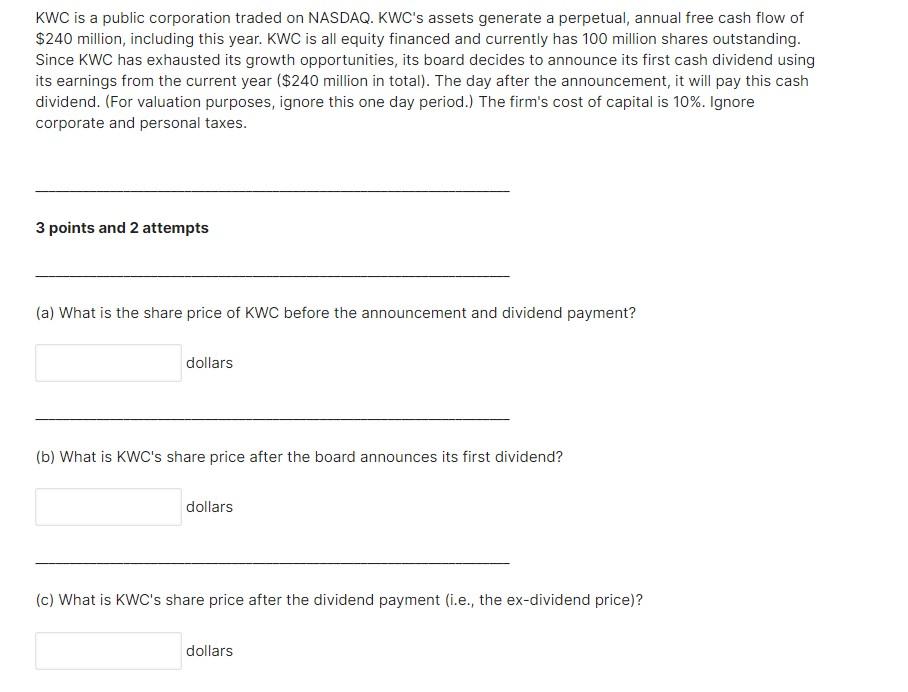

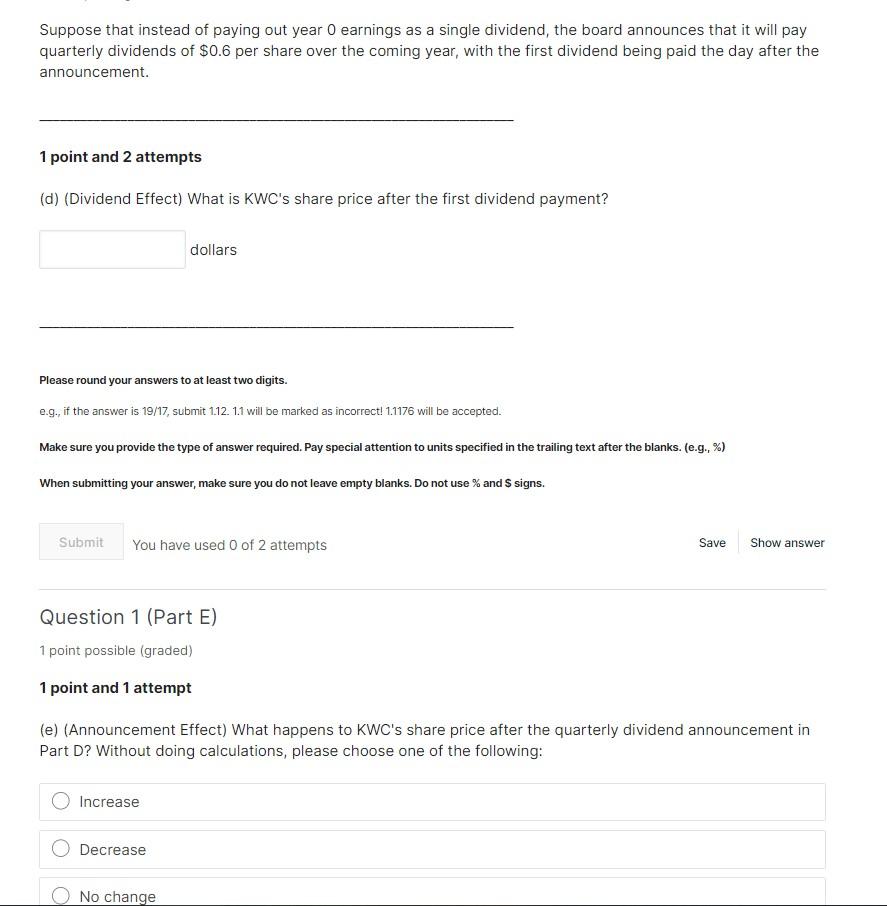

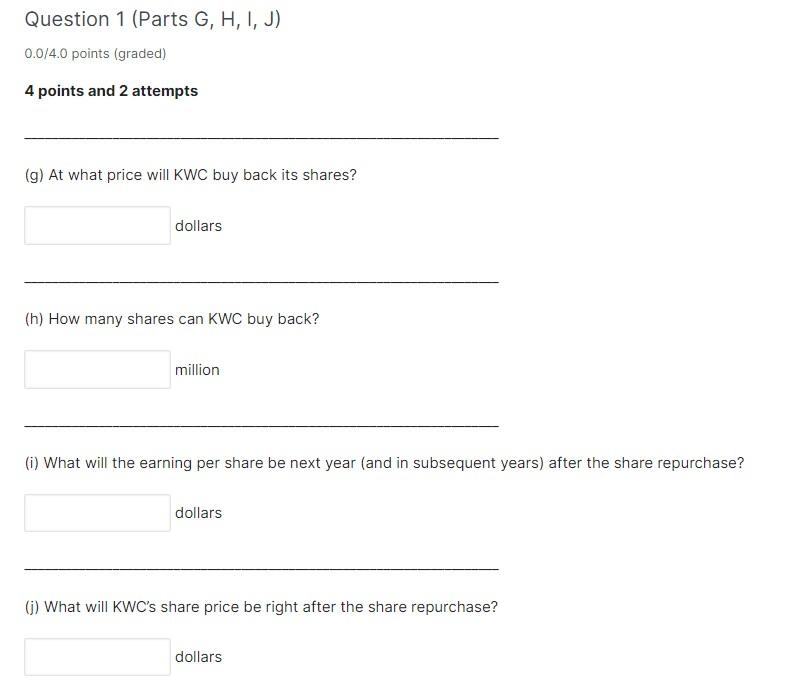

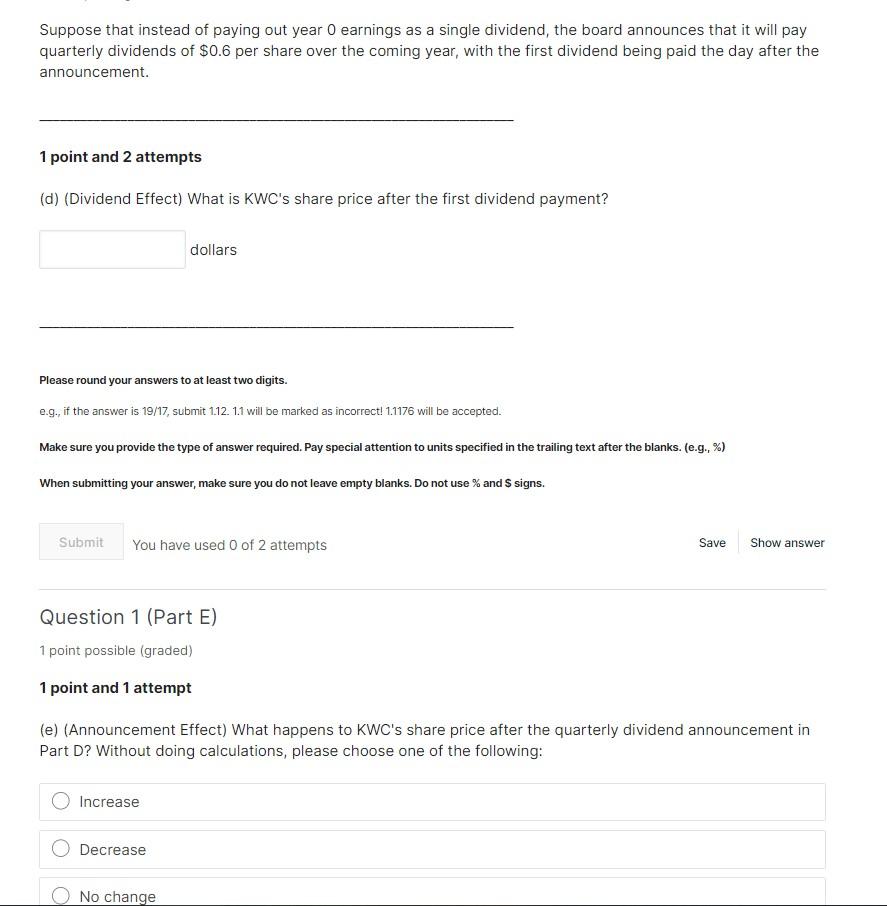

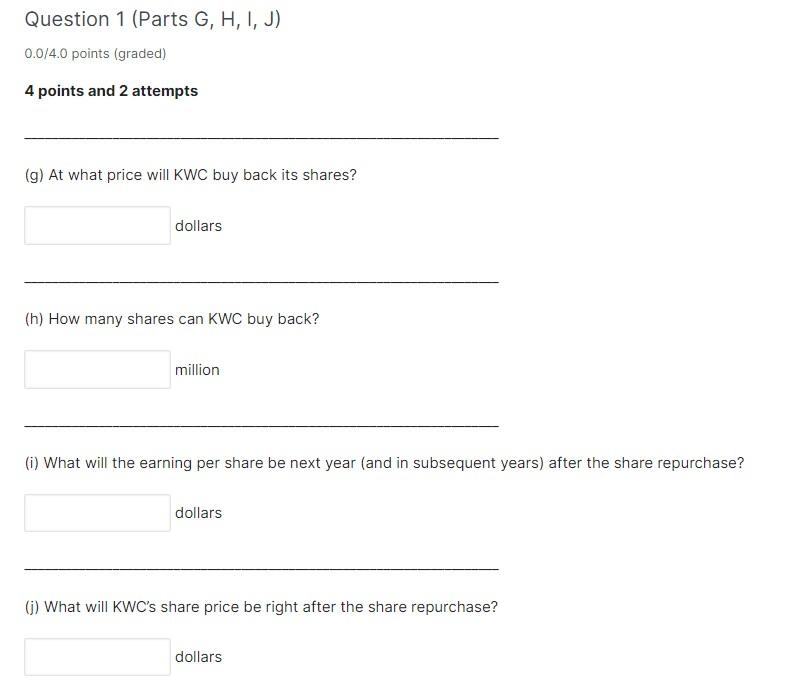

KWC is a public corporation traded on NASDAQ. KWC's assets generate a perpetual, annual free cash flow of $240 million, including this year. KWC is all equity financed and currently has 100 million shares outstanding. Since KWC has exhausted its growth opportunities, its board decides to announce its first cash dividend using its earnings from the current year ($240 million in total). The day after the announcement, it will pay this cash dividend. (For valuation purposes, ignore this one day period.) The firm's cost of capital is 10%. Ignore corporate and personal taxes. 3 points and 2 attempts (a) What is the share price of KWC before the announcement and dividend payment? dollars (b) What is KWC's share price after the board announces its first dividend? dollars (c) What is KWC's share price after the dividend payment (i.e., the ex-dividend price)? dollars Suppose that instead of paying out year 0 earnings as a single dividend, the board announces that it will pay quarterly dividends of $0.6 per share over the coming year, with the first dividend being paid the day after the announcement 1 point and 2 attempts (d) (Dividend Effect) What is KWC's share price after the first dividend payment? dollars Please round your answers to at least two digits. e.g., if the answer is 19/17, submit 1.12. 1.1 will be marked as incorrect 1.1176 will be accepted. Make sure you provide the type of answer required. Pay special attention to units specified in the trailing text after the blanks. (e.g., %) When submitting your answer, make sure you do not leave empty blanks. Do not use % and S signs. Submit You have used 0 of 2 attempts Save Show answer Question 1 (Part E) 1 point possible (graded) 1 point and 1 attempt (e) (Announcement Effect) What happens to KWC's share price after the quarterly dividend announcement in Part D? Without doing calculations, please choose one of the following: Increase Decrease No change Question 1 (Parts G, H, I, J) 0.0/4.0 points (graded) 4 points and 2 attempts (g) At what price will KWC buy back its shares? dollars (h) How many shares can KWC buy back? million (i) What will the earning per share be next year (and in subsequent years) after the share repurchase? dollars 6) What will KWC's share price be right after the share repurchase? dollars KWC is a public corporation traded on NASDAQ. KWC's assets generate a perpetual, annual free cash flow of $240 million, including this year. KWC is all equity financed and currently has 100 million shares outstanding. Since KWC has exhausted its growth opportunities, its board decides to announce its first cash dividend using its earnings from the current year ($240 million in total). The day after the announcement, it will pay this cash dividend. (For valuation purposes, ignore this one day period.) The firm's cost of capital is 10%. Ignore corporate and personal taxes. 3 points and 2 attempts (a) What is the share price of KWC before the announcement and dividend payment? dollars (b) What is KWC's share price after the board announces its first dividend? dollars (c) What is KWC's share price after the dividend payment (i.e., the ex-dividend price)? dollars Suppose that instead of paying out year 0 earnings as a single dividend, the board announces that it will pay quarterly dividends of $0.6 per share over the coming year, with the first dividend being paid the day after the announcement 1 point and 2 attempts (d) (Dividend Effect) What is KWC's share price after the first dividend payment? dollars Please round your answers to at least two digits. e.g., if the answer is 19/17, submit 1.12. 1.1 will be marked as incorrect 1.1176 will be accepted. Make sure you provide the type of answer required. Pay special attention to units specified in the trailing text after the blanks. (e.g., %) When submitting your answer, make sure you do not leave empty blanks. Do not use % and S signs. Submit You have used 0 of 2 attempts Save Show answer Question 1 (Part E) 1 point possible (graded) 1 point and 1 attempt (e) (Announcement Effect) What happens to KWC's share price after the quarterly dividend announcement in Part D? Without doing calculations, please choose one of the following: Increase Decrease No change Question 1 (Parts G, H, I, J) 0.0/4.0 points (graded) 4 points and 2 attempts (g) At what price will KWC buy back its shares? dollars (h) How many shares can KWC buy back? million (i) What will the earning per share be next year (and in subsequent years) after the share repurchase? dollars 6) What will KWC's share price be right after the share repurchase? dollars