Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KT plc is considering bidding for CT ltd a telecom company whose details are as follows; CT ltd . ' s share capital is K

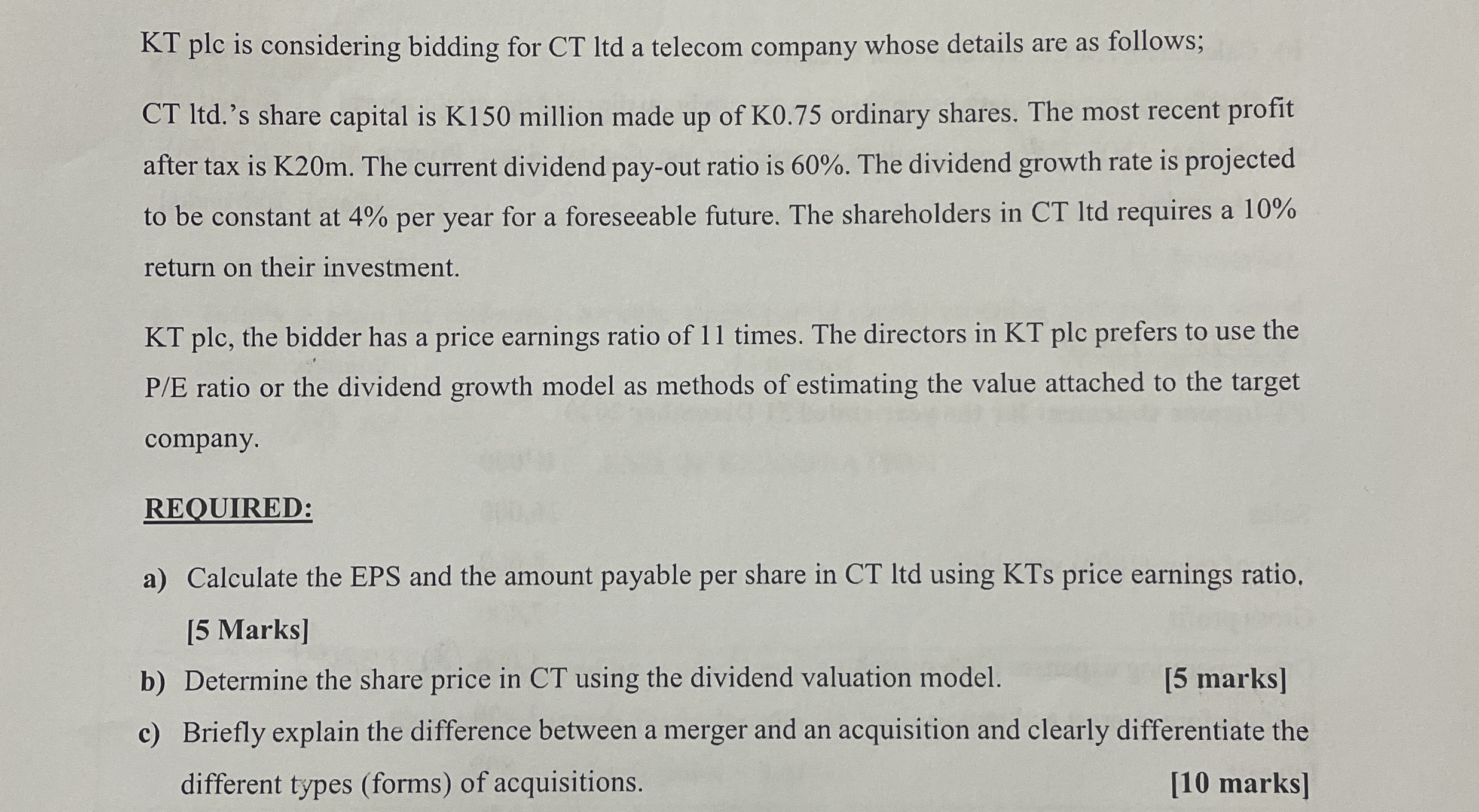

KT plc is considering bidding for CT ltd a telecom company whose details are as follows;

CT ltds share capital is K million made up of K ordinary shares. The most recent profit after tax is K m The current dividend payout ratio is The dividend growth rate is projected to be constant at per year for a foreseeable future. The shareholders in CT ltd requires a return on their investment.

KT plc the bidder has a price earnings ratio of times. The directors in KT plc prefers to use the ratio or the dividend growth model as methods of estimating the value attached to the target company.

REOUIRED:

a Calculate the EPS and the amount payable per share in CT Itd using KTs price earnings ratio. Marks

b Determine the share price in CT using the dividend valuation model.

marks

c Briefly explain the difference between a merger and an acquisition and clearly differentiate the different types forms of acquisitions.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started