Krista is single living with her kid and had a taxable income $80,259 last year. In addition, she owed other taxes of $2,336. She was entitled to a childcare credit of $668 and a foreign tax credit of $1,719. If her employer withheld $270 per week for 52 weeks, does Krista qualify for a refund or owe more taxes? How much?

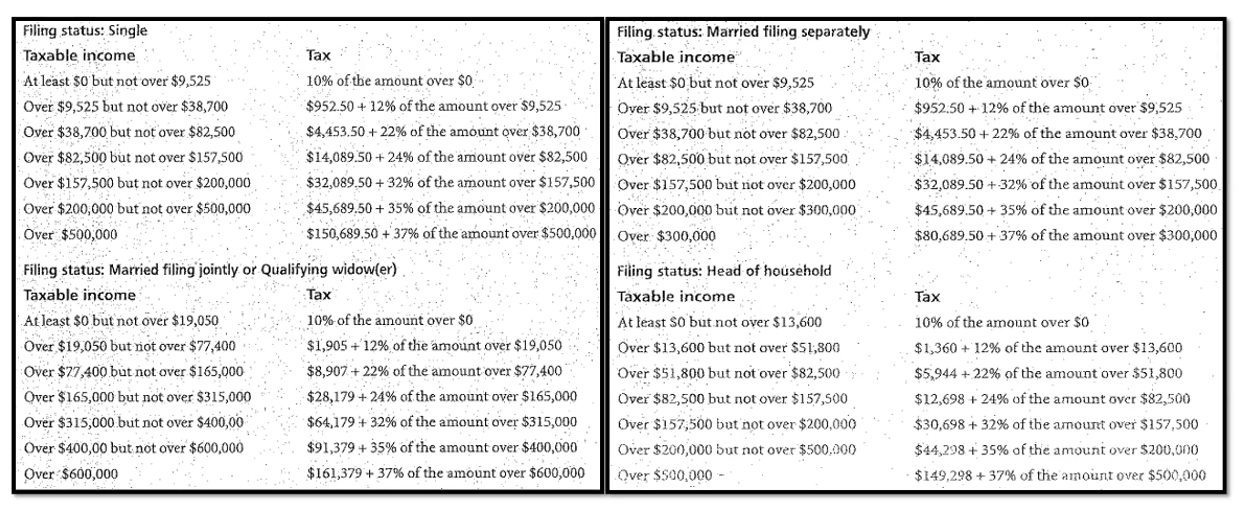

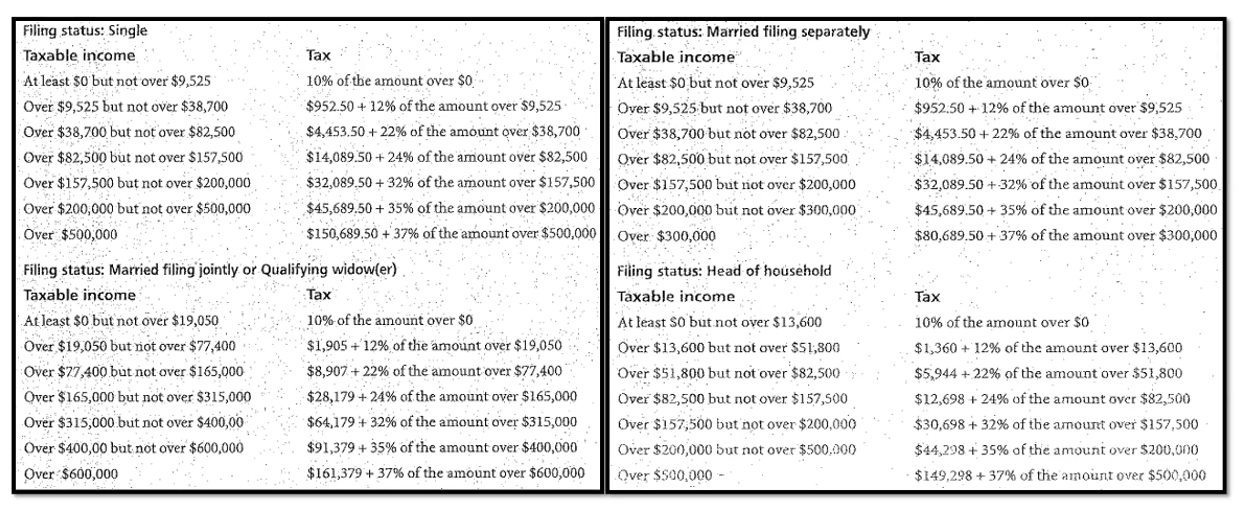

Tax Filing status: Single Taxable income At least $0 but not over $9,525 Over $9,525 but not over $38,700 Over $38,700 but not over $82,500 Over $82,500 but not over $157,500 Over $157,500 but not over $200,000 Over $200,000 but not over $500,000 Over $500,000 10% of the amount over $0 $952.50 + 12% of the amount over $9,525 $4,453.50 +22% of the amount over $38,700 $14,089.50 +24% of the amount over $82,500 $32,089.50 + 32% of the amount over $157,500 $45,689.50+ 35% of the amount over $200,000 $150,689.50 +37% of the amount over $500,000 Filing status: Married filing separately Taxable income At least $0 but not over $9,525 Over $9,525 but not over $38,700 Over $38,700 but not over $82,500 Over $82,500 but not over $157,500 Over $157,500 but not over $200,000 Over $200,000 but not over $300,000 Over $300,000 Tax 10% of the amount over $0 $952:50 + 12% of the amount over $9,525 $4,453.50 +22% of the amount over $38,700 $14,089.50 +24% of the amount over $82,500 $32,089.50 + 32% of the amount over $157,500 $45,689.50 + 35% of the amount over $200,000 $80,689.50 +37% of the amount over $300,000 Filing status: Married filing jointly or Qualifying widow(er) Taxable income Tax At least $0 but not over $19,050 10% of the amount over $0 Over $19,050 but not over $77,400 $1,905 + 12% of the amount over $19,050 Over $77,400 but not over $165,000 $8,907 +22% of the amount over $77,400 Over $165,000 but not over $315,000 $28,179 +24% of the amount over $165,000 Over $315,000 but not over $400,00 $64,179 + 32% of the amount over $315,000 Over $400,00 but not over $600,000 $91,379 + 35% of the amount over $400,000 Over $600,000 $161,379 +37% of the amount over $600,000 Filing status: Head of household Taxable income At least so but not over $13,600 Over $13,600 but not over $51,800 Over $51,800 but not over $82,500 Over $82,500 but not over $157,500 Over $157,500 but not over $200,000 Over $200,000 but not over $500,000 Over $500,000 - Tax 10% of the amount over $0 $1,360 + 12% of the amount over $13,600 $5,944 +22% of the amount over $51,800 $12,698 +24% of the amount over $82,500 $30,698 + 32% of the amount over $157,500 $44,298 + 35% of the amount over $200,000 $149,298 + 37% of the amount over $500,000 Tax Filing status: Single Taxable income At least $0 but not over $9,525 Over $9,525 but not over $38,700 Over $38,700 but not over $82,500 Over $82,500 but not over $157,500 Over $157,500 but not over $200,000 Over $200,000 but not over $500,000 Over $500,000 10% of the amount over $0 $952.50 + 12% of the amount over $9,525 $4,453.50 +22% of the amount over $38,700 $14,089.50 +24% of the amount over $82,500 $32,089.50 + 32% of the amount over $157,500 $45,689.50+ 35% of the amount over $200,000 $150,689.50 +37% of the amount over $500,000 Filing status: Married filing separately Taxable income At least $0 but not over $9,525 Over $9,525 but not over $38,700 Over $38,700 but not over $82,500 Over $82,500 but not over $157,500 Over $157,500 but not over $200,000 Over $200,000 but not over $300,000 Over $300,000 Tax 10% of the amount over $0 $952:50 + 12% of the amount over $9,525 $4,453.50 +22% of the amount over $38,700 $14,089.50 +24% of the amount over $82,500 $32,089.50 + 32% of the amount over $157,500 $45,689.50 + 35% of the amount over $200,000 $80,689.50 +37% of the amount over $300,000 Filing status: Married filing jointly or Qualifying widow(er) Taxable income Tax At least $0 but not over $19,050 10% of the amount over $0 Over $19,050 but not over $77,400 $1,905 + 12% of the amount over $19,050 Over $77,400 but not over $165,000 $8,907 +22% of the amount over $77,400 Over $165,000 but not over $315,000 $28,179 +24% of the amount over $165,000 Over $315,000 but not over $400,00 $64,179 + 32% of the amount over $315,000 Over $400,00 but not over $600,000 $91,379 + 35% of the amount over $400,000 Over $600,000 $161,379 +37% of the amount over $600,000 Filing status: Head of household Taxable income At least so but not over $13,600 Over $13,600 but not over $51,800 Over $51,800 but not over $82,500 Over $82,500 but not over $157,500 Over $157,500 but not over $200,000 Over $200,000 but not over $500,000 Over $500,000 - Tax 10% of the amount over $0 $1,360 + 12% of the amount over $13,600 $5,944 +22% of the amount over $51,800 $12,698 +24% of the amount over $82,500 $30,698 + 32% of the amount over $157,500 $44,298 + 35% of the amount over $200,000 $149,298 + 37% of the amount over $500,000