Question

Kyros Plc is a multinational construction company. The company would like to invest in a project to increase capacity of production in one of its

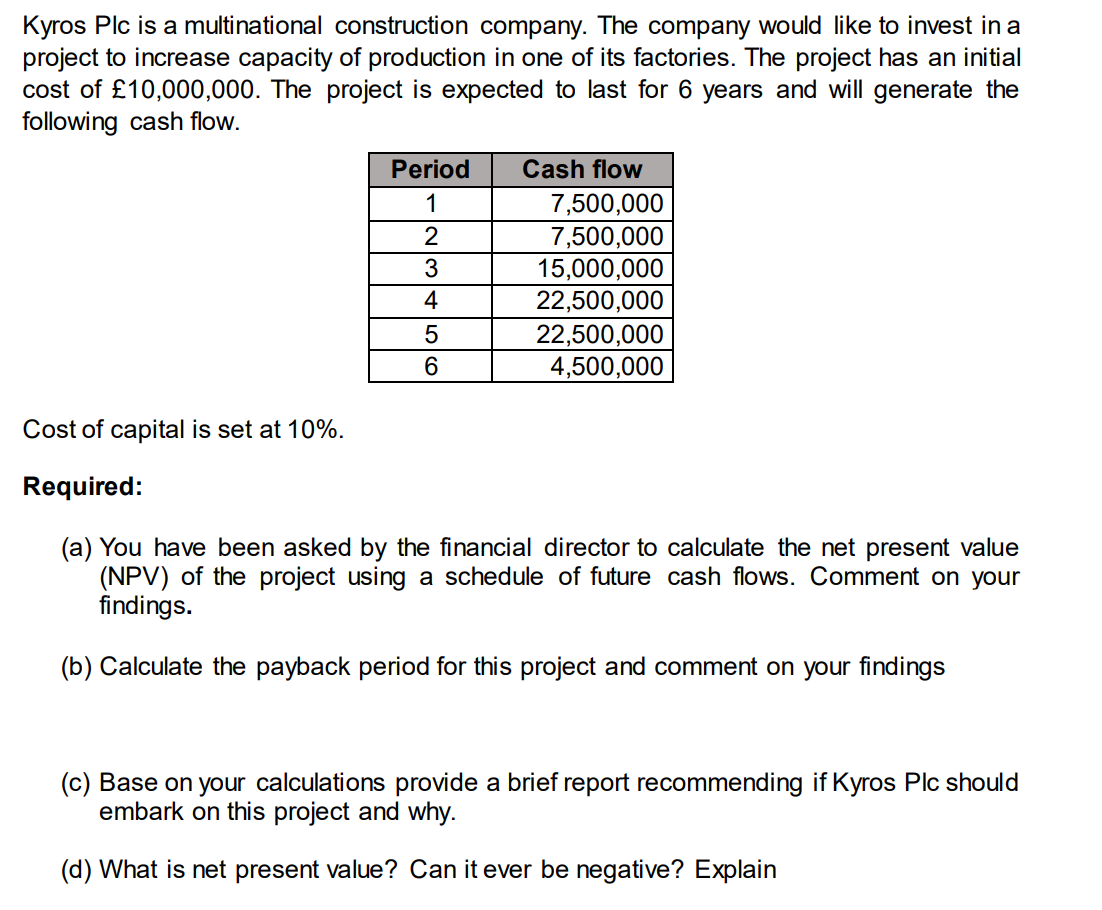

Kyros Plc is a multinational construction company. The company would like to invest in a project to increase capacity of production in one of its factories. The project has an initial cost of 10,000,000. The project is expected to last for 6 years and will generate the following cash flow. Period Cash flow 1 7,500,000 2 7,500,000 3 15,000,000 4 22,500,000 5 22,500,000 6 4,500,000 Cost of capital is set at 10%.

Required: (a) You have been asked by the financial director to calculate the net present value (NPV) of the project using a schedule of future cash flows. Comment on your findings.

(b) Calculate the payback period for this project and comment on your findings

(c) Base on your calculations provide a brief report recommending if Kyros Plc should embark on this project and why.

(d) What is net present value? Can it ever be negative? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started