Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kumba Iron Ore (Kumba) is a major supplier of iron ore to the steel industry and the company is the 4th largest supplier of

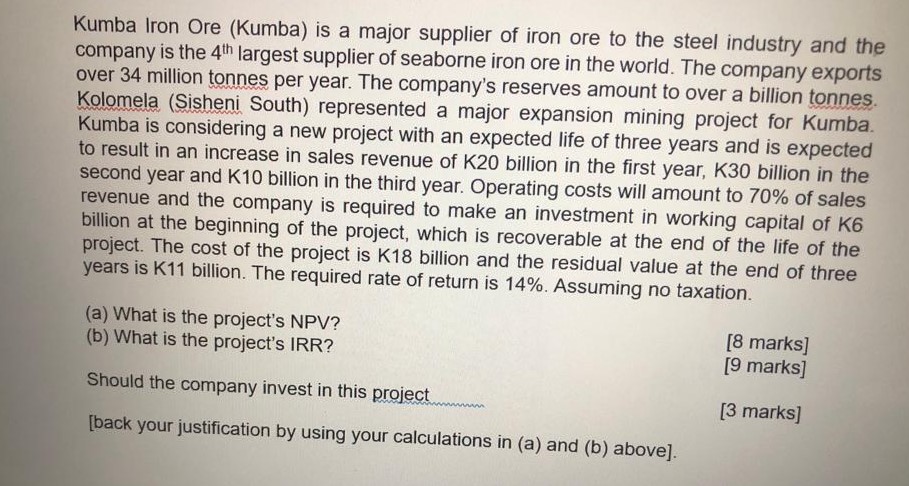

Kumba Iron Ore (Kumba) is a major supplier of iron ore to the steel industry and the company is the 4th largest supplier of seaborne iron ore in the world. The company exports over 34 million tonnes per year. The company's reserves amount to over a billion tonnes. Kolomela (Sisheni South) represented a major expansion mining project for Kumba. Kumba is considering a new project with an expected life of three years and is expected to result in an increase in sales revenue of K20 billion in the first year, K30 billion in the second year and K10 billion in the third year. Operating costs will amount to 70% of sales revenue and the company is required to make an investment in working capital of K6 billion at the beginning of the project, which is recoverable at the end of the life of the project. The cost of the project is K18 billion and the residual value at the end of three years is K11 billion. The required rate of return is 14%. Assuming no taxation. (a) What is the project's NPV? (b) What is the project's IRR? Should the company invest in this project [back your justification by using your calculations in (a) and (b) above]. [8 marks] [9 marks] [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV and Internal Rate of Return IRR for the project we can use th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started