Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kurt; a single, cash basis, calendar year taxpayer; had the following transactions during the year: - On February 1, 2022, he purchased Apple stock for

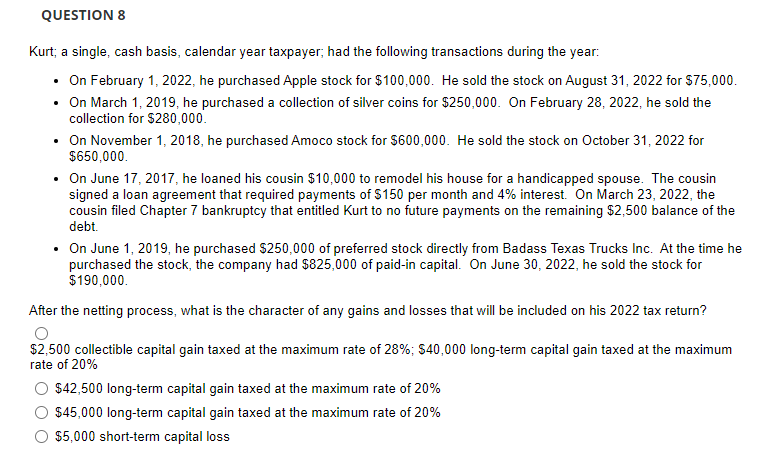

Kurt; a single, cash basis, calendar year taxpayer; had the following transactions during the year: - On February 1, 2022, he purchased Apple stock for $100,000. He sold the stock on August 31, 2022 for $75,000. - On March 1, 2019, he purchased a collection of silver coins for $250,000. On February 28, 2022, he sold the collection for $280,000. - On November 1, 2018, he purchased Amoco stock for $600,000. He sold the stock on October 31, 2022 for $650,000. - On June 17,2017 , he loaned his cousin $10,000 to remodel his house for a handicapped spouse. The cousin signed a loan agreement that required payments of $150 per month and 4% interest. On March 23, 2022, the cousin filed Chapter 7 bankruptcy that entitled Kurt to no future payments on the remaining $2,500 balance of the debt. - On June 1, 2019, he purchased $250,000 of preferred stock directly from Badass Texas Trucks Inc. At the time he purchased the stock, the company had $825,000 of paid-in capital. On June 30,2022 , he sold the stock for $190,000. After the netting process, what is the character of any gains and losses that will be included on his 2022 tax return? $2,500 collectible capital gain taxed at the maximum rate of 28%;$40,000 long-term capital gain taxed at the maximum rate of 20% $42,500 long-term capital gain taxed at the maximum rate of 20% $45,000 long-term capital gain taxed at the maximum rate of 20% $5,000 short-term capital loss

Kurt; a single, cash basis, calendar year taxpayer; had the following transactions during the year: - On February 1, 2022, he purchased Apple stock for $100,000. He sold the stock on August 31, 2022 for $75,000. - On March 1, 2019, he purchased a collection of silver coins for $250,000. On February 28, 2022, he sold the collection for $280,000. - On November 1, 2018, he purchased Amoco stock for $600,000. He sold the stock on October 31, 2022 for $650,000. - On June 17,2017 , he loaned his cousin $10,000 to remodel his house for a handicapped spouse. The cousin signed a loan agreement that required payments of $150 per month and 4% interest. On March 23, 2022, the cousin filed Chapter 7 bankruptcy that entitled Kurt to no future payments on the remaining $2,500 balance of the debt. - On June 1, 2019, he purchased $250,000 of preferred stock directly from Badass Texas Trucks Inc. At the time he purchased the stock, the company had $825,000 of paid-in capital. On June 30,2022 , he sold the stock for $190,000. After the netting process, what is the character of any gains and losses that will be included on his 2022 tax return? $2,500 collectible capital gain taxed at the maximum rate of 28%;$40,000 long-term capital gain taxed at the maximum rate of 20% $42,500 long-term capital gain taxed at the maximum rate of 20% $45,000 long-term capital gain taxed at the maximum rate of 20% $5,000 short-term capital loss Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started