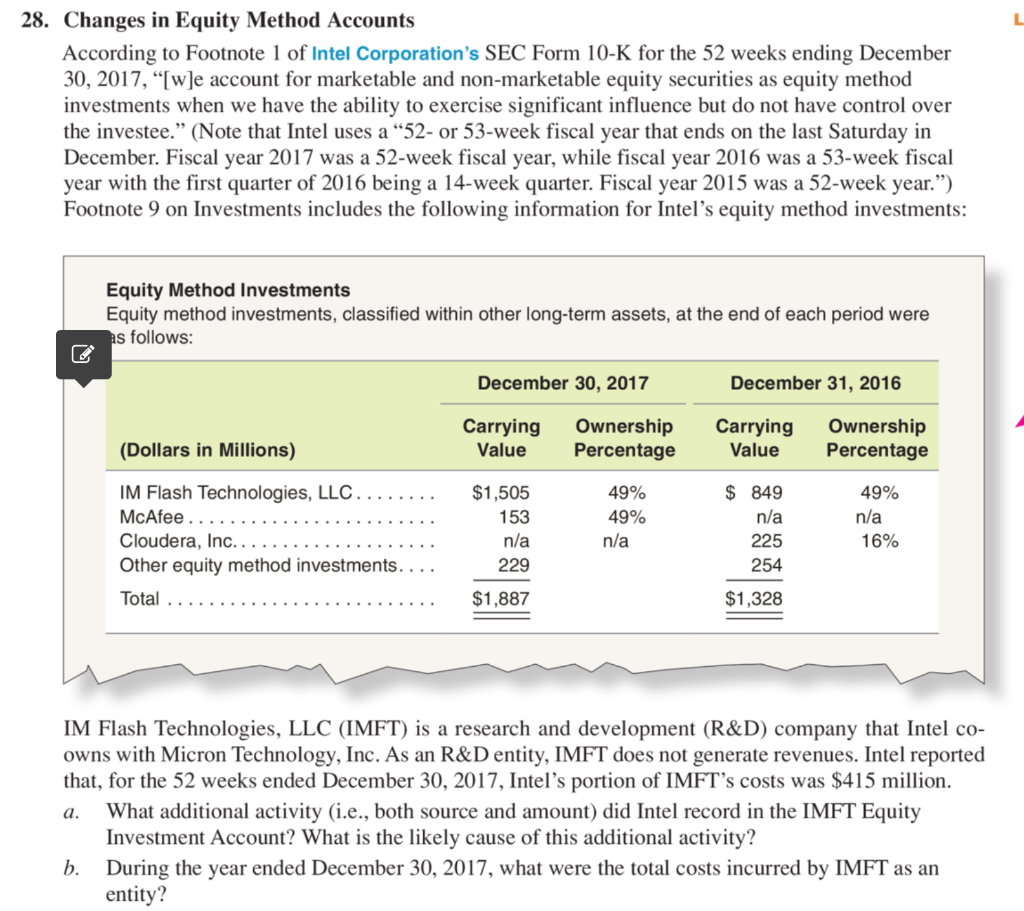

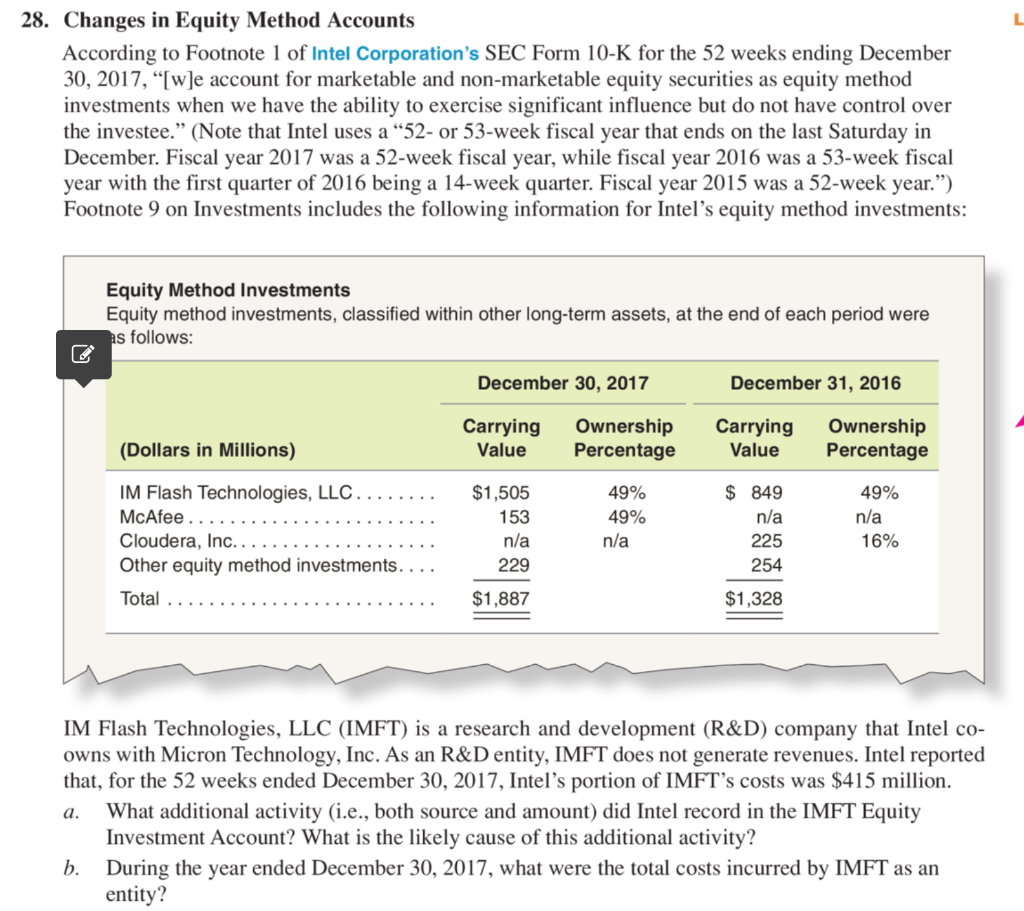

L 28. Changes in Equity Method Accounts According to Footnote 1 of Intel Corporation's SEC Form 10-K for the 52 weeks ending December 30, 2017, [w]e account for marketable and non-marketable equity securities as equity method investments when we have the ability to exercise significant influence but do not have control over the investee. (Note that Intel uses a 52- or 53-week fiscal year that ends on the last Saturday in December. Fiscal year 2017 was a 52-week fiscal year, while fiscal year 2016 was a 53-week fiscal year with the first quarter of 2016 being a 14-week quarter. Fiscal year 2015 was a 52-week year.) Footnote 9 on Investments includes the following information for Intel's equity method investments: Equity Method Investments Equity method investments, classified within other long-term assets, at the end of each period were as follows: December 30, 2017 December 31, 2016 Carrying Value Ownership Percentage Carrying Value Ownership Percentage (Dollars in Millions) 49% 49% IM Flash Technologies, LLC. McAfee Cloudera, Inc... Other equity method investments.. $1,505 153 n/a 229 $ 849 n/a 225 254 49% n/a 16% n/a Total $1,887 $1,328 a. IM Flash Technologies, LLC (IMFT) is a research and development (R&D) company that Intel co- owns with Micron Technology, Inc. As an R&D entity, IMFT does not generate revenues. Intel reported that, for the 52 weeks ended December 30, 2017, Intel's portion of IMFT's costs was $415 million. What additional activity (i.e., both source and amount) did Intel record in the IMFT Equity Investment Account? What is the likely cause of this additional activity? b. During the year ended December 30, 2017, what were the total costs incurred by IMFT as an entity? L 28. Changes in Equity Method Accounts According to Footnote 1 of Intel Corporation's SEC Form 10-K for the 52 weeks ending December 30, 2017, [w]e account for marketable and non-marketable equity securities as equity method investments when we have the ability to exercise significant influence but do not have control over the investee. (Note that Intel uses a 52- or 53-week fiscal year that ends on the last Saturday in December. Fiscal year 2017 was a 52-week fiscal year, while fiscal year 2016 was a 53-week fiscal year with the first quarter of 2016 being a 14-week quarter. Fiscal year 2015 was a 52-week year.) Footnote 9 on Investments includes the following information for Intel's equity method investments: Equity Method Investments Equity method investments, classified within other long-term assets, at the end of each period were as follows: December 30, 2017 December 31, 2016 Carrying Value Ownership Percentage Carrying Value Ownership Percentage (Dollars in Millions) 49% 49% IM Flash Technologies, LLC. McAfee Cloudera, Inc... Other equity method investments.. $1,505 153 n/a 229 $ 849 n/a 225 254 49% n/a 16% n/a Total $1,887 $1,328 a. IM Flash Technologies, LLC (IMFT) is a research and development (R&D) company that Intel co- owns with Micron Technology, Inc. As an R&D entity, IMFT does not generate revenues. Intel reported that, for the 52 weeks ended December 30, 2017, Intel's portion of IMFT's costs was $415 million. What additional activity (i.e., both source and amount) did Intel record in the IMFT Equity Investment Account? What is the likely cause of this additional activity? b. During the year ended December 30, 2017, what were the total costs incurred by IMFT as an entity