Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kyle Naidoo, a resident of the Republic, sells and repairs household appliances from a shop he leases in a local shopping centre. Kyle operates a

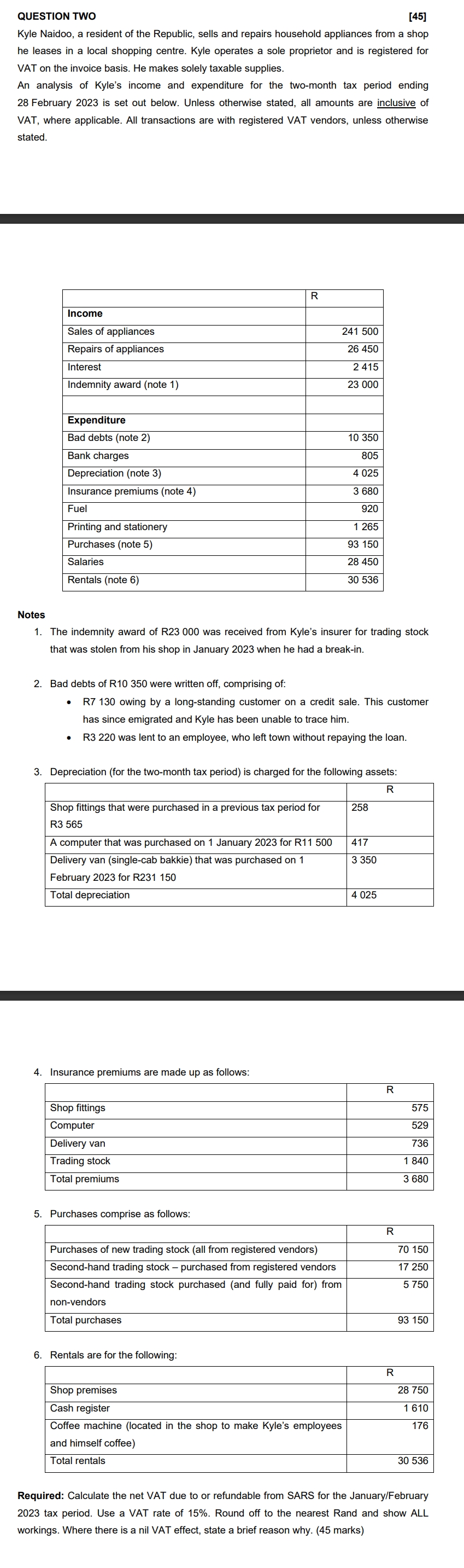

Kyle Naidoo, a resident of the Republic, sells and repairs household appliances from a shop

he leases in a local shopping centre. Kyle operates a sole proprietor and is registered for

VAT on the invoice basis. He makes solely taxable supplies.

An analysis of Kyle's income and expenditure for the twomonth tax period ending

February is set out below. Unless otherwise stated, all amounts are inclusive of

VAT, where applicable. All transactions are with registered VAT vendors, unless otherwise

stated.

Notes

The indemnity award of R was received from Kyle's insurer for trading stock

that was stolen from his shop in January when he had a breakin

Bad debts of R were written off, comprising of:

R owing by a longstanding customer on a credit sale. This customer

has since emigrated and Kyle has been unable to trace him.

R was lent to an employee, who left town without repaying the loan.

Depreciation for the twomonth tax period is charged for the following assets:

Insurance premiums are made up as follows:

Purchases comprise as follows:

Rentals are for the following:

Required: Calculate the net VAT due to or refundable from SARS for the JanuaryFebruary

tax period. Use a VAT rate of Round off to the nearest Rand and show ALL

workings. Where there is a nil VAT effect, state a brief reason why. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started