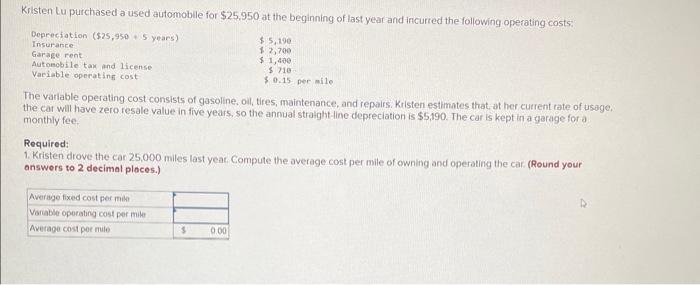

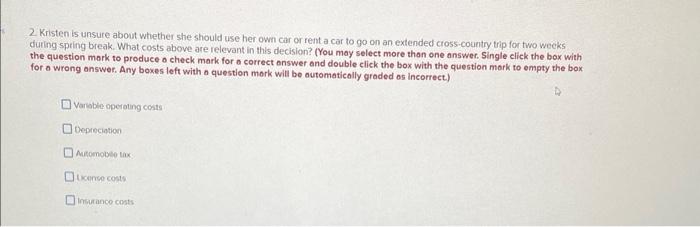

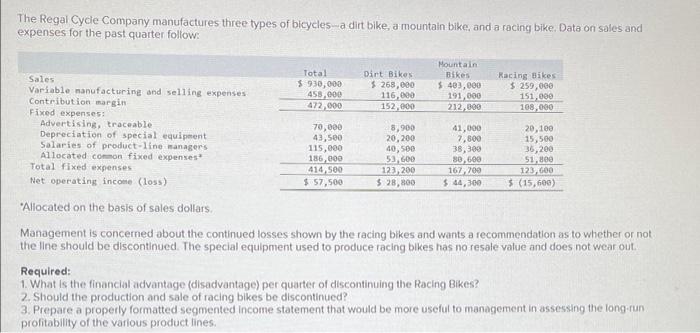

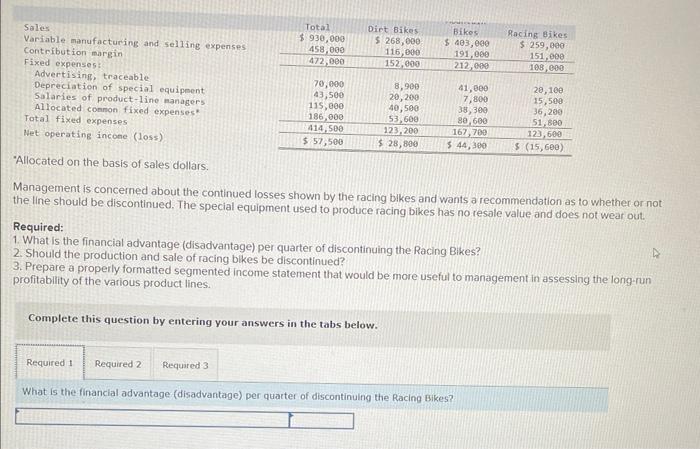

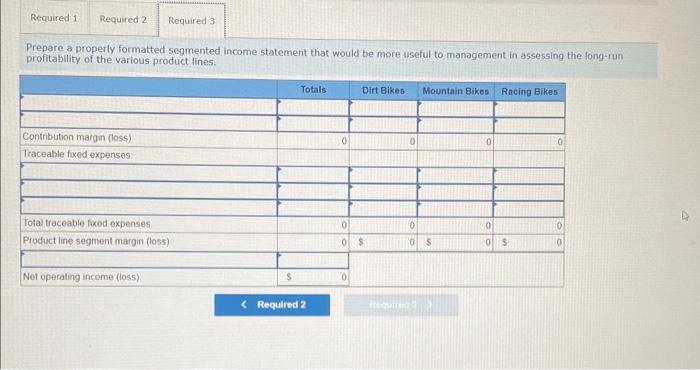

Kristen tu purchased a used automoblle for $25,950 at the beginning of last yeat and incurred the following operating costs: The variable operating cost consists of gasoline, oll, tifes, maintenance, and repoirs. Kristen estimates that, at her cutrent rate of usage, the cat will have zero resale value in five years, so the annual straight-line depreciation is $5,190. The car is kept in a garage for a monthly fee. Required: 1. Kristen drove the car 25,000 miles last yeat. Compute the average cost per mile of owning and operating the car. (Round your answers to 2 decimal ploces.) 2. Kristen is unsure about whether she should use her own car or rent a car to go on an extended cross-country trip for two weeke during sping break. What costs above are relevant in this decision? (You may select more than one answer. Single click the box with the question mark to produce o check mark for a correct onswer and double elick the box with the question mork to empty the box for o wrong answer. Any boxes left with a question mork will be automaticolly graded os incorrect) Vanoble operoting costs Depreciotion Matomoble tiox t icense costs Insurance costs The Regai Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: -Allocated on the basis of sales dollars. Management is concemed about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing blkes has no resale value and does not wear out. Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long run profitability of the various product lines. "Allocated on the basis of sales dollars. Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines. Complete this question by entering your answers in the tabs below. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines