Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kyle purchased a variable annuity and allocated one-quarter of his $60,000 deposit to the fixed account and the remainder to the separate account, with half

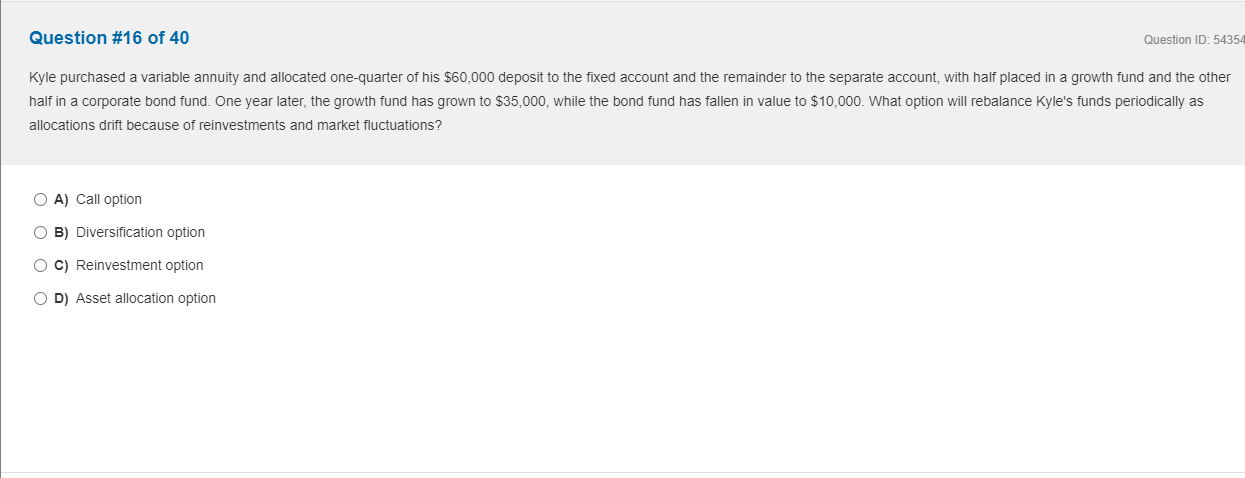

Kyle purchased a variable annuity and allocated one-quarter of his $60,000 deposit to the fixed account and the remainder to the separate account, with half placed in a growth fund and the other half in a corporate bond fund. One year later, the growth fund has grown to $35,000, while the bond fund has fallen in value to $10,000. What option will rebalance Kyle's funds periodically as allocations drift because of reinvestments and market fluctuations? A) Call option B) Diversification option C) Reinvestment option D) Asset allocation option

Kyle purchased a variable annuity and allocated one-quarter of his $60,000 deposit to the fixed account and the remainder to the separate account, with half placed in a growth fund and the other half in a corporate bond fund. One year later, the growth fund has grown to $35,000, while the bond fund has fallen in value to $10,000. What option will rebalance Kyle's funds periodically as allocations drift because of reinvestments and market fluctuations? A) Call option B) Diversification option C) Reinvestment option D) Asset allocation option Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started