Answered step by step

Verified Expert Solution

Question

1 Approved Answer

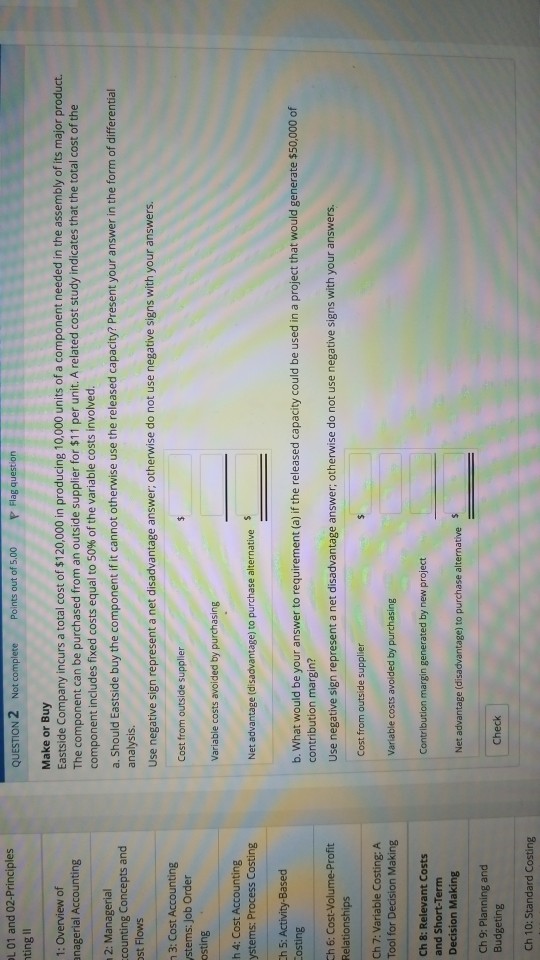

L 01 and 02-Principles ting l QUESTION 2 Not complete Points out of 5.00 Flag question Make or Buy Eastside Company incurs a total cost

L 01 and 02-Principles ting l QUESTION 2 Not complete Points out of 5.00 Flag question Make or Buy Eastside Company incurs a total cost of $120,000 in producing 10,000 units of a component needed in the assembly of its major product The component can be purchased from an outside supplier for $11 per unit. A related cost study indicates that the total cost of the component includes fixed costs equal to 50% of the variable costs involved. a. Should Eastside buy the component if it cannot otherwise use the released capacity? Present your answer in the form of differential analysis 1: Overview of anagerial Accounting 2: Managerial counting Concepts and st Flows Use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers. Cost from outside supplier Variable costs avoided by purchasing n 3: Cost Accounting ystems: Job Order h 4: Cost Accounting ystems: Process Costing Net advantage ( h 5: Activity-Based b. What would be your answer to requirement (a) if the released capacity could be used in a project that would generate $50,000 of contribution margin? Ch 6: Cost-Volume-Profit Use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers Cost from outside supplier Variable costs avoided by purchasing Contribution margin generated by new project Ch 7: Variable Costing: A Tool for Decision Making Ch 8: Relevant Costs and Short-Term Decision Making Net advantage (disadvantage) to purchase alternative Ch 9: Planning and Budgeting Ch 10: Standard Costing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started