Question:

Take the actual SABR formula per Section 6.2.1 with σ0 = 0.5%, β = 0, ρ = −25%, ν = 30%, and F = 4%. By considering an expiry of 20 years and strikes at 10 basis points increments from 1 % to 2 % inclusive, try and construct an arbitrage involving butterflies (i.e. long a call at strike K − δ short two calls at strike K and long a call at strike K + δ where δ > 0). This is an illustration of the problem of negative densities under the SABR model for very low strikes and long enough expiry.

Section 6.2.1

Transcribed Image Text:

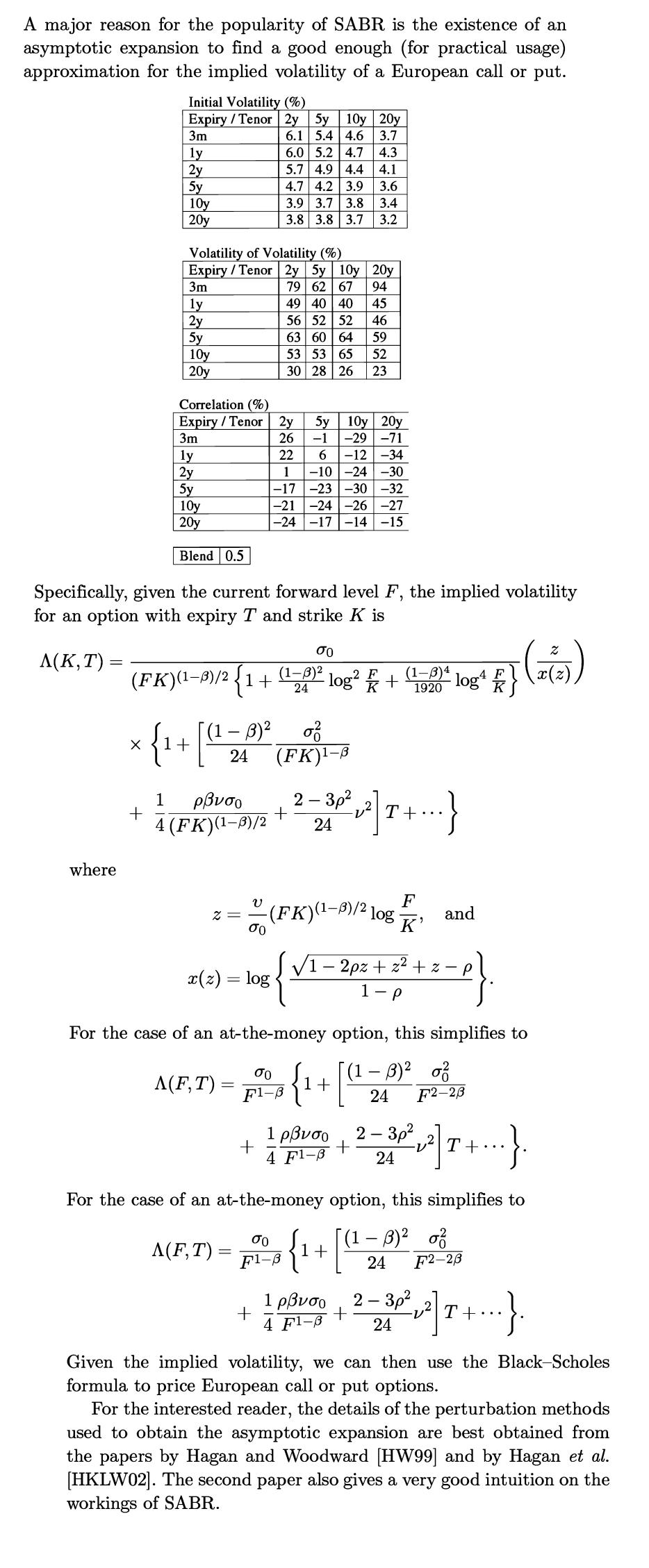

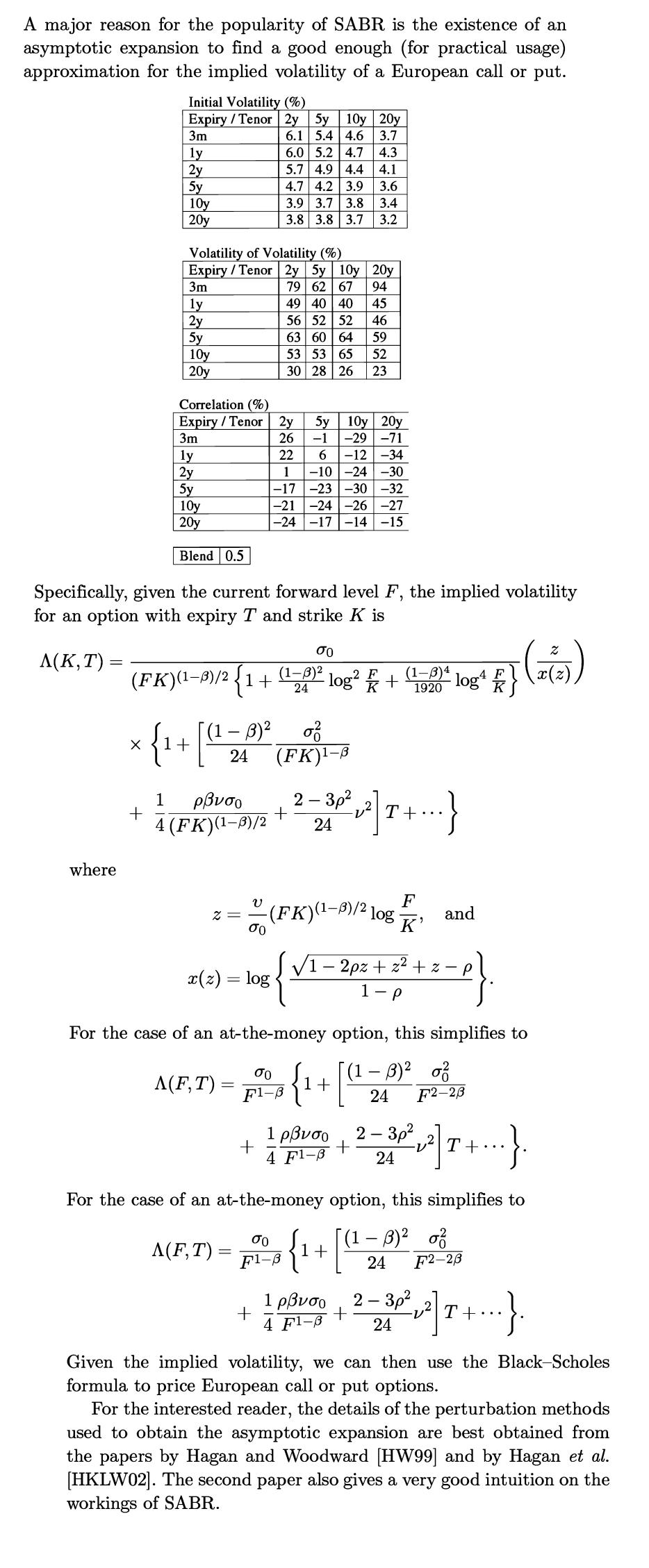

A major reason for the popularity of SABR is the existence of an

asymptotic expansion to find a good enough (for practical usage)

approximation for the implied volatility of a European call or put.

where

Initial Volatility (%)

Expiry / Tenor 2y 5y 10y 20y

3m

6.1 5.4 4.6

3.7

6.0 5.2 4.7

4.3

5.7 4.9 4.4

4.1

4.7 4.2 3.9

3.6

3.9 3.7 3.8

3.4

3.8 3.8 3.7 3.2

X

ly

2y

5y

+

10y

20y

Volatility of Volatility (%)

Expiry / Tenor 2y 5y 10y

3m

ly

2y

5y

10y

20y

ly

2y

5y

10y

20y

Blend 0.5

(FK)(1-3)/2 1 +

Correlation (%)

Expiry / Tenor 2y

3m

26

1+

(1 - 3)²

Specifically, given the current forward level F, the implied volatility

for an option with expiry T and strike K is

A(K,T) =

[(₁

24

1 ρβυσο

4 (FK)(1-3)/2

z =

V

σο

A(F,T) =

20y

79 62 67 94

49 40 40

x(z) = log

56 52 52

63 60 64

53 53 65 52

30 28 26 23

5y 10y 20y

-1 -29 -71

22

6 -12 -34

-10-24 -30

-17 -23 -30 -32

1

-21 -24-26 -27

-24-17-14 -15

σο

(1-3)² 2 F (1-3)4

log² +

24

1920

0²

(FK)¹-B

σο

F1-3

+

45 46 59

2-3p²

24

F

(FK)(¹-0)/2 log ¹ and

√1-2pz +z²+z-p

1+

2², ²] T +...}

For the case of an at-the-money option, this simplifies to

σο

A(F,T) = ¡{¹+

F1-B

1-p

1ρβνσο

+ +

4 F1-B

4 F

log ¹ K} (x(3))

-

24

F2-28

+ + ²] +}.

1ρβνσο

+

4 F1-8

2-3p²

24

For the case of an at-the-money option, this simplifies to

(1 - 3)² o

24 F2-23

2 - 30/²2, 2] T +... }.

24

Given the implied volatility, we can then use the Black-Scholes

formula to price European call or put options.

For the interested reader, the details of the perturbation methods

used to obtain the asymptotic expansion are best obtained from

the papers by Hagan and Woodward [HW99] and by Hagan et al.

[HKLW02]. The second paper also gives a very good intuition on the

workings of SABR.