Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kustom Kitchens Pty Ltd ('Kustom Kitchens') is a resident private company that was incorporated in June 1993 to conduct the business of building kitchens

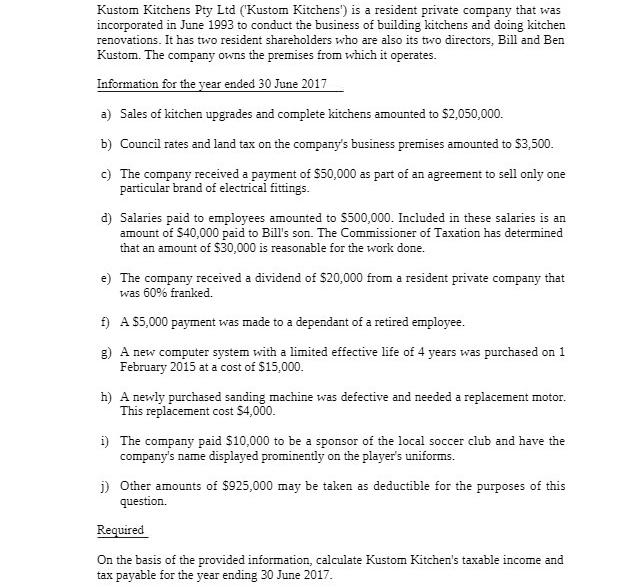

Kustom Kitchens Pty Ltd ('Kustom Kitchens') is a resident private company that was incorporated in June 1993 to conduct the business of building kitchens and doing kitchen renovations. It has two resident shareholders who are also its two directors, Bill and Ben Kustom. The company owns the premises from which it operates. Information for the year ended 30 June 2017 a) Sales of kitchen upgrades and complete kitchens amounted to $2,050,000. b) Council rates and land tax on the company's business premises amounted to $3,500. c) The company received a payment of $50,000 as part of an agreement to sell only one particular brand of electrical fittings. d) Salaries paid to employees amounted to $500,000. Included in these salaries is an amount of $40,000 paid to Bill's son. The Commissioner of Taxation has determined that an amount of $30,000 is reasonable for the work done. e) The company received a dividend of $20,000 from a resident private company that was 60% franked. f) A $5,000 payment was made to a dependant of a retired employee. g) A new computer system with a limited effective life of 4 years was purchased on 1 February 2015 at a cost of $15,000. h) A newly purchased sanding machine was defective and needed a replacement motor. This replacement cost $4,000. i) The company paid $10,000 to be a sponsor of the local soccer club and have the company's name displayed prominently on the player's uniforms. j) Other amounts of $925,000 may be taken as deductible for the purposes of this question. Required On the basis of the provided information, calculate Kustom Kitchen's taxable income and tax payable for the year ending 30 June 2017.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Kustom Kitchens Pty Ltd Taxable Income and Tax Payable Year ending 30 June 2017 1 Income Sales 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started