Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kylvia created her own fast fashion retail store as she thought that it was a profitable industry and she thought that she could steal

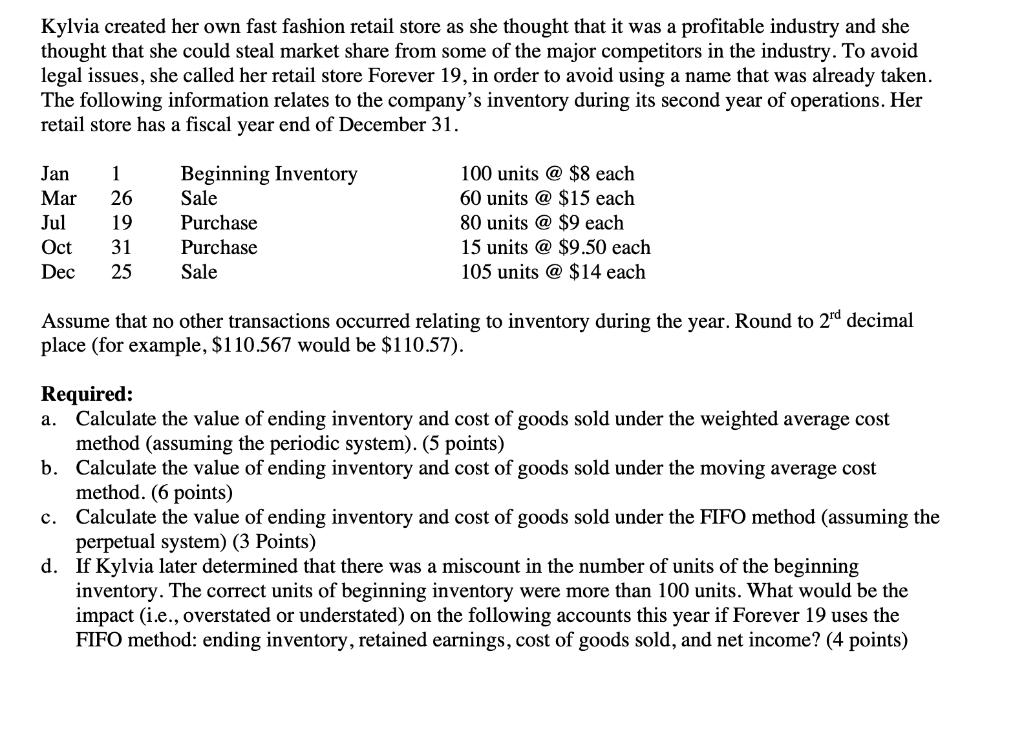

Kylvia created her own fast fashion retail store as she thought that it was a profitable industry and she thought that she could steal market share from some of the major competitors in the industry. To avoid legal issues, she called her retail store Forever 19, in order to avoid using a name that was already taken. The following information relates to the company's inventory during its second year of operations. Her retail store has a fiscal year end of December 31. Jan 1 Mar 26 Jul 19 Oct 31 Dec 25 Beginning Inventory Sale Purchase Purchase Sale 100 units @ $8 each 60 units @ $15 each 80 units @ $9 each 15 units @ $9.50 each 105 units @ $14 each Assume that no other transactions occurred relating to inventory during the year. Round to 2rd decimal place (for example, $110.567 would be $110.57). Required: a. Calculate the value of ending inventory and cost of goods sold under the weighted average cost method (assuming the periodic system). (5 points) b. Calculate the value of ending inventory and cost of goods sold under the moving average cost method. (6 points) c. Calculate the value of ending inventory and cost of goods sold under the FIFO method (assuming the perpetual system) (3 Points) d. If Kylvia later determined that there was a miscount in the number of units of the beginning inventory. The correct units of beginning inventory were more than 100 units. What would be the impact (i.e., overstated or understated) on the following accounts this year if Forever 19 uses the FIFO method: ending inventory, retained earnings, cost of goods sold, and net income? (4 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER a Calculation using the weighted average cost method periodic system To calculate the ending inventory and cost of goods sold using the weighted average cost method we need to calculate the wei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started