Answered step by step

Verified Expert Solution

Question

1 Approved Answer

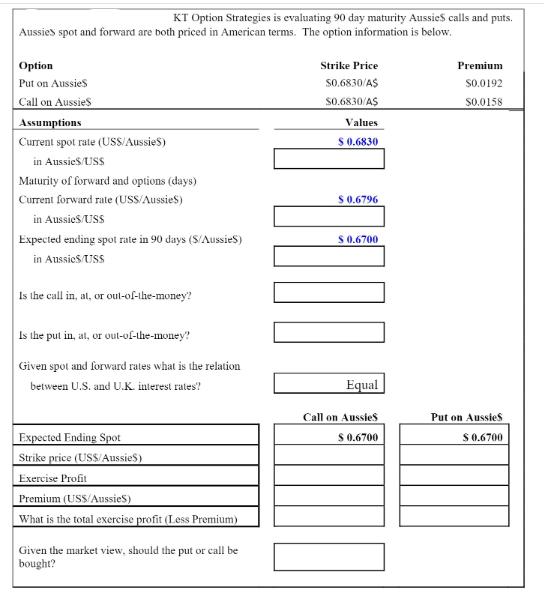

KT Option Strategies is evaluating 90 day maturity Aussies calls and puts. Aussies spot and forward are both priced in American terms. The option

KT Option Strategies is evaluating 90 day maturity Aussies calls and puts. Aussies spot and forward are both priced in American terms. The option information is below. Option Put on Aussies Call on Aussies Assumptions Current spot rate (USS/Aussies) in Aussies/USS Maturity of forward and options (days) Strike Price S0.6830/A$ Premium $0.0192 $0.6830/A$ $0.0158 Values $ 0.6830 Current forward rate (USS/Aussies) $ 0.6796 in Aussies/USS Expected ending spot rate in 90 days (S/Aussies) S 0.6700 in Aussies/USS Is the call in, at, or out-of-the-money? Is the put in, at, or out-of-the-money? Given spot and forward rates what is the relation between U.S. and U.K. interest rates? Expected Ending Spot Strike price (US$/Aussies) Exercise Profit Premium (USS/Aussies) What is the total exercise profit (Less Premium) Given the market view, should the put or call be bought? Equal Call on Aussies Put on Aussies $ 0.6700 $ 0.6700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine if the call and put options are in at or outofthemoney we compare the strike price of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started