Answered step by step

Verified Expert Solution

Question

1 Approved Answer

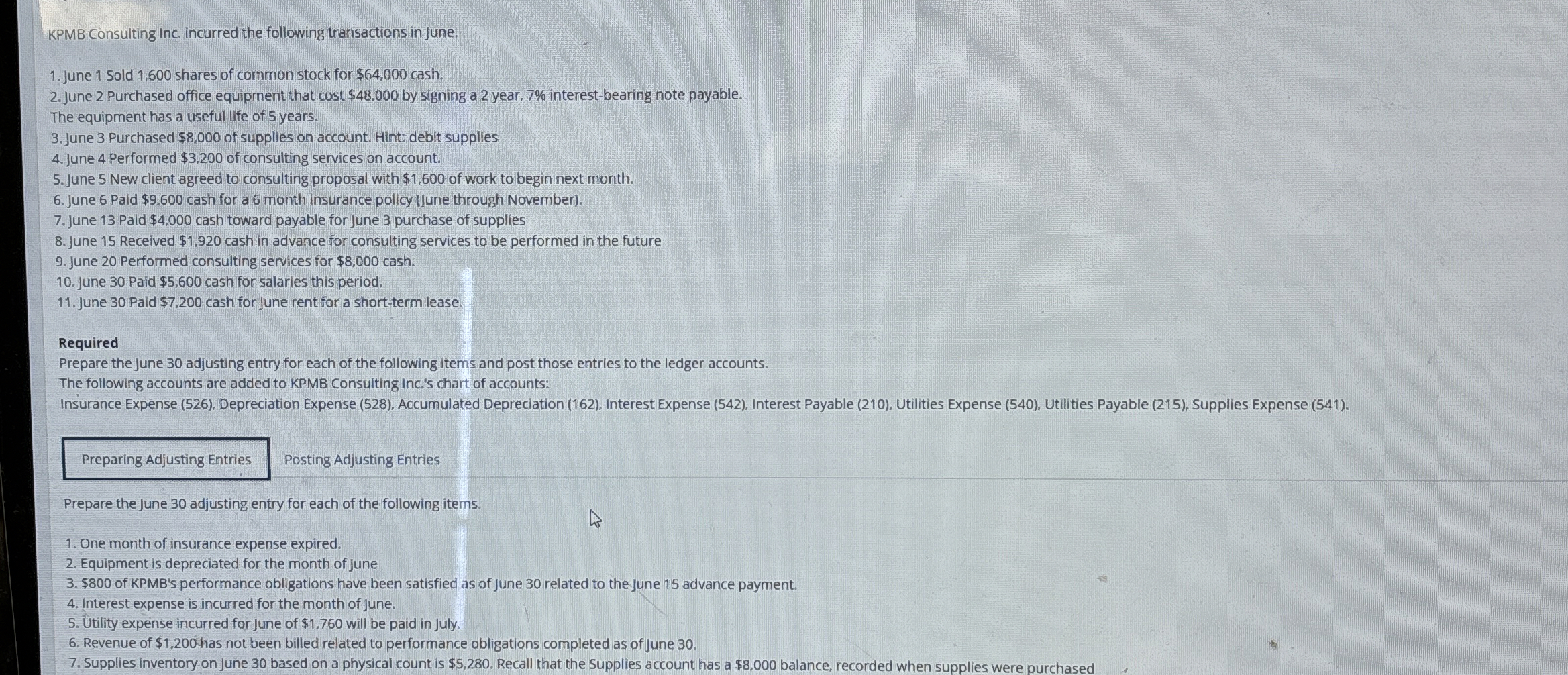

KPMB Consulting Inc. incurred the following transactions in June. June 1 Sold 1 , 6 0 0 shares of common stock for $ 6 4

KPMB Consulting Inc. incurred the following transactions in June.

June Sold shares of common stock for $ cash.

June Purchased office equipment that cost $ by signing a year, interestbearing note payable.

The equipment has a useful life of years.

June Purchased $ of supplies on account. Hint debit supplies

June Performed $ of consulting services on account.

June New client agreed to consulting proposal with $ of work to begin next month.

June Paid $ cash for a month insurance policy June through November

June Paid $ cash toward payable for June purchase of supplies

June Received $ cash in advance for consulting services to be performed in the future

June Performed consulting services for $ cash.

June Paid $ cash for salaries this period.

June Paid $ cash for june rent for a shortterm lease.

Required

Prepare the June adjusting entry for each of the following items and post those entries to the ledger accounts.

The following accounts are added to KPMB Consulting Inc.s chart of accounts:

Insurance Expense Depreciation Expense Accumulated Depreciation Interest Expense Interest Payable Utilities Expense Utilities Payable Supplies Expense

Posting Adjusting Entries

Prepare the June adjusting entry for each of the following items.

One month of insurance expense expired.

Equipment is depreciated for the month of June

$ of KPMBs performance obligations have been satisfied as of June related to the June advance payment.

Interest expense is incurred for the month of June.

Utility expense incurred for June of $ will be paid in July.

Revenue of $ has not been billed related to performance obligations completed as of June

Supplies inventory on June based on a physical count is $ Recall that the Supplies account has a $ balance, recorded when supplies were purchased

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started