Question

Kyle and James conclude their education three years ago and started a small business. Their company offers a neck device that looks at the heartbeat,

Kyle and James conclude their education three years ago and started a small business. Their company offers a neck device that looks at the heartbeat, temperature, and respiration of dairy cattle. The device contains a sensor unit and a communication module. This info is uploaded to a cloud database and the info is then analyzed and visualized through a progressive web application.

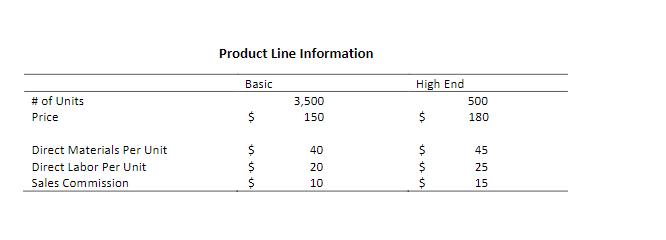

Kyle and James then engage with 10 potential customers and get offered $150-200 for their devices. They are able to produce this device for $100 per unit. They decide on selling the device for $150 per unit.

At the beginning of the 4th year, their company introduces a higher-end version where it can also monitor the location and movement of the cattle. The material and labor costs for the upgraded collar were each $10 higher than the previous model. They then price the new high-end version at $180. They end up selling 3,500 basic models, and 500 high-end models throughout the year.

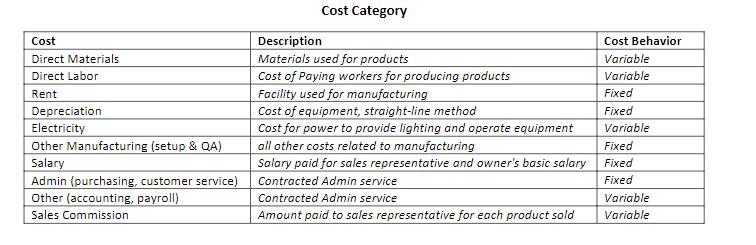

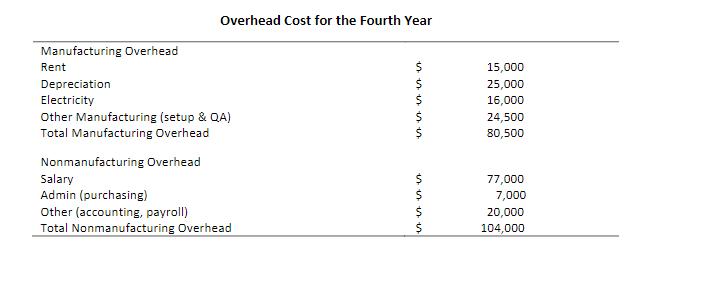

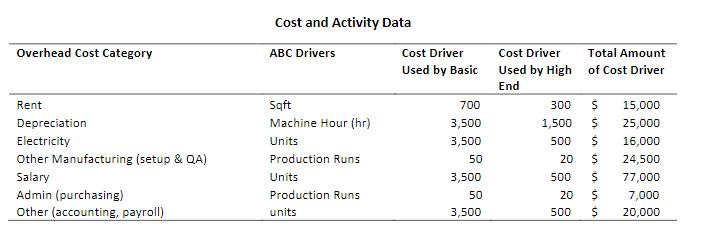

Their company uses a simple traditional overhead allocation system to allocate its overhead based one single cost

driver: the number of units produced. Based on the previous year's data, they budgeted $105 cost per unit for the Basic model and $115 for the higher-end model. However, the actual year-end net income was lower than they expected.

They suspected that the new product cost more to produce. They know the direct material cost, and direct labor cost, they know they must investigate overhead cost.

Please use the information provided to allocated the manufacturing overhead cost using the ABC allocation, to determine the actual cost of each product and please prepare a projected income statement for year five using the information with cost behavior (fixed or variable). You do not need to consider inflation. Assuming the company will sell 4,000 units of the basic model at $200 per unit, and 1,000 units of high-end model at $240 per unit

.

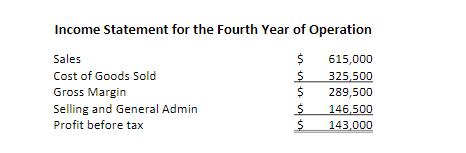

Income Statement for the Fourth Year of Operation Sales 615,000 325,500 Cost of Goods Sold Gross Margin 289,500 Selling and General Admin 146,500 Profit before tax 143,000 i en for inferi $ $ $ $

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Answer Cost sheet for the 5th year Detail bale Sale units uni...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started