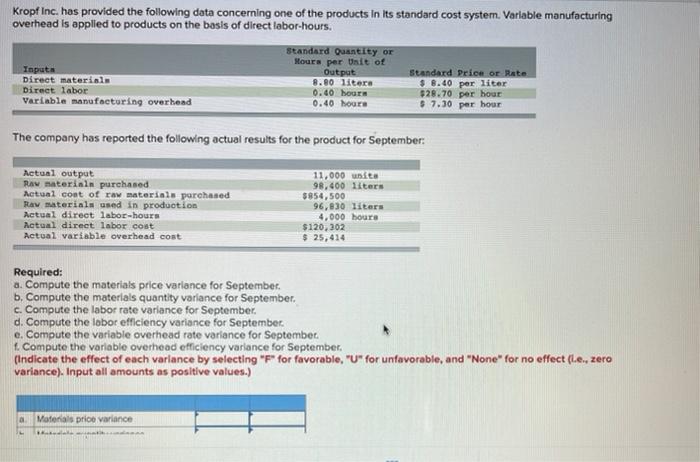

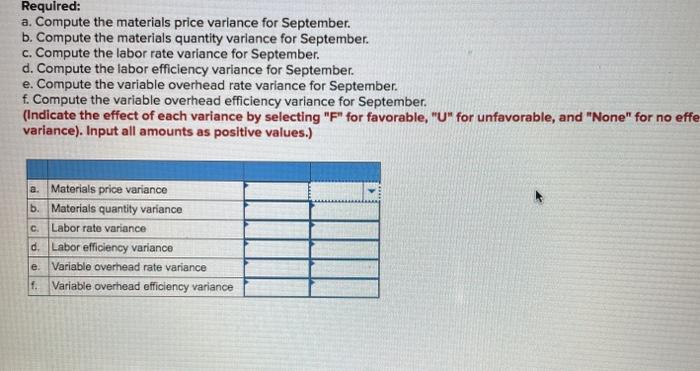

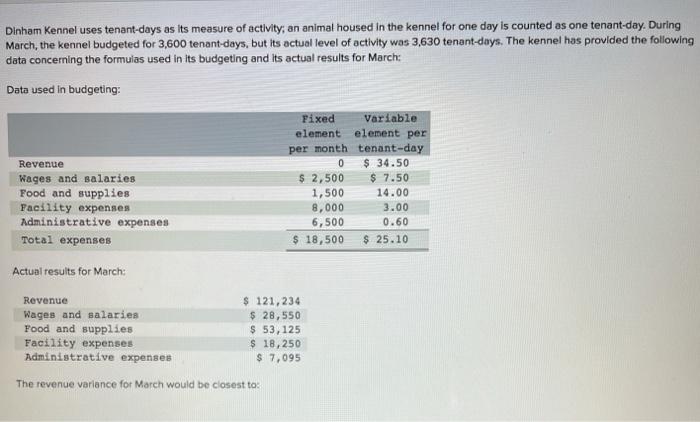

Krop Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours. standard Quantity or Moura per Unit of Inputs Output Standard Price or Rate Direct material 8.80 litera $ 8.40 per liter Direct labor 0.40 hours $28.70 per hour Variable manufacturing overhead 0.40 hours $ 7.30 per hour The company has reported the following actual results for the product for September: Actual output Raw materinin purchased Actual cost of raw materials purchased Rav materials used in production Actual direct labor-hours Actual direct labor cost Actual variable overhead cost 11,000 unite 98,400 liters $854,500 96,830 liters 4,000 hours $120,302 $ 25,414 Required: a. Compute the materials price variance for September b. Compute the materials quantity variance for September c. Compute the labor rate variance for September d. Compute the labor efficiency variance for September e. Compute the variable overhead rate variance for September . 1. Compute the variable overhead efficiency variance for September. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (l.e., zero variance). Input all amounts as positive values.) Materials prioo variance Required: a. Compute the materials price variance for September. b. Compute the materials quantity variance for September. c. Compute the labor rate variance for September d. Compute the labor efficiency variance for September e. Compute the variable overhead rate variance for September. f. Compute the variable overhead efficiency variance for September. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effe variance). Input all amounts as positive values.) a. Materials price variance b. Materials quantity variance c. Labor rate variance d. Labor efficiency variance Variable overhead rate variance 1. Variable overhead efficiency variance e Dinham Kennel uses tenant-days as its measure of activity, an animal housed in the kennel for one day Is counted as one tenant-day. During March, the kennel budgeted for 3,600 tenant-days, but its actual level of activity was 3,630 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for March Data used in budgeting: Revenue Wages and salaries Food and supplies Facility expenses Administrative expenses Total expenses Fixed Variable element element per per month tenant-day 0 $ 34.50 $ 2,500 $ 7.50 1,500 14.00 8,000 3.00 6,500 0.60 $ 18,500 $ 25.10 Actual results for March: Revenue Wages and salaries Food and supplies Facility expenses Administrative expenses $ 121,234 $ 28,550 $ 53,125 $ 18,250 $ 7,095 The revenue variance for March would be closest to