Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kyra would like to purchase a home by making monthly payments. She has found a new house selling for $345,000. Her local bank offers

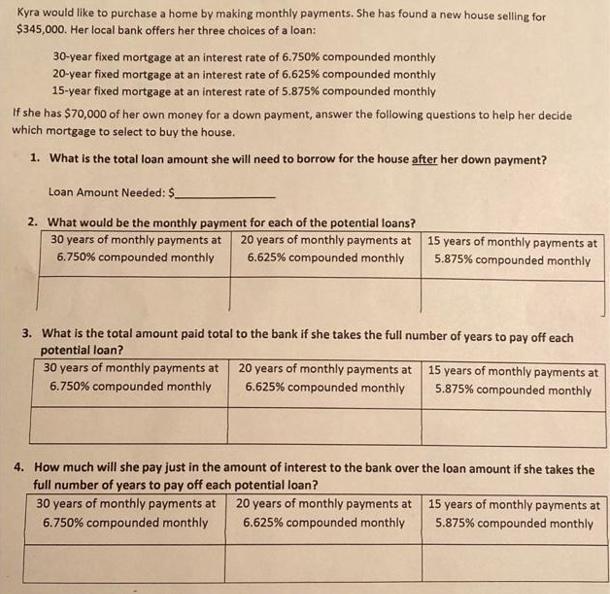

Kyra would like to purchase a home by making monthly payments. She has found a new house selling for $345,000. Her local bank offers her three choices of a loan: 30-year fixed mortgage at an interest rate of 6.750 % compounded monthly 20-year fixed mortgage at an interest rate of 6.625% compounded monthly 15-year fixed mortgage at an interest rate of 5.875% compounded monthly If she has $70,000 of her own money for a down payment, answer the following questions to help her decide which mortgage to select to buy the house. 1. What is the total loan amount she will need to borrow for the house after her down payment? Loan Amount Needed: $ 2. What would be the monthly payment for each of the potential loans? 20 years of monthly payments at 6.625% compounded monthly 30 years of monthly payments at 6.750 % compounded monthly 3. What is the total amount paid total to the bank if she takes the full number of years to pay off each potential loan? 30 years of monthly payments at 6.750 % compounded monthly 15 years of monthly payments at 5.875% compounded monthly 20 years of monthly payments at 6.625% compounded monthly 15 years of monthly payments at 5.875% compounded monthly 4. How much will she pay just in the amount of interest to the bank over the loan amount if she takes the full number of years to pay off each potential loan? 30 years of monthly payments at 6.750% compounded monthly 20 years of monthly payments at 6.625% compounded monthly 15 years of monthly payments at 5.875% compounded monthly

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Lets compute the loan amount monthly payments total amount paid to the bank and interest rate for each possible loan choice to provide the answers to these questions Given House price 345000 Down paym...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started