Question

Gilts are bonds that are issued by the British government, and they are generally considered very low-risk investments. Assume that the portfolio manager uses an

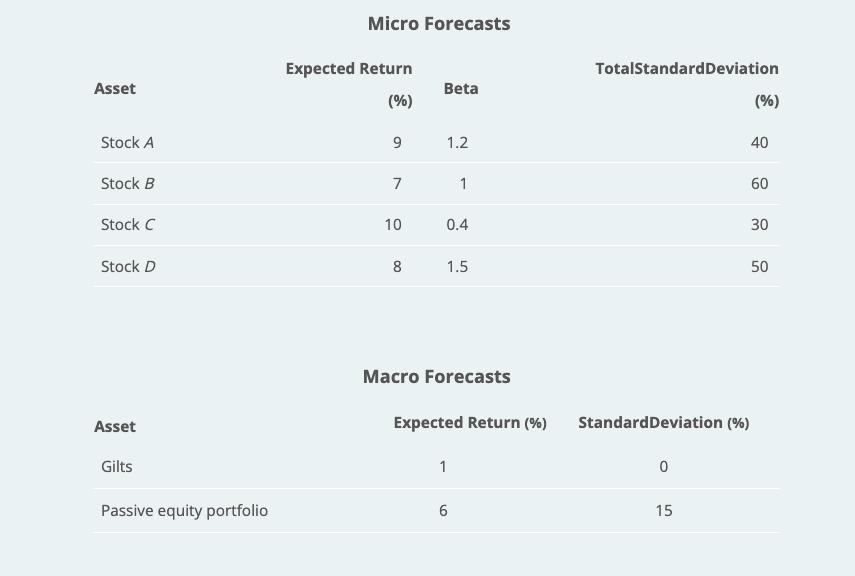

Gilts are bonds that are issued by the British government, and they are generally considered very low-risk investments. Assume that the portfolio manager uses an index model and treats residual standard deviations as firm-specific risks. In addition, the fund prohibits short-selling within the active portfolio. a) Calculate expected excess returns, alpha values, and residual variances for these stocks.

Asset Stock A Stock B Stock C Stock D Asset Gilts Passive equity portfolio Micro Forecasts Expected Return (%) 9 7 10 8 Beta 1.2 0.4 1 1.5 Macro Forecasts Expected Return (%) 1 6 TotalStandardDeviation 0 15 (%) 40 StandardDeviation (%) 60 30 50

Step by Step Solution

3.43 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Stock A ERA 9 alpha ERA rf 9 1 8 sigmaA 40 Stock B ERB 7 alpha ERB rf 7 1 6 sigmaB 30 Stock C ERC 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson

10th edition

978-1285441979, 1285441974, 978-1133626992, 1133626998, 978-1133940593

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App