Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Our sales and profits are driven through both our physical stores and broad e-commerce capabilities. [Our operations] consist primarily of retail operations, with the

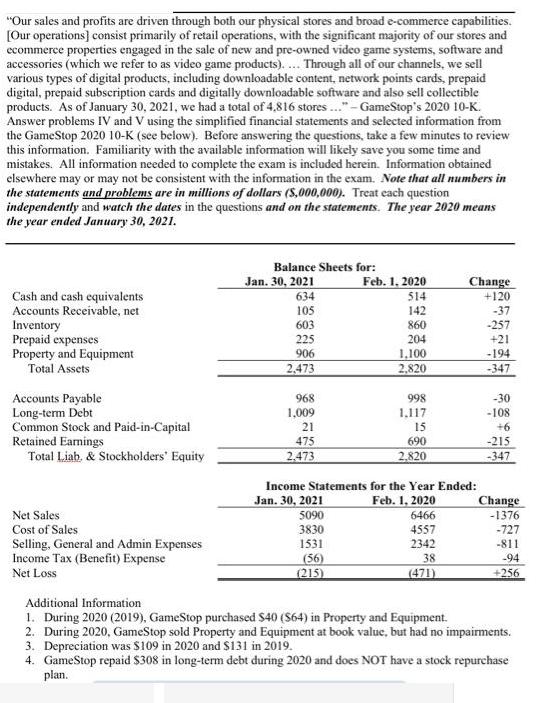

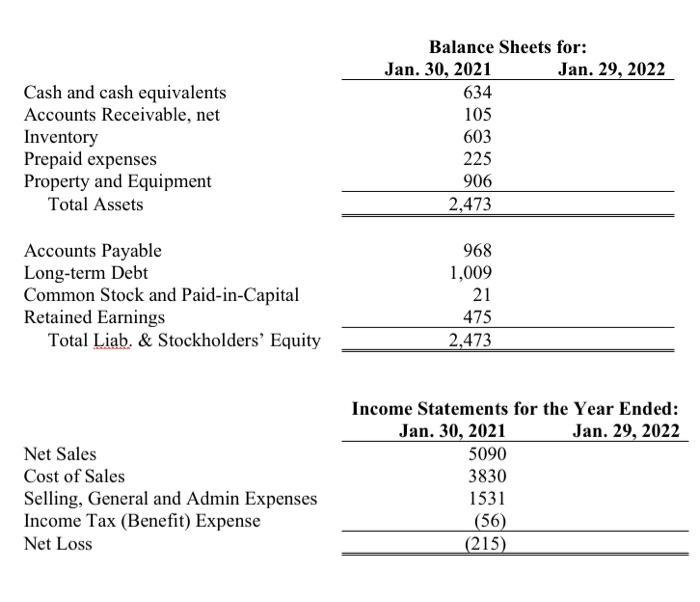

"Our sales and profits are driven through both our physical stores and broad e-commerce capabilities. [Our operations] consist primarily of retail operations, with the significant majority of our stores and ecommerce properties engaged in the sale of new and pre-owned video game systems, software and accessories (which we refer to as video game products).... Through all of our channels, we sell various types of digital products, including downloadable content, network points cards, prepaid digital, prepaid subscription cards and digitally downloadable software and also sell collectible products. As of January 30, 2021, we had a total of 4,816 stores..."- GameStop's 2020 10-K. Answer problems IV and V using the simplified financial statements and selected information from the GameStop 2020 10-K (see below). Before answering the questions, take a few minutes to review this information. Familiarity with the available information will likely save you some time and mistakes. All information needed to complete the exam is included herein. Information obtained elsewhere may or may not be consistent with the information in the exam. Note that all numbers in the statements and problems are in millions of dollars ($,000,000). Treat each question independently and watch the dates in the questions and on the statements. The year 2020 means the year ended January 30, 2021. Cash and cash equivalents Accounts Receivable, net Inventory Prepaid expenses Property and Equipment Total Assets Accounts Payable Long-term Debt Common Stock and Paid-in-Capital Retained Earnings Total Liab. & Stockholders' Equity Net Sales Cost of Sales Selling, General and Admin Expenses Income Tax (Benefit) Expense Net Loss Balance Sheets for: Jan. 30, 2021 634 105 603 225 906 2,473 968 1,009 21 475 2,473 Feb. 1, 2020 514 142 860 204 1,100 2,820 5090 3830 1531 (56) (215) 998 1.117 15 690 2,820 Income Statements for the Year Ended: Jan. 30, 2021 Feb. 1, 2020 Change +120 6466 4557 2342 38 (471) -37 -257 +21 -194 -347 -30 -108 +6 -215 -347 Change -1376 -727 -811 -94 +256 Additional Information 1. During 2020 (2019), GameStop purchased $40 ($64) in Property and Equipment. 2. During 2020, GameStop sold Property and Equipment at book value, but had no impairments. 3. Depreciation was $109 in 2020 and $131 in 2019. 4. GameStop repaid $308 in long-term debt during 2020 and does NOT have a stock repurchase plan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The cash flow stetement has the following components i Cash flow from operating activity ii Cash f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started