for the Most Bank and Trust has been assigned the task of analyzing the firm's request RP Inc. Ble Sheets for 123181331/19 9 SI7000 516000 38.000 Marketable securities Accounts receivable Inventory Prepaid Telcurrent Net plant and equipment Touala ST 2 1100 SIS 30.000 Labritid Stockholder 16.00 Accounts payable Notes payable Accu Total current liabilities Long-term debe Commonsteckholders' equity Total liabilities and equity 510 ST S150.00 $2233 $ DAI Targah Management Studie-2021 RP, Inc. Income Store For the Year Ended 123102019 Sales call credit 5700.000 Les Cost of good old SA Gross profits Les Operating and in Cientral and administrative 550.000 Depreciation a. Total Profit before interest and taxes (EBIT) $120.000 Les Interest 10.000 Profit before takes $110.000 Les Taxes a Calculate the financial ratios for 2019 corresponding to the industry norms provided below: (13 Marks) Current ratio Acid-test ratio Debt ratio Long-term debt to total capitalization Times interest earned Average collection period Inventory turnover (based on COGS) Return on total assets Gross profit margin Operating income return on investment Operating profit margin Total asset tumover Fixed asset turnover Ratio Norm 1.80 0.90 0.50 0.70 10.00 20.00 7.00 8.40% 25.0% 16.8% 14.0% 1.20 1.80 b. Which of the ratios reported above in the industry norms do you feel should be most crucial in determining whether the bank should extend the line of credit? Why? (4 Marks) (500 words) c. Use the information provided by the financial ratios to decide if you would support making the loan. (3 Marks) (500 words)