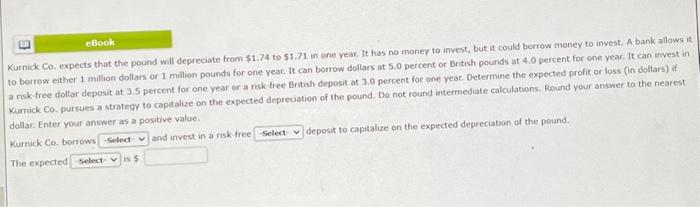

Kurnick Co. expects that the pound will depreciate from $1.74 to 51.71 in one year, It has no money to invest, but it coald borrow money to invest. A bank allows it to borrow either 1 million dollars or 1 million pounds for one year. It can borrow dollars at 5.0 percent or British pounds at 4.0 percent for one year. It can imest in a risk-free doltar deposit at 3.5 percent for one year or a risk-tree British deposit at 3.0 percent for one year. Determine the expected profit or loss (in dollars) if Kurnick Co. pursues a strategy to capitalize on the expected depreciation of the pound. Do not round intermediate calculations. Round your answer to the nearest dollar Enter your answer as a positive value. Kurnick Co, borrows and ifvest in a risk-free deposit to capitalize on the expected depreciation of the pound. The expected is 5 Kurnick Co. expects that the pound will depreciate from $1.74 to $1.71 in one year. It has no money to invest, but it could borrow money to invest. A bank allows it to borrow either 1 million dollars or 1 milion pounds for one year. It can borrow dollars at 5.0 percent or British pounds at 4.0 percent for one yeat. It can invest in a risk-free dollar deposit at 3.5 percent for one yeat of a risk-free British depost at 3.0 percent for one yeac. Determine the expected profit or loss (in dollars) if Kurnick Co. pursues a strategy to capitalize on the expected depreciation of the pound. Do not round intermediate calculations. Round your answer to the nearest dollar. Enter your answer as a postive value. Kurnick Co, borrows and invest in a tisk free deposit to capralize on the expected depreciation of the pound. That expected is 5 Kurnick Co. expects that the pound will depreciate from $1.74 to $1.71 in one year, it has no money to invest, but it could borrow money to invest. A bank allows it to borrow either 1 million dollars or 1 milion pounds for one year. It can borrow dollars at 5.0 percent or British pounds at 4.0 percent for one year. It can invest in a risk-free dollar deposit at 3.5 percent for one year or a risk-free Bntish deposit at 3.0 percent for one year, betermune the expected profit or loss (in dollars) if Kurnick Co. pursues a strategy to capitalize on the expected depreciation of the pound. Do not round intermediate cakculations. Rovind your answer to the nearest. dollat. Enter your answer as a positive value