Risk reversals and strangles are described in Section 2.3.2 as packages of calls and puts with strikes

Question:

Risk reversals and strangles are described in Section 2.3.2 as packages of calls and puts with strikes on either side of the forward. Using the approximation to the SABR formula per Section 6.2.3, compute the implied vols for strikes 0.8 F, F, and 1.25F : where F = 1 is the initial value of the forward. Take σ0 = 15%, β = 1, ρ = −30%, and ν = 50% initially. Try varying each of σ0, ρ, and ν one at a time and see how the smile changes. Hence, convince yourself that a mapping between σ0, ρ, ν, and atm option prices, risk reversal prices, strangle prices is meaningful and stable.

Section 2.3.2

Section 6.2.3

Transcribed Image Text:

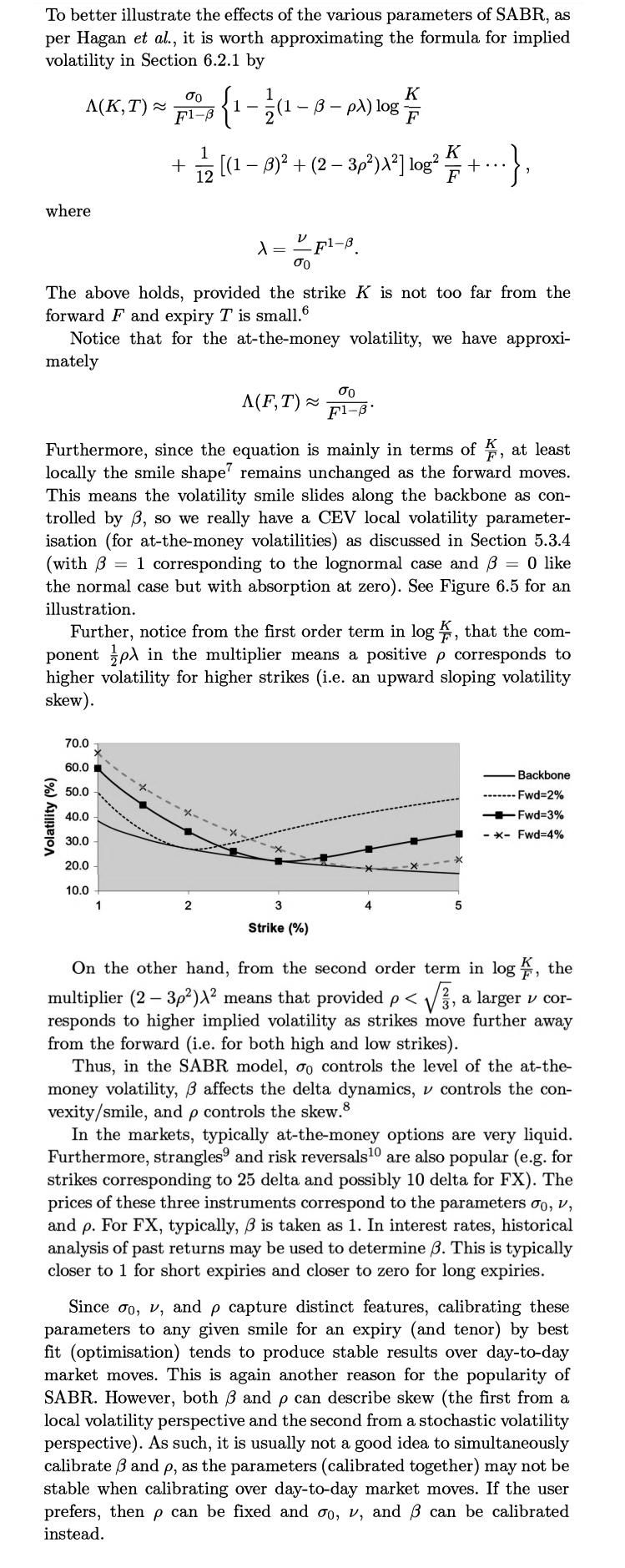

The FX markets have developed a significant body of conventions over the years. Typically, options are not quoted via strikes but by deltas instead. The most liquid options tend to be at-the-money, 25-delta strangles and risk reversals and 10-delta strangles and risk reversals. We consider these below. At-the-money options These are not as innocent as they sound. Specifically, at-the-money typically means delta-neutral except for long expiries (e.g. over 10 years in USD/JPY) where it means the strike corresponds to the forward FX rate. Delta-neutral refers to a call and put having the same delta. (Obviously, we mean call delta = put delta.) Specifically, the Black-Scholes formula for a call is C =Xe"fTN(dı) — KenTN(d2) with d₁ Ac d₂=d₁ - o√T, where X is spot FX, K is strike, T is expiry, r is domestic rate, rf is foreign rate, and o is vol. Thus, the domestic spot delta of a call is given by log()+ (r-rf + 1/0²) T αντ > = Ə (XefT TN(d₁) - Ke TN (dz)) Əx 1 =enf7 N(d1) + Xe-"Tn(d1) -Ke-T 'n(d₂). 'Χοντ =e="fT N(d₁) + Xe-¹₁Tn(d₂)e-d₂0√T-10²T_ - Ke-Tn(d₂). with n(x) n(d₂)e = e¯¹₁¹ N(d₁) + = e-rf™ N(d₁) = -d₂0√T-10²T e 1 Χοντ ², so that n(d₁) A n(d₂) {e(_r+r₁) XOVE (Xe - IT Kel-T+7)T - KerT) Χοντ X 48= 2x (x)=xax-X² 1 = Similarly, we can show that the domestic spot delta for a put is Ap = efT (N(d₁) 1). So, delta neutrality requires e −fTN(d1)= -e-T (N(d₁) 1), i.e. we need to choose a strike such that d₁ N-¹ (), i.e. K = X exp(-o√/TN−¹(½) + (r − rƒ + 1/0²)T). However, in FX, we can see the price of an option from either currency. Specifically, suppose we have an option to buy one unit of currency A (e.g. US dollar) for K units of currency B (e.g. yen). The Black-Scholes formula gives its price C in terms of currency B. But say the majority of market participants function in currency A,¹ then they would like to hedge in currency A. If they had sold an option and received currency B, then this option premium (which can be valued in currency A) serves as a natural hedge for the con- tract. This leads to the concept of a foreign delta, and some currency pairs have their at-the-money options quoted as being delta-neutral based on the foreign delta (in currency A) = Notice that in currency B terms, the value is now ac C C əx X X = Ac 1 Χοντ √ (d₂+0√T) ² e √2π 1 Χσντ C On top of this, delta-neutral can be based on spot delta or forward delta. Forward delta is where the derivative of price is with respect to the forward rather than the spot. It is typically used for options whose expiries are not too short (e.g. over one year). It is beyond the scope of this book to discuss all the conventions in FX. So it is better to conclude here, but it is certainly useful to make the reader aware that there are more complications than one would have initially guessed. Strangles Strangles are where you are long a call and a put both being out- of-the-money to a similar extent. It is thus a measure of volatility smile (i.e. how much higher out-of-the-money implied volatility is compared to at-the-money implied volatility). In FX, the market quotes market strangles. Specifically, the quotes are for 25-delta¹² and 10-delta strangles, and the strikes are chosen as follows: Let q = σA Atm be the quote of the A-delta strangle (e.g. where A = 25). Then given the at-the-money volatility Atm, we can determine the volatility of the strangle A. The strikes of the strangle K and Kp are such that Ac = efTN (d₁ (Kc)) and Ape TT (1- N (di (Kp))). Notice that whilst this does not tell us the volatilities at strikes Kc and Kp, it imposes the key constraint C (Kc) + P (Kp) C (Kc,σA) + P (Kp,σA), i.e. the price of the strangle based on the true volatilities of call and put options agrees with the price of the strangle if both call and put options are priced with the volatility σ. Risk reversals A risk reversal can be described as being long a call and short a put with the same moneyness or vice versa. In this way, a risk reversal is a measure of skew (i.e. how much more out-of-the-money calls are worth vis-à-vis out-of-the-money puts). Typically, quotes are for 25-delta and 10-delta risk reversals. Specifically, the quote is of the form QA = oc-op, where ac and op are implied volatilities for the strikes Ke and Kp for the appropriate delta. The trouble is: What are these strikes? Since strikes for mar- ket strangles are not obtained from deltas computed from the true volatilities at those strikes, their strikes are different from those of risk reversals. As such, the problem is not uniquely determined in that some form of model dependent volatility interpolation over strikes, together with the quotes for market strangles is necessary, in order to obtain the strikes for the risk reversals since all we have is the constraint that the volatilities at this strike must satisfy.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

Hamza Amjad

Currently I am student in master degree program.from last two year I am tutring in Academy and I tought many O/A level student in home tution.

4.80+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

The demand for a commodity typically depends on the income of the consumer, the real price of the commodity, and the real price of complementary or competing products. Table P-20 gives the per capita...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Write a program that takes an integer command-line argument n and prints all the positive powers of 2 less than or equal to n. Make sure that your program works properly for all values of n.

-

Explain sustainable income. What relationship does this concept have to the treatment of irregular itemson the income statement?

-

What does the message method of Rubys StandardError class do?

-

Explain the importance of sales variance.

-

Activity-based costing, batch-level variance analysis. Jo Nathan Publishing Company specializes in printing specialty textbooks for a small but profitable college market. Due to the high setup costs...

-

The following information pertains to Mason Company for Year 2. Beginning inventory 132 units @ $38 Units purchased 390 units @ $57 Ending inventory consisted of 50 units. Mason sold 472 units at...

-

Take the actual SABR formula per Section 6.2.1 with 0 = 0.5%, = 0, = 25%, = 30%, and F = 4%. By considering an expiry of 20 years and strikes at 10 basis points increments from 1 % to 2 %...

-

Consider the Hull-White model with SDE dr t = ,(t)((t) r t )dt + (t)dW t . Following the same logic as we did in the text, determine (t). Can you see why in practice calculating (t) directly is not...

-

Elizabeth Villeneuve is a senior economist at Proplus Financial Economics Consulting (Proplus). She is responsible for the valuation of equity markets in developing countries and is reviewing the...

-

3. Two companies (A and B) are duopolists that produce identical products. Demand for the products is given by the following demand function: P = 10,000 QA- QB - where QA and QB are the quantities...

-

Consider the following initial-value problem. f'(x) = 2ex - 6x; f(0) = 4 Integrate the function f'(x). (Remember the constant of integration.) || | f'(x)dx = Find the value of C using the condition...

-

The value chain is based on primary activities logstica Operations External logistics Marketing and sales Service and are complemented by support activities Company infrastructure is what it is,...

-

On average, both arms and hands together account for 13% of a person's mass, while the head is 7.0% and the trunk and legs account for 80%. We can model a spinning skater with her arms outstretched...

-

8. Look at the image to the right. Using the Law of Force and Acceleration, predict how acceleration would change if you changed the mass of the boy. 9. Using the same picture from #8, discuss how...

-

Determine the current amount of money that must be invested at 12% nominal interest, compounded monthly, to provide an annuity of $10,000 (per year) for 6 years, starting 12 years from now. The...

-

The cost curve for the city water supply is C(Q) = 16 + 1/4 Q2, where Q is the amount of water supplied and C(Q) is the cost of providing Q acre-feet of water. (An acre-foot is the amount of water...

-

Identify the reagents you would use to convert 2-bromo-2-methylbutane into 3-methyl-1-butyne.

-

Would ethanol (CH 3 CH 2 OH) be a suitable solvent in which to perform the following proton transfer? Explain your answer: ONH2 + NH3 NH2 H.

-

Identify the reagents you would use to convert 1-pentene into a geminal dibromide (geminal indicates that both bromine atoms are connected to the same carbon atom).

-

Discuss American History

-

Your firm has developed a new lithium ion battery polymer that could enhance the performance of lithion ion batteries. These batteries have applications in many markets including cellphones, laptops,...

-

Need help analyzing statistical data 1. ANOVA) True or false: If we assume a 95% confidence level, there is a significant difference in performance generally across all groups. 2. (t-test) True or...

Study smarter with the SolutionInn App