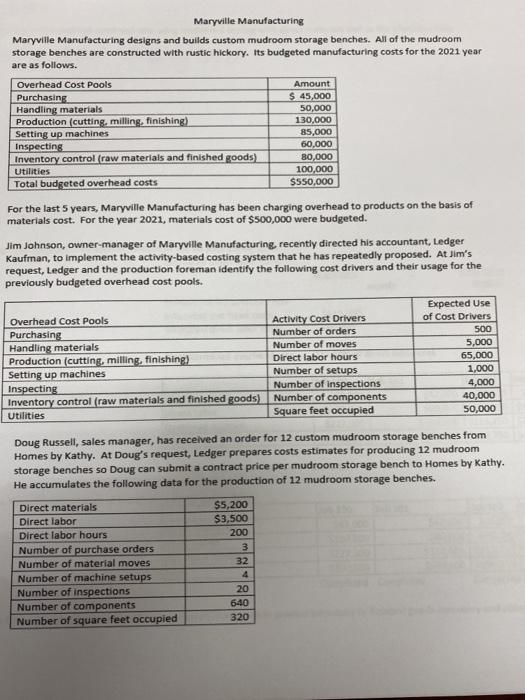

Maryville Manufacturing Maryville Manufacturing designs and builds custom mudroom storage benches. All of the mudroom storage benches are constructed with rustic hickory. Its budgeted manufacturing costs for the 2021 year are as follows. Overhead Cost Pools Amount Purchasing $ 45,000 Handling materials 50,000 Production (cutting, milling, finishing) 130,000 Setting up machines 85,000 Inspecting 60,000 Inventory control raw materials and finished goods) 80,000 Utilities 100,000 Total budgeted overhead costs S550,000 For the last 5 years, Maryville Manufacturing has been charging overhead to products on the basis of materials cost. For the year 2021, materials cost of $500,000 were budgeted. Jim Johnson, owner-manager of Maryville Manufacturing, recently directed his accountant, Ledger Kaufman, to implement the activity-based costing system that he has repeatedly proposed. At Jim's request, Ledger and the production foreman identify the following cost drivers and their usage for the previously budgeted overhead cost pools. Overhead Cost Pools Activity Cost Drivers Purchasing Number of orders Handling materials Number of moves Production (cutting, milling, finishing) Direct labor hours Setting up machines Number of setups Inspecting Number of inspections Inventory control (raw materials and finished goods) Number of components Utilities Square feet occupied Expected Use of Cost Drivers 500 5,000 65,000 1,000 4,000 40,000 50,000 Doug Russell, sales manager, has received an order for 12 custom mudroom storage benches from Homes by Kathy. At Doug's request, Ledger prepares costs estimates for producing 12 mudroom storage benches so Doug can submit a contract price per mudroom storage bench to Homes by Kathy. He accumulates the following data for the production of 12 mudroom storage benches. Direct materials Direct labor Direct labor hours Number of purchase orders Number of material moves Number of machine setups Number of inspections Number of components Number of square feet occupied $5,200 $3,500 200 3 32 4 20 640 320 Question 1. Compute the predetermined overhead rate using traditional costing with direct materials cost as the allocation base * Please show step by step