Answered step by step

Verified Expert Solution

Question

1 Approved Answer

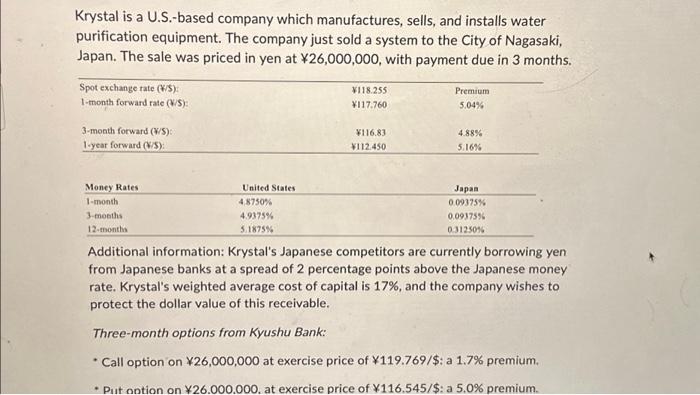

Krystal is a U.S.-based company which manufactures, sells, and installs water purification equipment. The company just sold a system to the City of Nagasaki, Japan.

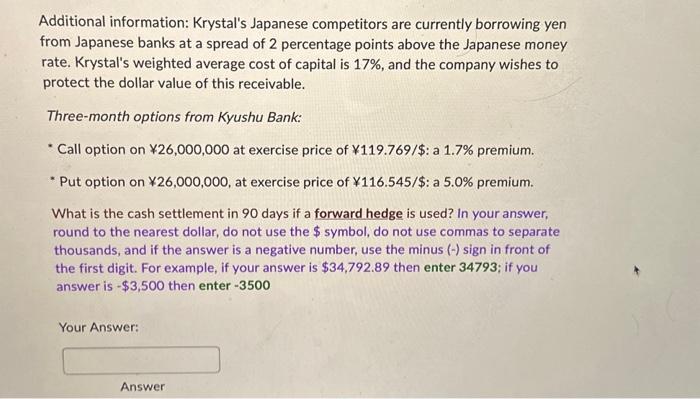

Krystal is a U.S.-based company which manufactures, sells, and installs water purification equipment. The company just sold a system to the City of Nagasaki, Japan. The sale was priced in yen at 26,000,000, with payment due in 3 months. Spot exchange rate (/$): 1-month forward rate (/$): 3-month forward (/$): 1-year forward (/$): Money Rates 1-month 3-months 12-months United States 4.8750% 4.9375% 5.1875% 118.255 117.760 116.83 112.450 Premium 5.04% 4.88% 5.16% Japan 0.09375% 0.09375% 0.31250% Additional information: Krystal's Japanese competitors are currently borrowing yen from Japanese banks at a spread of 2 percentage points above the Japanese money rate. Krystal's weighted average cost of capital is 17%, and the company wishes to protect the dollar value of this receivable. Three-month options from Kyushu Bank: * * Call option on 26,000,000 at exercise price of 119.769/$: a 1.7% premium. * Put option on 26,000,000, at exercise price of 116.545/$: a 5.0% premium.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started