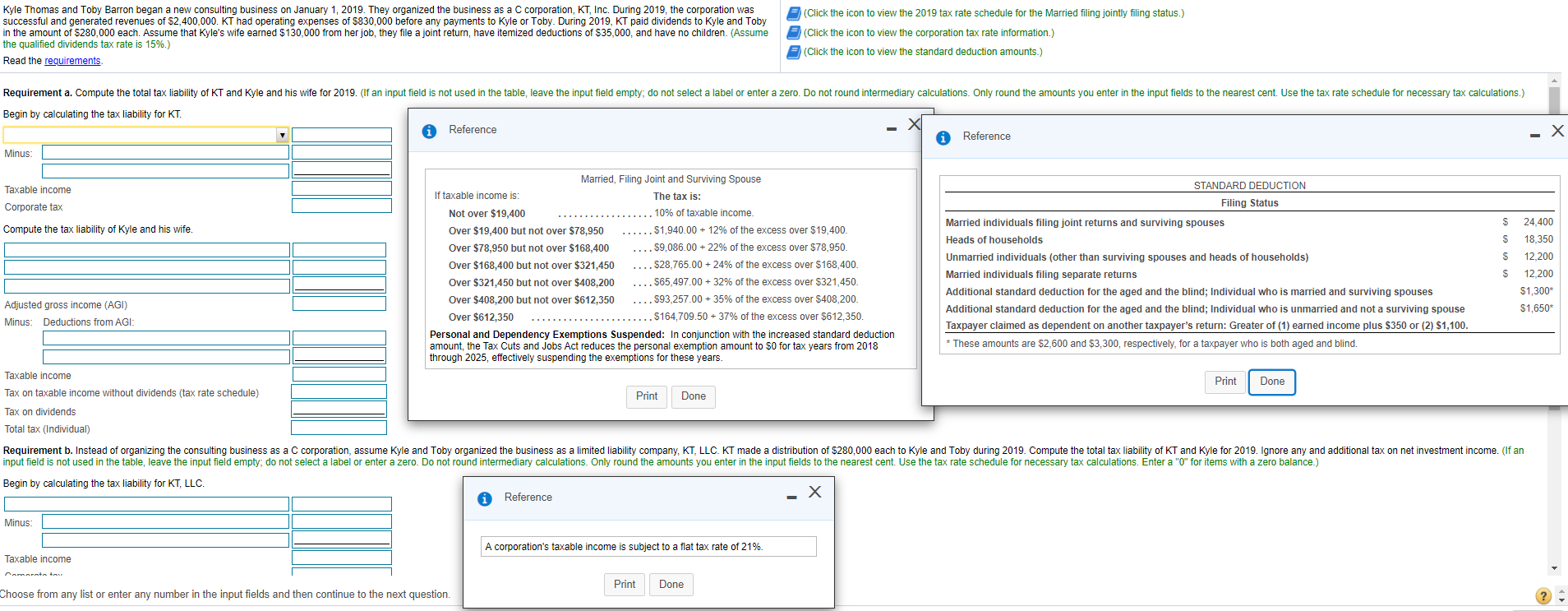

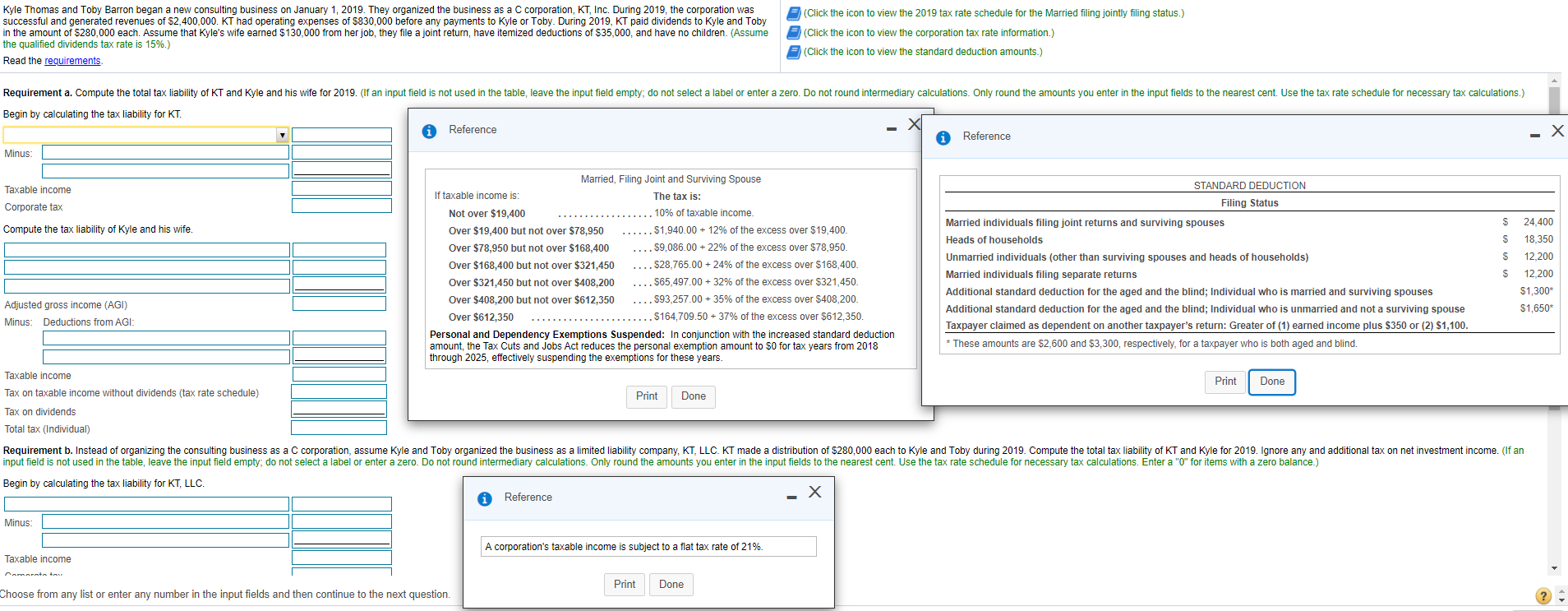

Kyle Thomas and Toby Barron began a new consulting business on January 1, 2019. They organized the business as a C corporation, KT, Inc. During 2019, the corporation was successful and generated revenues of $2,400,000. KT had operating expenses of $830,000 before any payments to Kyle or Toby. During 2019, KT paid dividends to Kyle and Toby in the amount of $280,000 each. Assume that Kyle's wife earned $130,000 from her job, they file a joint return, have itemized deductions of $35,000, and have no children. (Assume the qualified dividends tax rate is 15%.) Read the requirements (Click the icon to view the 2019 tax rate schedule for the Married filing jointly filing status.) (Click the icon to view the corporation tax rate information.) (Click the icon to view the standard deduction amounts.) Requirement a. Compute the total tax liability of KT and Kyle and his wife for 2019. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero. Do not round intermediary calculations. Only round the amounts you enter in the input fields to the nearest cent. Use the tax rate schedule for necessary tax calculations.) Begin by calculating the tax liability for KT. Reference Reference Minus: Married, Filing Joint and Surviving Spouse Taxable income STANDARD DEDUCTION If taxable income is: The tax is: Corporate tax Filing Status Not over $19,400 10% of taxable income. $ 24,400 Compute the tax liability of Kyle and his wife. Married individuals filing joint returns and surviving spouses Over $19,400 but not over $78,950 $1,940.00 + 12% of the excess over $19,400. Heads of households $ 18,350 Over $78,950 but not over $168,400 $9,086.00 +22% of the excess over $78,950. S Unmarried individuals (other than surviving spouses and heads of households) 12.200 Over $168,400 but not over $321,450 $28,765.00 +24% of the excess over $168,400 Married individuals filing separate returns S 12,200 Over $321,450 but not over $408,200 $65,497.00 + 32% of the excess over $321,450. Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses $1,300 Adjusted gross income (AGI) Over $408,200 but not over $612,350 $93,257.00 + 35% of the excess over $408,200. Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse $1,650* Over $612,350 Minus: Deductions from AGI: . $164,709.50 + 37% of the excess over $612,350. Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. Personal and Dependency Exemptions Suspended: In conjunction with the increased standard deduction amount, the Tax Cuts and Jobs Act reduces the personal exemption amount to $0 for tax years from 2018 These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind. through 2025, effectively suspending the exemptions for these years. Taxable income Don Tax on taxable income without dividends (tax rate schedule) Print Done Tax on dividends Total tax (Individual) Requirement b. Instead of organizing the consulting business as a C corporation, assume Kyle and Toby organized the business as a limited liability company, KT, LLC. KT made a distribution of $280,000 each to Kyle and Toby during 2019. Compute the total tax liability of KT and Kyle for 2019. Ignore any and additional tax on net investment income. (If an input field is not used in the table, leave the input field empty, do not select a label or enter a zero. Do not round intermediary calculations. Only round the amounts you enter in the input fields to the nearest cent. Use the tax rate schedule for necessary tax calculations. Enter a "0" for items with a zero balance.) Begin by calculating the tax liability for KT, LLC. Reference Minus A corporation's taxable income is subject to a flat tax rate of 21%. Taxable income arata Print Done Choose from any list or enter any number in the input fields and then continue to the next question. Kyle Thomas and Toby Barron began a new consulting business on January 1, 2019. They organized the business as a C corporation, KT, Inc. During 2019, the corporation was successful and generated revenues of $2,400,000. KT had operating expenses of $830,000 before any payments to Kyle or Toby. During 2019, KT paid dividends to Kyle and Toby in the amount of $280,000 each. Assume that Kyle's wife earned $130,000 from her job, they file a joint return, have itemized deductions of $35,000, and have no children. (Assume the qualified dividends tax rate is 15%.) Read the requirements (Click the icon to view the 2019 tax rate schedule for the Married filing jointly filing status.) (Click the icon to view the corporation tax rate information.) (Click the icon to view the standard deduction amounts.) Requirement a. Compute the total tax liability of KT and Kyle and his wife for 2019. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero. Do not round intermediary calculations. Only round the amounts you enter in the input fields to the nearest cent. Use the tax rate schedule for necessary tax calculations.) Begin by calculating the tax liability for KT. Reference Reference Minus: Married, Filing Joint and Surviving Spouse Taxable income STANDARD DEDUCTION If taxable income is: The tax is: Corporate tax Filing Status Not over $19,400 10% of taxable income. $ 24,400 Compute the tax liability of Kyle and his wife. Married individuals filing joint returns and surviving spouses Over $19,400 but not over $78,950 $1,940.00 + 12% of the excess over $19,400. Heads of households $ 18,350 Over $78,950 but not over $168,400 $9,086.00 +22% of the excess over $78,950. S Unmarried individuals (other than surviving spouses and heads of households) 12.200 Over $168,400 but not over $321,450 $28,765.00 +24% of the excess over $168,400 Married individuals filing separate returns S 12,200 Over $321,450 but not over $408,200 $65,497.00 + 32% of the excess over $321,450. Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses $1,300 Adjusted gross income (AGI) Over $408,200 but not over $612,350 $93,257.00 + 35% of the excess over $408,200. Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse $1,650* Over $612,350 Minus: Deductions from AGI: . $164,709.50 + 37% of the excess over $612,350. Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. Personal and Dependency Exemptions Suspended: In conjunction with the increased standard deduction amount, the Tax Cuts and Jobs Act reduces the personal exemption amount to $0 for tax years from 2018 These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind. through 2025, effectively suspending the exemptions for these years. Taxable income Don Tax on taxable income without dividends (tax rate schedule) Print Done Tax on dividends Total tax (Individual) Requirement b. Instead of organizing the consulting business as a C corporation, assume Kyle and Toby organized the business as a limited liability company, KT, LLC. KT made a distribution of $280,000 each to Kyle and Toby during 2019. Compute the total tax liability of KT and Kyle for 2019. Ignore any and additional tax on net investment income. (If an input field is not used in the table, leave the input field empty, do not select a label or enter a zero. Do not round intermediary calculations. Only round the amounts you enter in the input fields to the nearest cent. Use the tax rate schedule for necessary tax calculations. Enter a "0" for items with a zero balance.) Begin by calculating the tax liability for KT, LLC. Reference Minus A corporation's taxable income is subject to a flat tax rate of 21%. Taxable income arata Print Done Choose from any list or enter any number in the input fields and then continue to the next