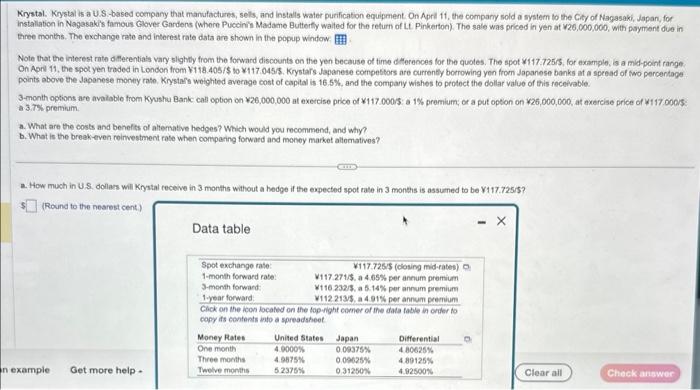

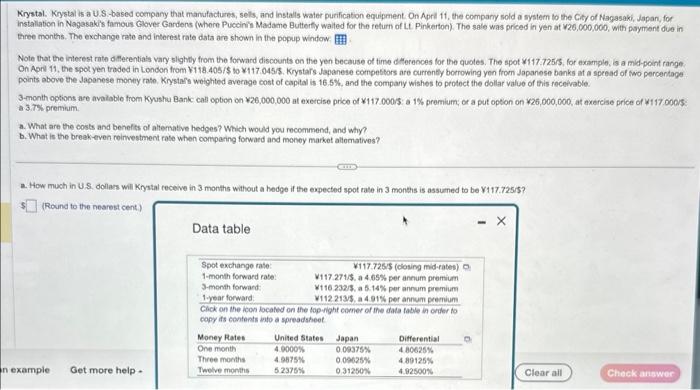

Krystal. Krystal is a U.S.-based company that manufactures, sels, and installs water purification equipment On April 11, the company sold a system to the City of Nagasaki, Japan, for installation in Napasaki's tamous Glover Gardens (where Puccinis Madame Butterfily walted for the feturn of Lt. Pinkarton). The sale was priced in yen at v2e. 000,000, with payment due in three months. The exchange rate and interest rate data are shown in the popup window Note that the interest rate oflerentials vary slightly from the forward discounts on the yen because of time deferences for the quoles. The spot *i17.725irs, for axample, is a mid-point range. points above the Japanese monty rato. Krystars weighted average cost of capital is 16.5%, and the company wishes to protoct the dollar value of this roceivabie. 3-month options are avalable from Kyushu Bankc call opbion on 26,000,000 at exercise price of *117.0005: a 1\%, premium; or a put opton on 26,000,000, at axereise price of *117 0005: a 3.75 premim. a. What are the costs and benefits of altemative hedges? Which would you recomment, and why? b. What is the breek even reinwestment rate when compesing forward and money manket allomatives? a. How much in U.S. dollars will Krystal receive in 3 months without a hedge if the expected spot rate in 3 moneths is assumed to be Y117.72515 ? (Round to the nearest cent) Data table Krystal. Krystal is a U.S.-based company that manufactures, sels, and installs water purification equipment On April 11, the company sold a system to the City of Nagasaki, Japan, for installation in Napasaki's tamous Glover Gardens (where Puccinis Madame Butterfily walted for the feturn of Lt. Pinkarton). The sale was priced in yen at v2e. 000,000, with payment due in three months. The exchange rate and interest rate data are shown in the popup window Note that the interest rate oflerentials vary slightly from the forward discounts on the yen because of time deferences for the quoles. The spot *i17.725irs, for axample, is a mid-point range. points above the Japanese monty rato. Krystars weighted average cost of capital is 16.5%, and the company wishes to protoct the dollar value of this roceivabie. 3-month options are avalable from Kyushu Bankc call opbion on 26,000,000 at exercise price of *117.0005: a 1\%, premium; or a put opton on 26,000,000, at axereise price of *117 0005: a 3.75 premim. a. What are the costs and benefits of altemative hedges? Which would you recomment, and why? b. What is the breek even reinwestment rate when compesing forward and money manket allomatives? a. How much in U.S. dollars will Krystal receive in 3 months without a hedge if the expected spot rate in 3 moneths is assumed to be Y117.72515 ? (Round to the nearest cent) Data table